📈Market Overview

Many traders believe the narrative that Bitcoin price drops ahead of CME BTC futures expiries, but data shows the trend is all bark and no bite. Historically, activity surrounding the Bitcoin monthly futures and options expiry has been blamed for weakening bullish momentum. A few studies from 2019 found a 2.3% average drop in BTC price 40 hours before the CME futures settlement date.

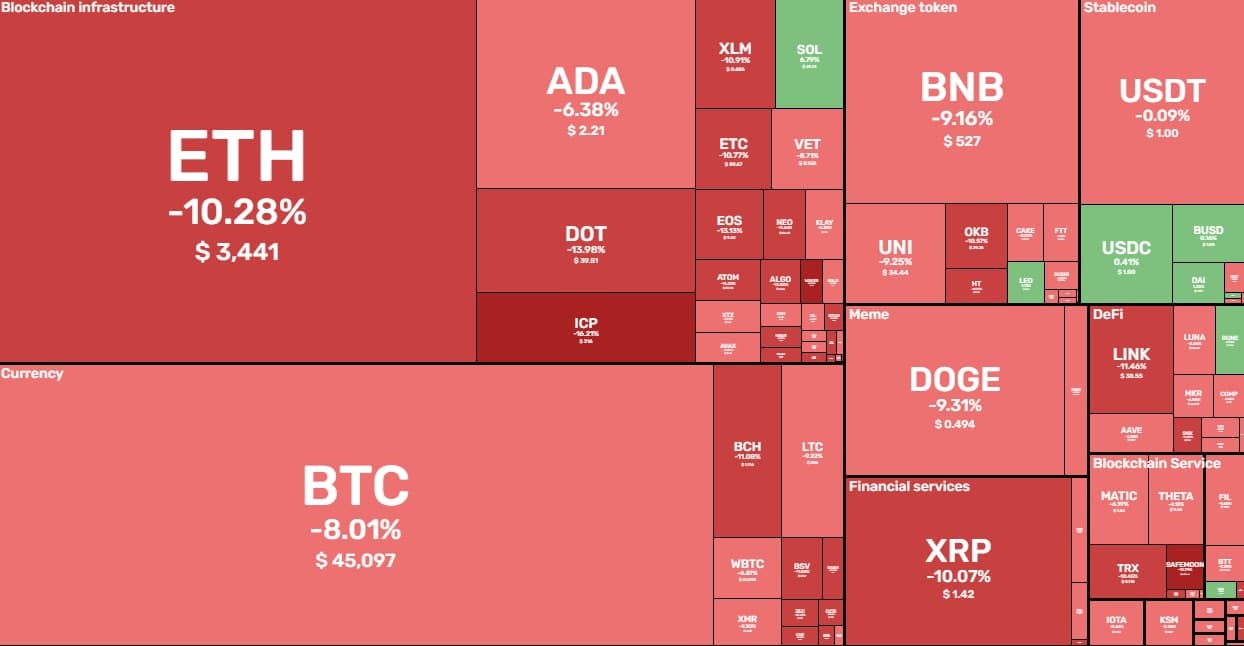

The entire Top 10 is traded in the red zone. Internet Computer -16.2%, Bitcoin Cash -11.8%, Ripple -10.1%.

Market capitalization: $2.07T

The BTC dominance: 40.4%

Fear & Greed Index: 27 (Fear)

https://cryptorank.io/heatmaps

Peercoin (PPC)+113.4%

Navcoin (NAV) +110.7%

OST (OST) +108.2%

Pundi X (NPXS) -47.4%

SONM (SNM) -45.3%

Hifi Finance (MFT) -38.1%

BTC Futures

Aggregated Volume — $119.95B

Aggregated Open Interest — $15.67B