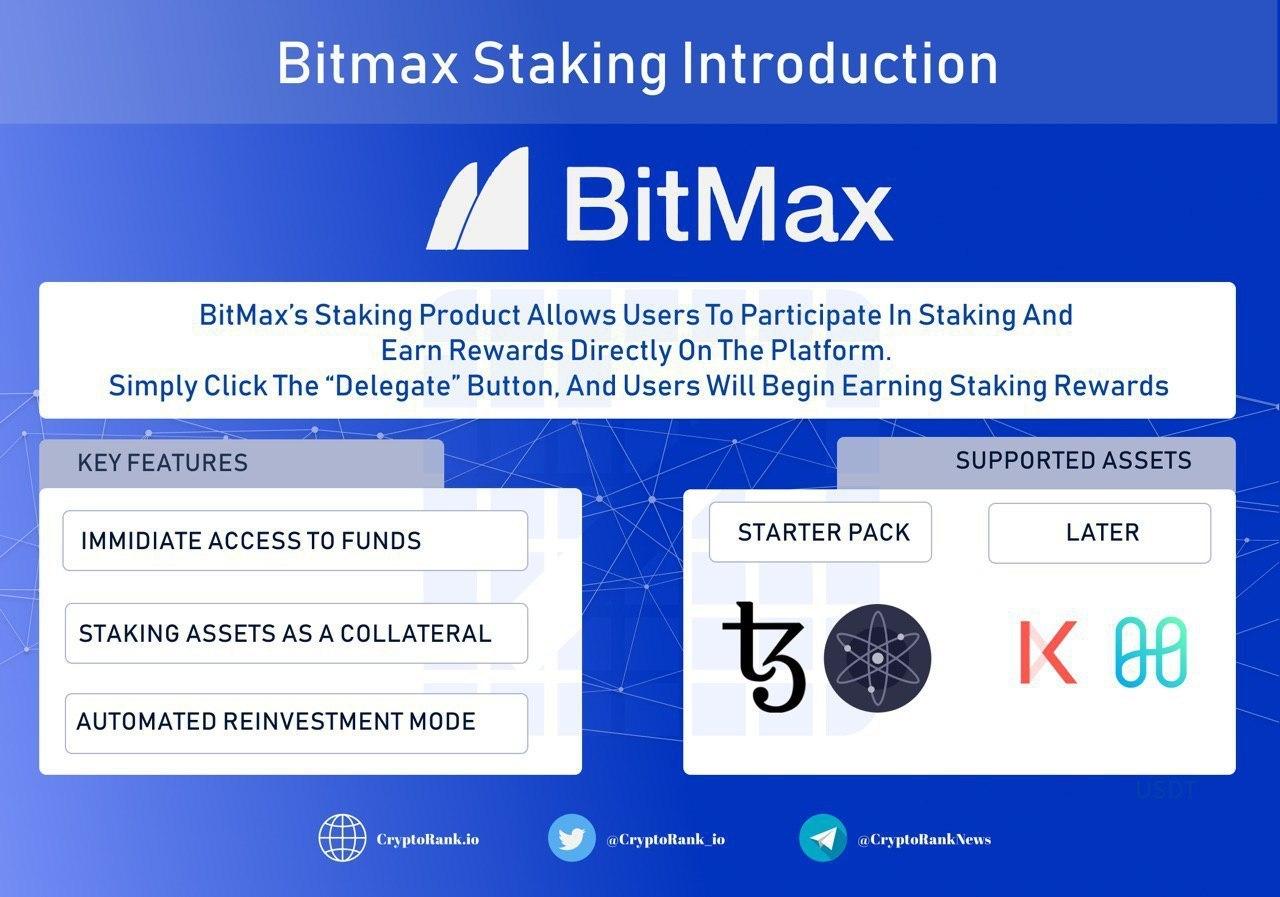

BitMax Staking Introduction

BitMax’s innovative staking product allows users to participate in staking and earn rewards directly on the platform. BitMax aggregates users’ staking interest and delegates assets to trusted validators on their behalf. Simply click the “Delegate” button, and users will begin earning staking rewards.

1. Core features of BitMax Staking

Immediate Access to Staked Assets

Unstake to trade or transfer without delay. To enhance users’ staking experience, BitMax maintains a liquidity pool of assets for immediate access after an asset is unstaked. “Instant Unbonding” allows users to manage staked assets at their own discretion even when delegating to a network with a lengthy unbonding period.

