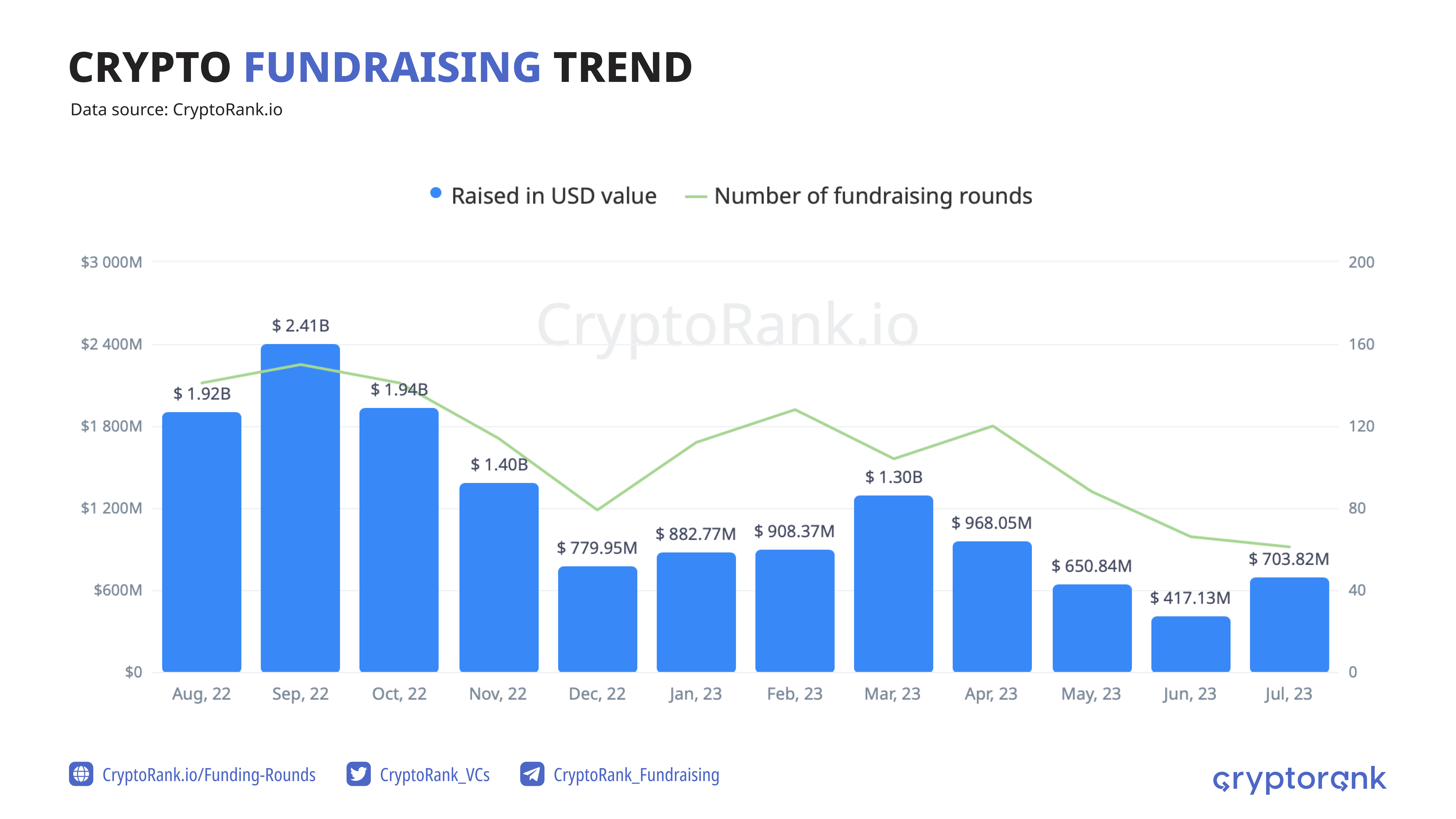

While the crypto market experienced relatively low volatility in July, crypto startups had a moderately successful month. Although the number of funding rounds decreased slightly, total raise in the crypto sphere increased by 64% in July 2023.

Let’s delve into the details to learn together the main insights of the past month.

