OKEx Swap and Futures Trading Experience Overview

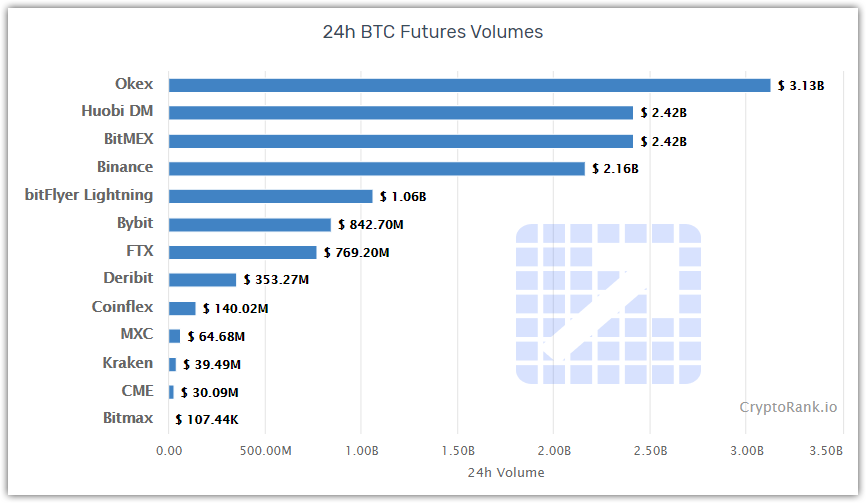

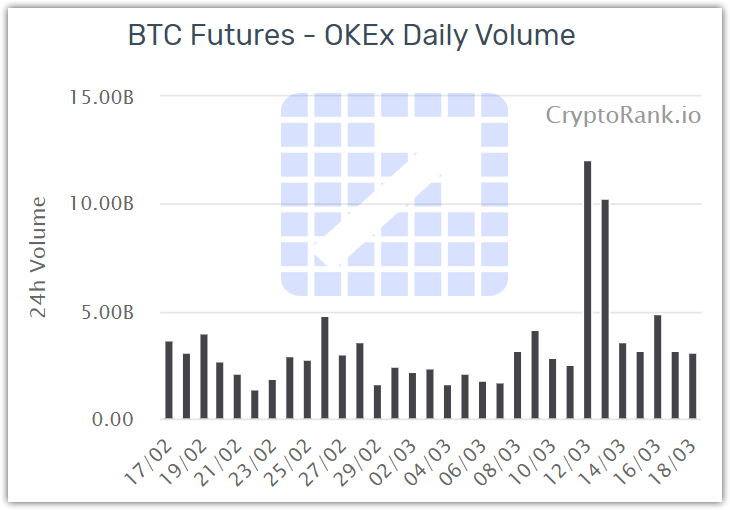

OKEx recently bypassed BitMex with $ 3.2 Billion volume daily of BTC futures and took 1st place in the 24h volume rating. That’s why the CryptoRank team decided to talk about their experience in trading on the OKEx exchange.

