Huobi DM Perpetual Swaps Overview by CryptoRank

Huobi cryptocurrency exchange has firmly taken its place among the world’s top sites over the 6 years of its existence. Huobi was able to achieve such results largely due to customers from Europe.

A few years after the launch, Leon Li, Huobi`s CEO, decided to buy out the Western and American-oriented BitYes trading exchange, which attracted a large number of traders and investors from these two regions.

Currently available on the Huobi exchange are spot trading, a fiat gateway, and the venue to trade leverage and Futures.

In late March, the Huobi exchange launched Perpetual Swaps on its Huobi DM (Huobi Futures) platform. As the name suggests, the perpetual swap is the permanent, never-delivered futures contract. Never-deliver means that a trader can hold it however long he wants, without having to repeat the opening action after the delivery.

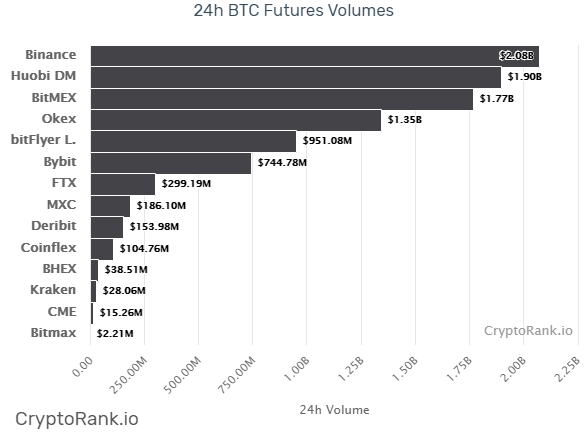

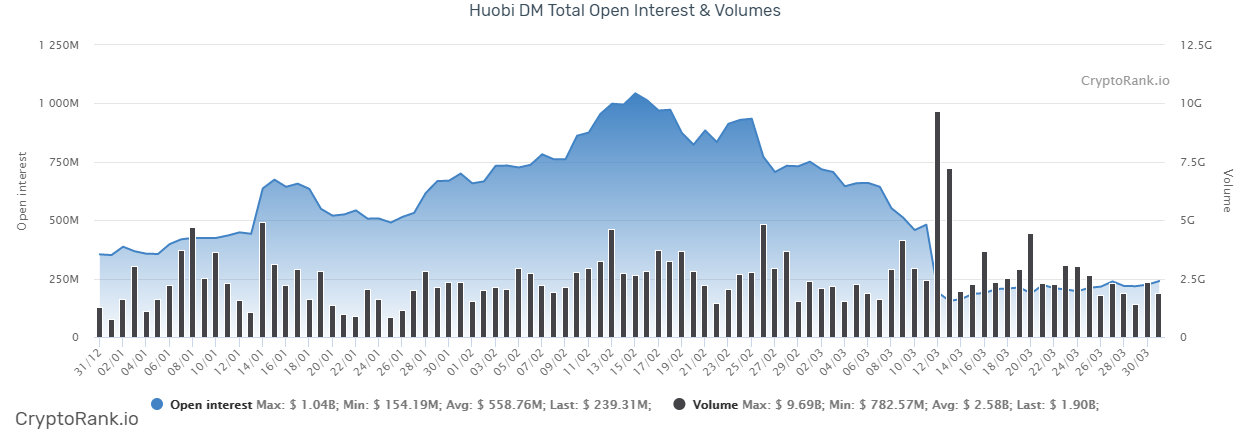

Huobi DM is a trading venue where cryptocurrency derivatives, such as futures and swaps, are traded. Users can earn revenue through the volatility of digital currency prices by opening long or short positions. At the moment, the exchange is at the top in terms of BTC Futures the daily trading volume.

Particular qualities of Huobi DM Perpetual Swaps:

- No delivery date and never expires;

- Various leverages, from 1 to 125x;