Executive Summary:

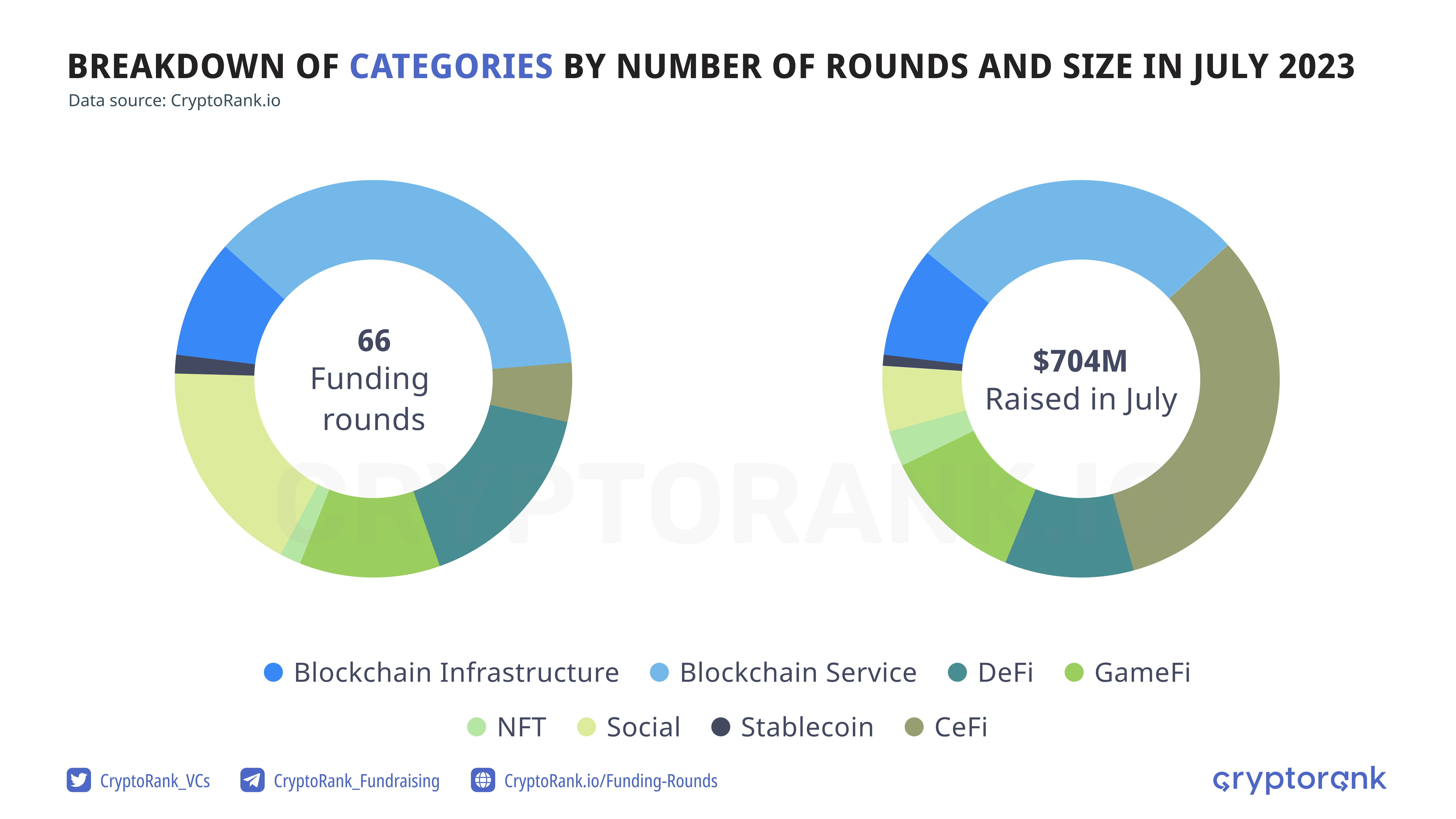

- The total amount raised increased by 69% MoM, but the number of fundraising rounds hit a 2.5 year low.