https://cryptorank.io/derivatives-analytics

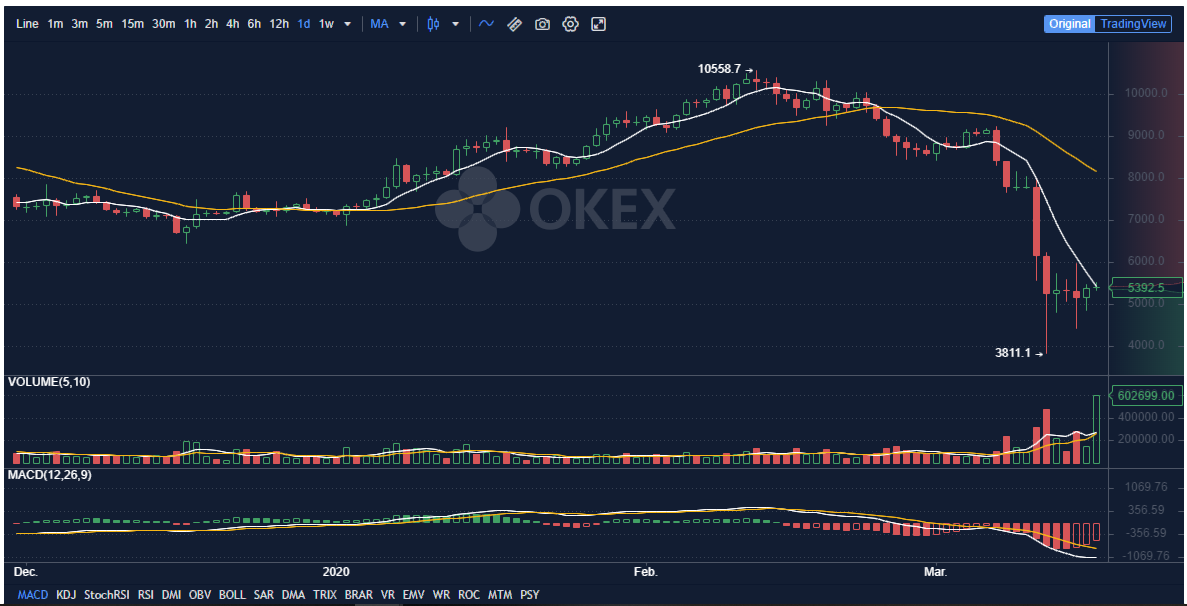

The Futures trading experience on the exchange has proven to be quite positive. The main advantage of OKEx is the ability to trade in cross-margin mode, sharing the balance on different futures contracts. As collateral, you can use either USDT or BTC and other crypto assets. The site’s interface is flexible and easy to understand, and suitable for both beginners and advanced users. The OKEx derivatives venue differs from Binance Futures by a larger number of contracts and the availability of deliverable futures and options. There are also 6 different types of orders: Limit, Advanced Limit, Stop-Limit, Trail, Iceberg and TWAP. But there are no OCO orders that allow one to simultaneously place Take and Stop orders. The trading chart opens in a separate tab and is more illustrative than on the Binance Futures platform. Nonetheless, there are no open orders displayed on it (unlike Bitmex).

https://cryptorank.io/derivatives-analytics

Smartphone trading fans also got their fair share of attention: the OKEx mobile app, just like the main site, has a pleasant and fast interface.

One of the OKEx downsides is the high cost of some contracts. For example, in the BTC/USDT contract value reaches 0.01 BTC, which does not allow you to trade all the available funds — a small balance of a couple of dollars will always remain.

In total, OKEx has launched three derivatives trading venues: Perpetual Swaps, Futures, and Options. Let’s analyze each in more detail.

OKEx Perpetual Swap

OKEx Perpetual Swap is a crypto derivative with BTC and USDT used for settlement. Each contract has a nominal value in underlying assets, such as BTC, LTC, ETH, and others. Traders can open short and long positions in 12 trading pairs.

As you can see from the table, the cost of one contract depends on what the investor leaves as collateral: BTC, USDT, ETH, etc. It is also important to note that in the trading of perpetual swaps there is no expiration date or delivery date. Every 24 hours at 9:00 UTC + 1, an automatic settlement is applied to your position, that is, your profit or loss will be at that moment in time, the entire UPL will be converted to RPL and your position will be reopened with new values.

This derivative instrument is similar to perpetual contracts for Binance Futures or Bitmex.

OKEx Futures

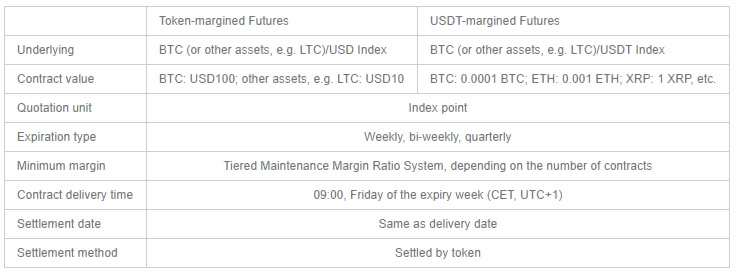

OKEx Futures, just like Perpetual Swap, is a crypto derivative, for which BTC and USDT are used for settlement. Each contract has a nominal value in underlying assets, such as BTC, LTC, ETH, and others. There are 72 contracts available for trading, which differ in the collateral currency and expiration date.

