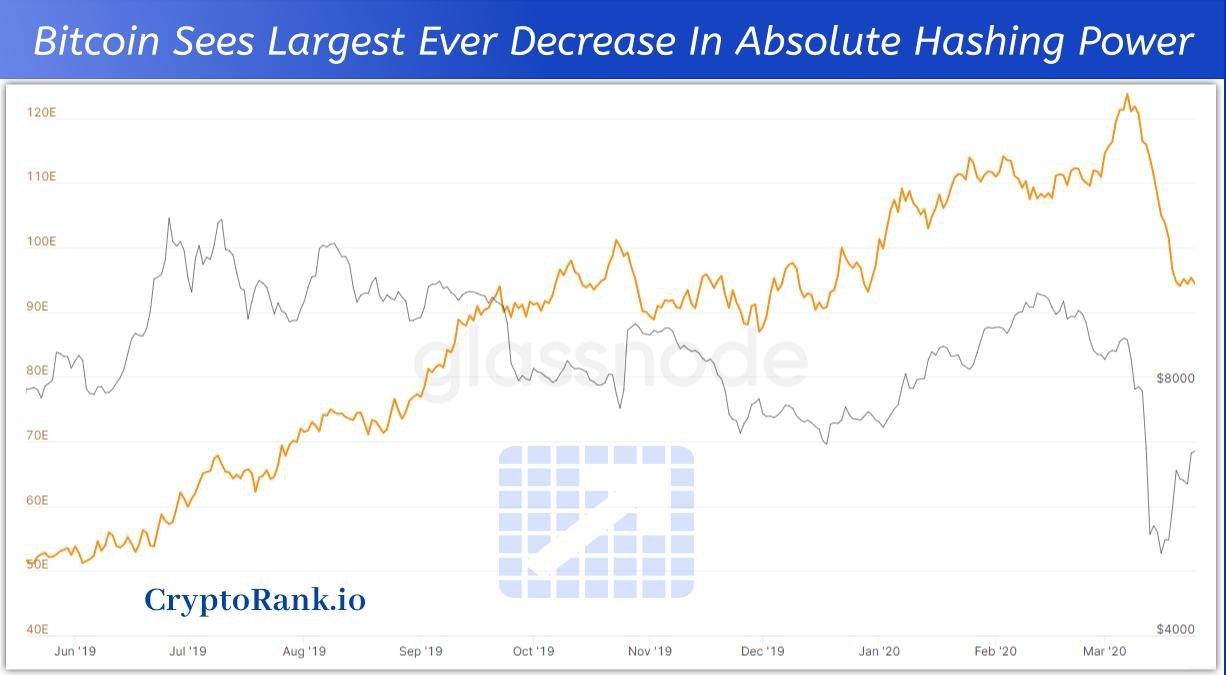

After Bitcoin`s hash rate reached its all-time high on March 1 2020, it began to decline steadily, for many miners left the network earlier this month.

This has been by far the largest ever decrease in absolute hashing power in the history of the Bitcoin network. Because of it, the Bitcoin`s hash rate has slowed down significantly: the blocks are being mined up to 25% slower than usually (normally, they are mined in 10 minutes each).

This situation can lead to a rapid price decrease. So far the factors are like this:

— Mining becomes less profitable, and even may become unprofitable;

— The hash rate decreases because of the miners` leaving Bitcoin;

— Less blocks are mined as hashing power decreases;

— Revenue from block rewards decreases.