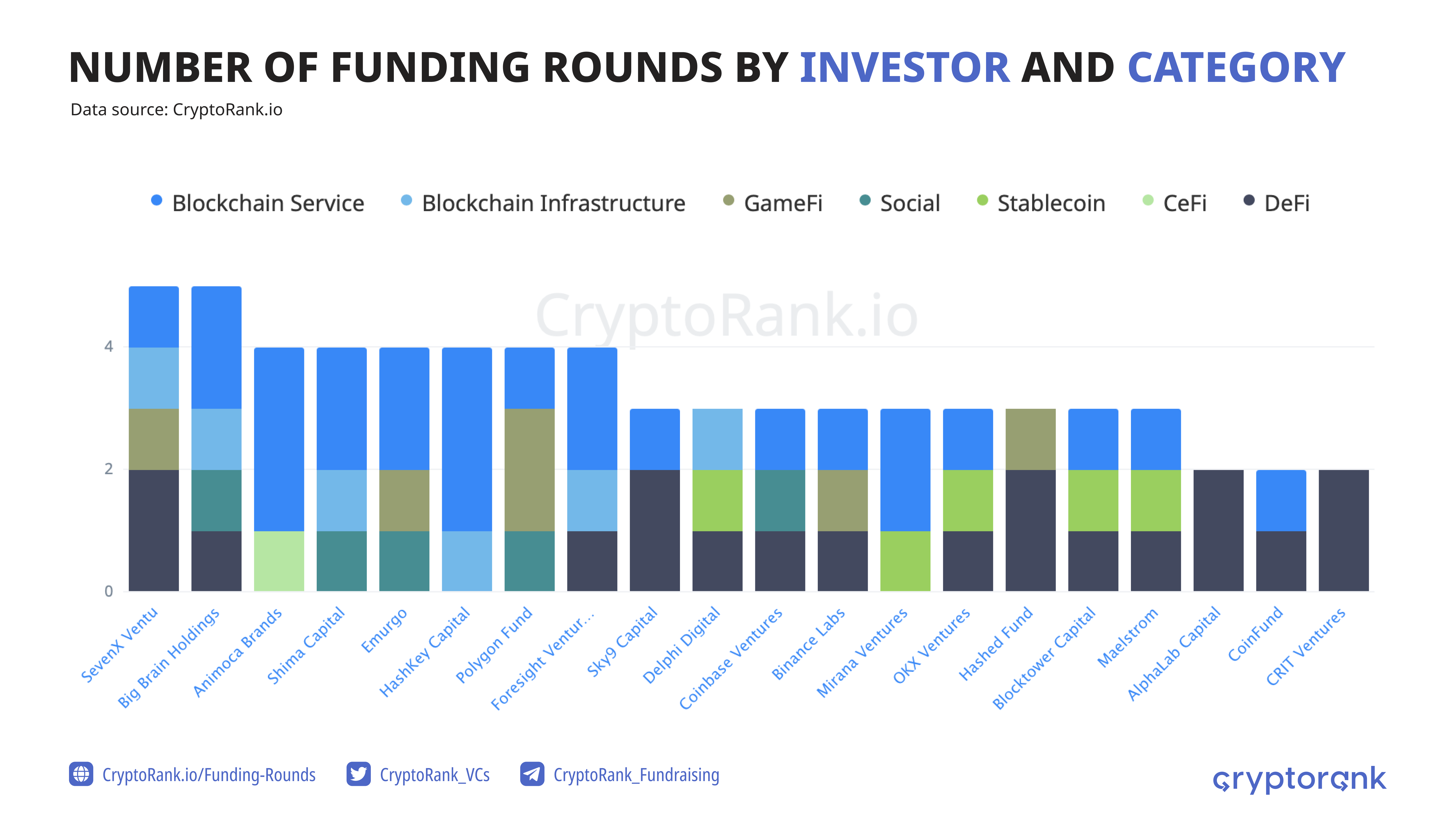

- Blockchain service is the most popular category among investors.

- The most active funds prefer to invest in Service and DeFi projects, with many exchanges among prominent backers.

- US-based projects and funds showed the highest level of activity, but Asian countries are gaining momentum.

Fundraising Remains Low Despite Increased Activity in July

Despite the decline in business activity over the summer, crypto funds announced a significant number of investments in July. Even though the crypto market showed a significant decline in trading volumes, funds invested a decent amount of money in startups. The amount of raises grew by 68.8% over the month, totaling $704 million. Since the beginning of the year, projects have raised more than $5.8 billion.

It is worth noting that the number of investment rounds has reached a minimum since November 2020. Such a decrease in activity may be due to seasonality, but we should also take note of the reversal of the correlation between bitcoin price and the total raised amount, which we covered in the previous analytical article.

Collection amounts this month were moderate, with only one project collecting more than $100M. Traditionally, rounds with high raise are mostly later stage investments.