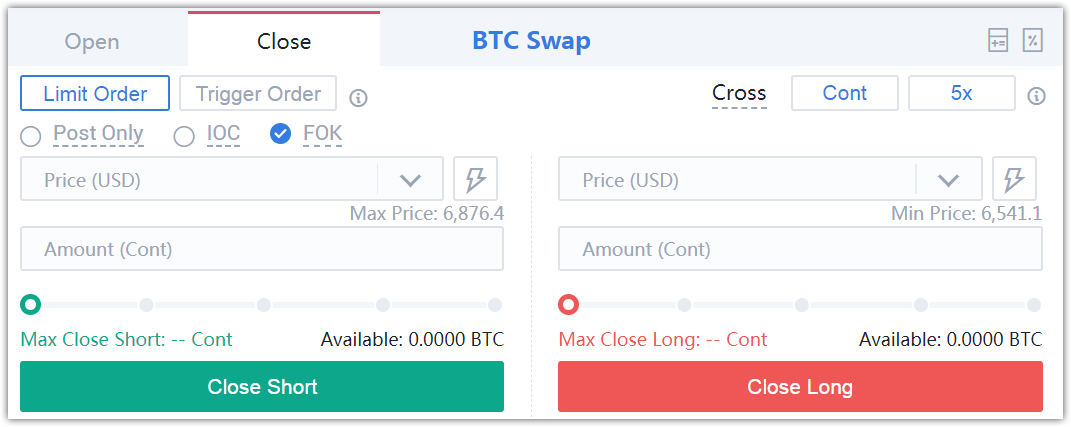

- 6 types of orders available: Post-only, IOC, FOK, Trigger, Limit and Lightning Close;

- The settlement period: every 8 hours (4:00, 12:00 and 20:00(GMT + 8);

- Paying funding: every 8 hours;

- Open/close position fee rate: maker = 0.02%, taker = 0.04%.

The limit order could be posted with one of the four options:

Post-only — this option guarantees that a limit order will be added to the order book and will not be combined with an existing order. If your order is combined with an existing one, it will be canceled. This type of order ensures that you only pay the commission of the maker, not the taker.

IOC — the “Immediate or Cancel” order requires the immediate partial or full execution of an order and the cancellation of an unfulfilled part of it. Unlike the FOK order, its partial execution is possible.

FOK — the “Fill or Kill” order is a limit order that is either instantly and completely executed or canceled. The main purpose of this type of order is to complete it at a certain price.

Lightning Close — this type of limit order helps users close positions immediately to avoid the impact of high crypto market volatility. If some positions still remain open, they are automatically converted into a limit order. Lightning Close helps to avoid losses caused by unfilled orders when the market is too volatile.

Trigger Order — the principle operation is the Stop Limit approach, that is, the order will be executed in a certain price range (buy or sell at a limit order price or better). When placing a Trigger Order, the trader sets a stop price for triggering and a limit price for executing the order.

It can also be noted that on Huobi DM in general, and with perpetual swaps in particular, there are no problems with liquidity, and slippage is quite minimized.

The most important Huobi DM innovation is the Tiered Adjustment Factor. If you have ever used perpetual futures contracts on other exchanges, then you know that liquidation always comes a little earlier than it should. This way the exchange is insured against the loss of its funds, taking them from you. Sometimes your “collateral losses” during liquidation amount to 15% of the position size.

Due to this problem, the Huobi Exchange has designed the Adjustment Factor to prevent users from losing margin calls on the system. The Adjustment Factor is calculated separately not only for each trading pair but also for each user. This means that the settlement commission is always known in advance, which gives traders a huge advantage in trading. You can see your Adjustment Factor on the left side of the trading terminal where all the information on the status of your account is located, including the settlement price. It is also worth noting that Huobi DM has the lowest correction factor compared across the entire industry.

Protection against “squeeze” and partial liquidation mechanism

The absence of hidden fees, the quick response of the support service and 20,000 Bitcoins fund insurance can also be attributed to the benefits of the platform. It is worth mentioning that the index price is calculated based on the spot price from 4 exchanges: Bitstamp, Gemini, Kraken, and Coinbase.

Huobi DM has a liquidation protection mechanism named liquidation circuit breaker. Unlike regular market circuit breakers that halt all transactions, the circuit breaker on HBDM will only interrupt abnormal liquidations. When the engine notices a significant deviation between the liquidation price and the market price (the so-called squeeze), then the liquidation will be paused, which will protect users’ position.

At the same time, partial liquidation feature helps traders to lower risks involved in liquidation by saving the part of the funds without liquidating an entire market position.

Output

The launch of perpetual swaps by the Huobi exchange is a logical and timely step because you can make good money with great volatility, while the convenient interface and the introduction of an Adjustment Factor allow you to make trading more productive.

Follow Huobi DM on social media:

Twitter: https://twitter.com/HuobiDM_Futures

Youtube: https://www.youtube.com/HuobiGlobal

Telegram Chat: https://t.me/HuobiDMEnglish