Just like in swaps, the contract value depends on the collateral asset and your position is recalculated every 24 hours.

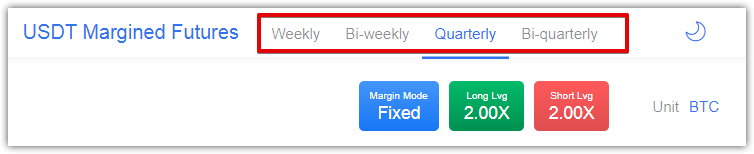

The main difference is that there is an expiration date for futures contracts, the date of which depends on the type of contract. There are 4 types of contracts: Weekly, Biweekly, Quarterly, and Bi-Quarterly. When the expiration date comes, your open position will be automatically settled.

On Futures and Swap, trading with leverage from 0.01 to 100 is available, which is perfect for hedging your main positions, as well as for riskier traders. There are also 2 types of margins available: isolated and cross. Cross margin is a margin that is distributed over an open position using the full amount of funds in the available balance. An isolated margin is a margin that is individually allocated for an open margin position with a fixed amount of collateral. If the collateral amount is not sufficient to support the loss, the position will be liquidated. You should pay very close attention to the choice of the margin type and the size of the leverage.

OKEx Options

There are also Options on OKEx. Options are contracts that give buyers the right, but not the obligation, to buy or sell an underlying asset at a predetermined price for a certain period. Only options of the European type are validated on OKEx. This means that such an option can be exercised only after the expiration of its validity. Execution of the contract before the deadline leads to the imposition of fines on the relevant parties who initiated the process.

OKEx Options, like swaps and futures, is a derivatives product settled in BTC. The face value of each option contract is 0.1 BTC. As well as on futures contracts, there are 4 different types of options, depending on the expiration date: Weekly, Biweekly, Quarterly, and Bi-Quarterly.

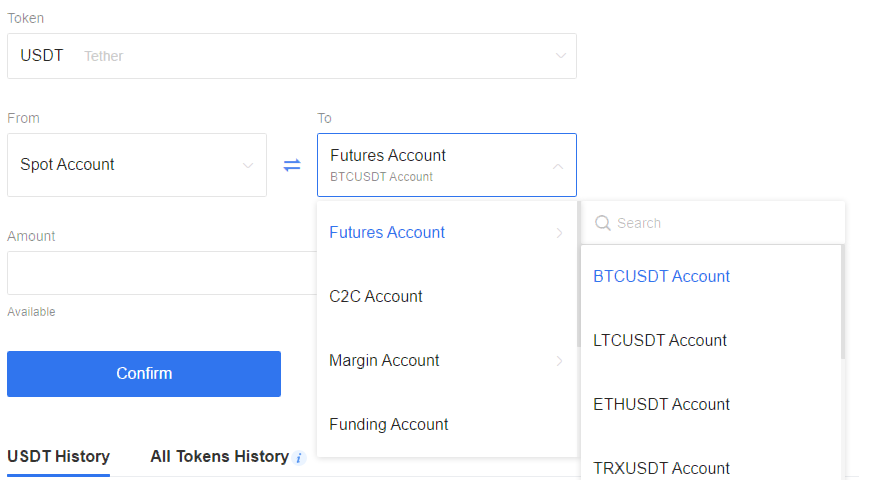

To start trading derivatives on OKEx, you need to complete a small quiz. First, you need to raise funds on the exchange. Then familiarize yourself with the trading rules of each instrument and go through a short quiz. The number of quiz attempts is unlimited. After that, you need to choose what you will trade with: swaps, futures or options, as well as choose a specific contract. Now you have to transfer funds to a specific contract.

After that, you can open short or long positions on a previously selected contract, taking advantage of all the flexibility of the OKEx order system.

In conclusion, we want to say that OKEx currently has good liquidity in the Bitcoin futures market, which, combined with the above advantages, makes it one of the best platforms for trading crypto derivatives.

Stay tuned in our Telegram channel and Twitter

Risk warning: Derivatives trading is subject to high market risk