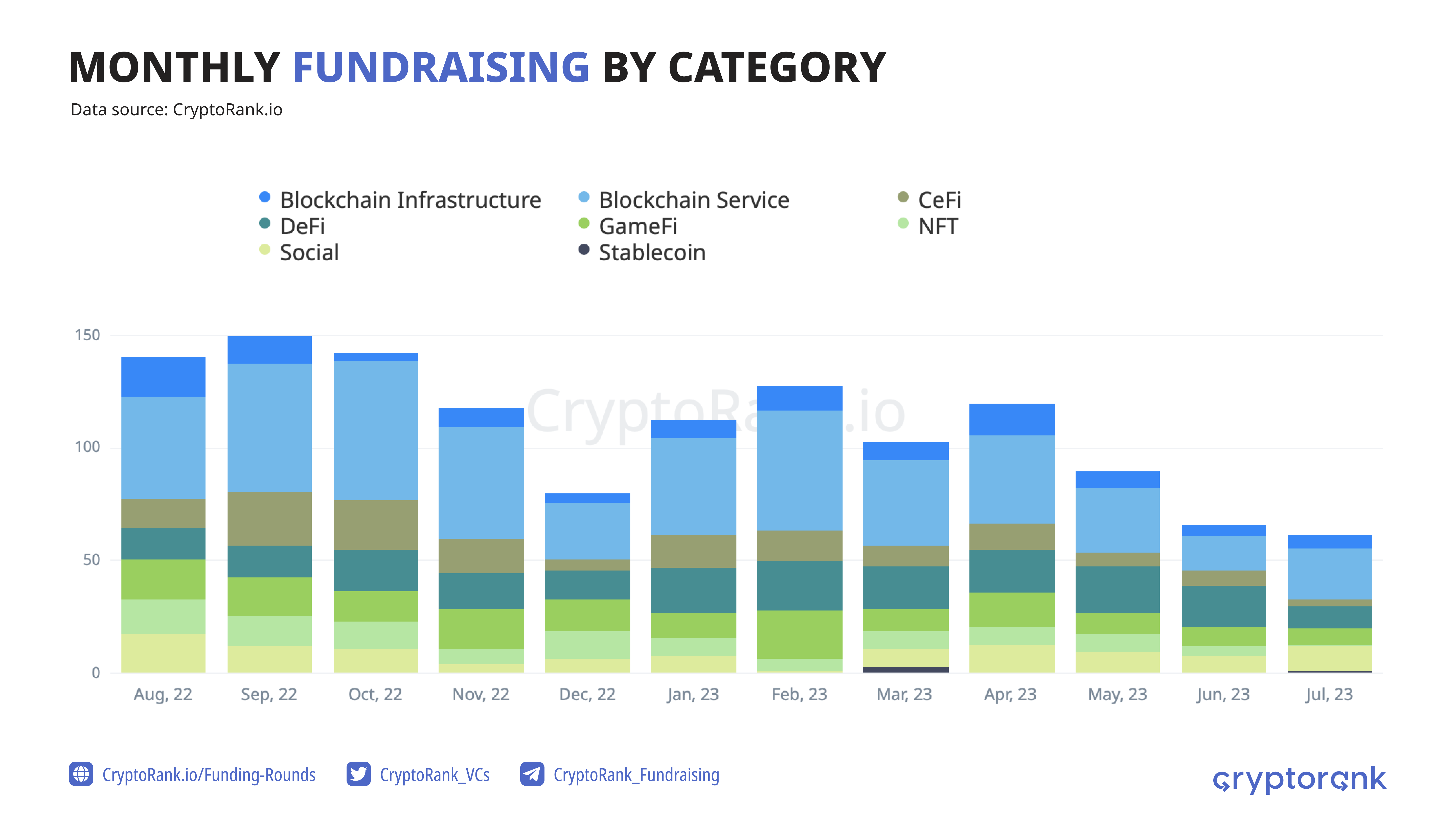

A closer look at popular categories in July may reveal more insights on the state of fundraising in blockchain.

Trending Categories

Blockchain Service has remained the most popular category for several months in a row. Overall, the breakdown of fundraising rounds by category is not much different from previous months. Blockchain Service is a fairly broad category that includes a variety of projects. Many of them aim to improve the usability of blockchain infrastructure, which has been an important trend lately.The most high-profile July round among Blockchain Service was the Series B fundraising round of Flashbots, backed by Paradigm. The company, now valued at $1 billion, has become the new unicorn of the blockchain industry.

On the other hand, CeFi startups have attracted the biggest amount of investments in July. One of the key rounds worth highlighting is Polychain Capital, raising $200M for a new fund.

