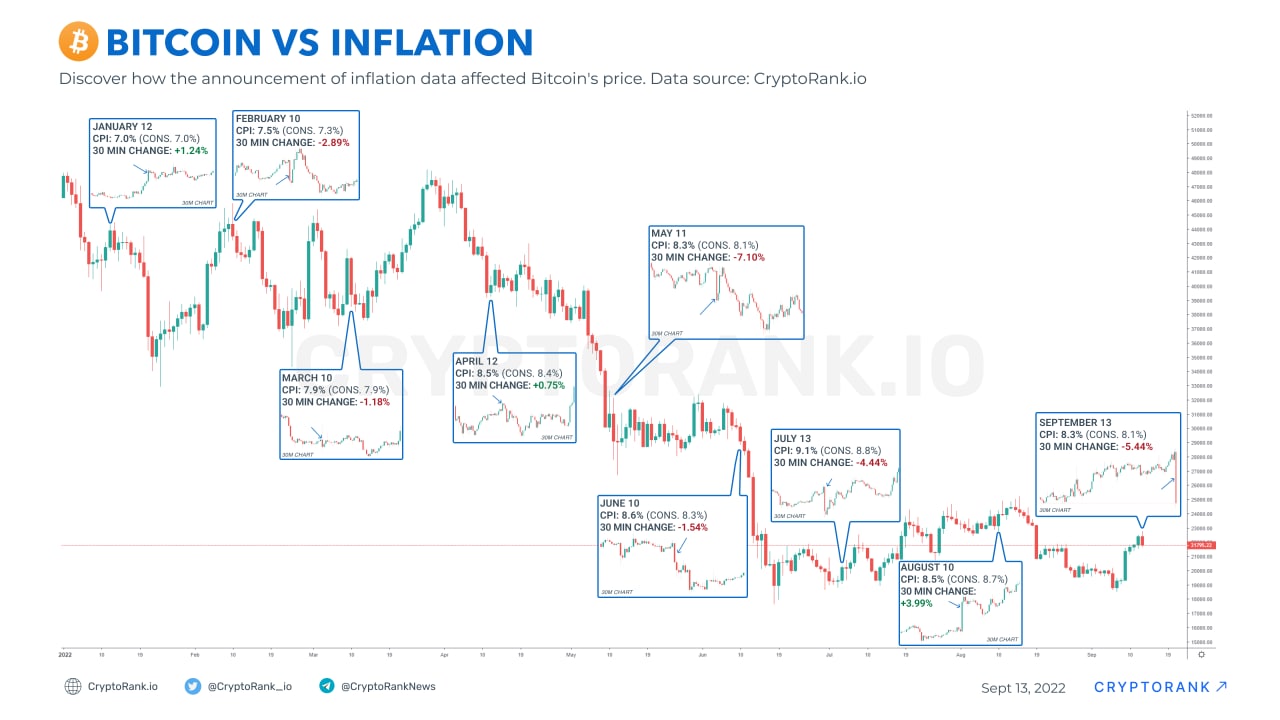

Bitcoin VS Inflation

The U.S. unseasonably adjusted Consumer Price Index in August was 8.3%, which is a higher than expected consensus of 8.1%. This index is a key measurement of a country’s inflation, which has a tremendous effect on global financial markets.

Bitcoin is believed to be a kind of inflation hedge, such as gold. However, lately, it has not performed well as a hedge due to macro factors. The main reason is the high correlation between Bitcoin (and crypto overall) and traditional financial markets as Bitcoin mostly follows significant moves of Wall Street. The same can be said for today when the CPI index was higher than expected, BTC fell by 5.44% in the first 30 minutes after the announcement (the moment is marked on the chart with the blue arrow), as well as many tech stocks falling at pre-market too. Usually, if the CPI is lower than the consensus forecast, the Bitcoin and broader market react positively, but a CPI lower than expectations most likely drives markets lower (since high inflation usually followed by increase of rates). Discover how the announcement of inflation data affected Bitcoin’s price.

👉https://cryptorank.io/price/bitcoin

Find the latest market intelligence and in-depth reports in our Telegram channel and Twitter