Margin Trading for Staked Assets

Trade staked assets while earning rewards. To further promote marketplace efficiency, BitMax permits staked assets to be used as margin collateral, thus allowing users to go long or short to hedge exposure while continuing to earn rewards.

Maximized Staking Returns

Automated reinvestment of rewards to compound return. To maximize returns on behalf of users, BitMax automatically redelegates staking rewards to staking pools, thus allowing users to further enhance yield. Users can choose to activate or deactivate “Compound Mode” at their own discretion.

2. Eligible currencies for staking

We will launching staking support for Cosmos and Tezos first, with KAVA and Harmony and many other emerging proof of stake blockchain projects in the pipeline are coming soon.

3. Frequently Asked Questions

Can I trade my digital assets while they’re staked?

Staked assets cannot be traded directly; however, staked assets can be used as collateral for margin trading, thus allowing users to go long or short the asset to hedge positions more effectively.

What are the major pain points associated with traditional staking?

When an individual, Alice, elects to stake an asset, she effectively agrees to lock-up the asset for an extended period of time. Unlocking Alice’s staked asset requires a lengthy unbonding period during which she neither has access to her asset nor is she eligible to receive staking rewards. Thus, there are two major pain-points associated with traditional staking:

A. Illiquid Position Management: User’s ability to trade out of asset position is limited especially in anticipation of an adverse market movement because the user cannot place orders to sell while the asset is being staked.

B. Inflexible Asset Management: The user gives up the ability to actively move assets from one venue to another in a seamless and nimble manner because of the lengthy unlock period associated with unbonding. See BitMax’s solution to these pain points associated with traditional staking.

What solutions does BitMax provide in response to pain points with traditional staking?

1. BitMax allows users to unstake assets to trade or transfer without delay. To enhance users’ staking experience, BitMax maintains a liquidity pool of assets for immediate access after an asset is unstaked. “Instant Unbonding” allows users to manage staked assets at their own discretion even when delegating to a network with a lengthy unbonding period.

2. BitMax allows users to trade staked assets while earning rewards. To further promote marketplace efficiency, BitMax allows for staked assets to be used as margin collateral. So users can go long or short to hedge exposure while continuing to earn rewards.

Can I use tokens in the margin account to participate in staking?

Yes. BitMax allows users to utilize assets held in Margin Accounts to directly participate in staking. A percentage discount will be applied to the value of assets in the calculation of margin rates.

How do I use staked tokens as collateral for margin trading?

Go to “Account Transfer” under “My Asset”, select the staking token, choose the “Asset Type” as “Staking Asset” and make a transfer to the margin account. A percentage discount will be applied to the value of assets in the calculation of margin rates.

Can I unstake my assets anytime? Is there a unlock period?

Most PoS networks employ an unbonding period when a delegator decides to quit staking. During this period, delegator cannot access the previously staked asset itself. Delegator also forfeits eligibility to earn staking rewards from the previously staked assets.

To alleviate this problem, BitMax allows users to unstake assets to trade or transfer without delay. To enhance users’ staking experience, BitMax maintains a liquidity pool of assets for immediate access after an asset is unstaked. “Instant Unbonding” allows users to manage staked assets at their own discretion even when delegating to a network with a lengthy unbonding period.

How are staking rewards calculated?

In most cases, if you stake your digital assets on T day (UTC), staking rewards will start to accumulate on T+1 day and begin to be distributed on T+2 day. If you quit staking and undelegated between 0:00 to 24:00 on T+N day, your staking period is N-1 days and you will only receive staking rewards for the N-1 day period.

How are staking rewards distributed?

The distribution of staking rewards is facilitated directly by PoS blockchain networks. Because BitMax aggregates staking interest from all platform users and delegates as a single counterparty, rewards are distributed directly to the platform. Once received, BitMax will credit individual users’ accounts proportionally based on their contribution to the staking pool.

Each PoS blockchain network employs different mechanisms to facilitate distribution of rewards;

therefore, BitMax will make the best efforts to timely credit users’ accounts.

Are staking rewards liquid?

Staking rewards are liquid and are available for sale once distributed.

How does “Compound Mode” work?

“Compound Mode” is an innovative feature introduced by BitMax that automatically redelegates

users’ staking rewards once it is distributed, thus compounding returns.

More details by the link: https://bit.ly/3bJJH3B

Stay tuned in our Telegram channel and Twitter