The list of the most active funds in July includes big names such as Animoca Brands, HashKey Capital, Coinbase Venture, Delphi Digital, and Binance Labs. The data shows that active funds are also investing significantly in Blockchain Service projects, with DeFi ranking second on the list.

It is worth noting that several exchanges are among the most active July funds. These centralized entities are integral to the blockchain now and regularly support young projects.

Geographical Distribution

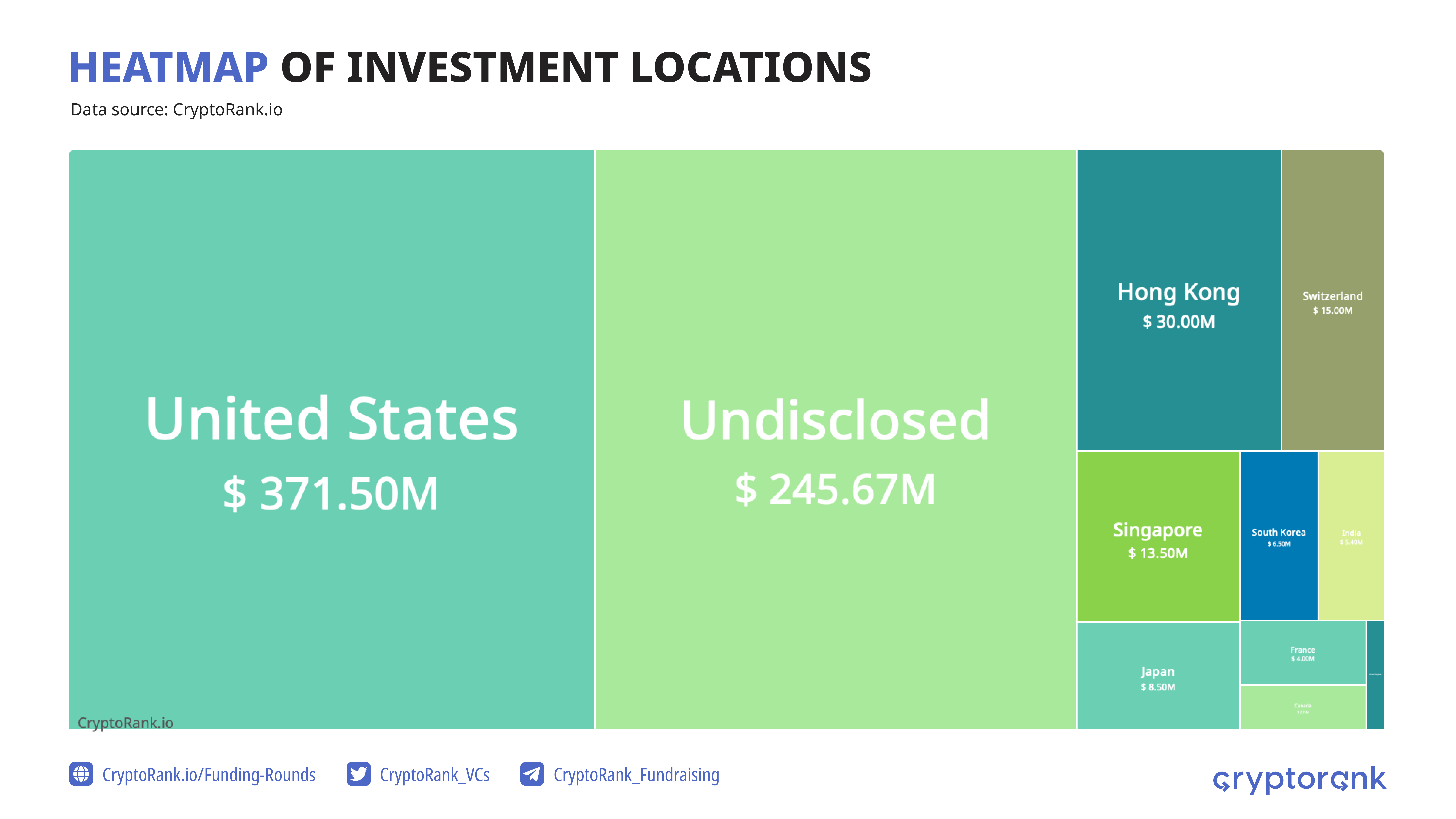

Startups based in the US attracted the largest amount of investment in July, an impressive $371 million. Hong Kong, Switzerland, and Singapore followed (excluding projects with undisclosed jurisdiction).

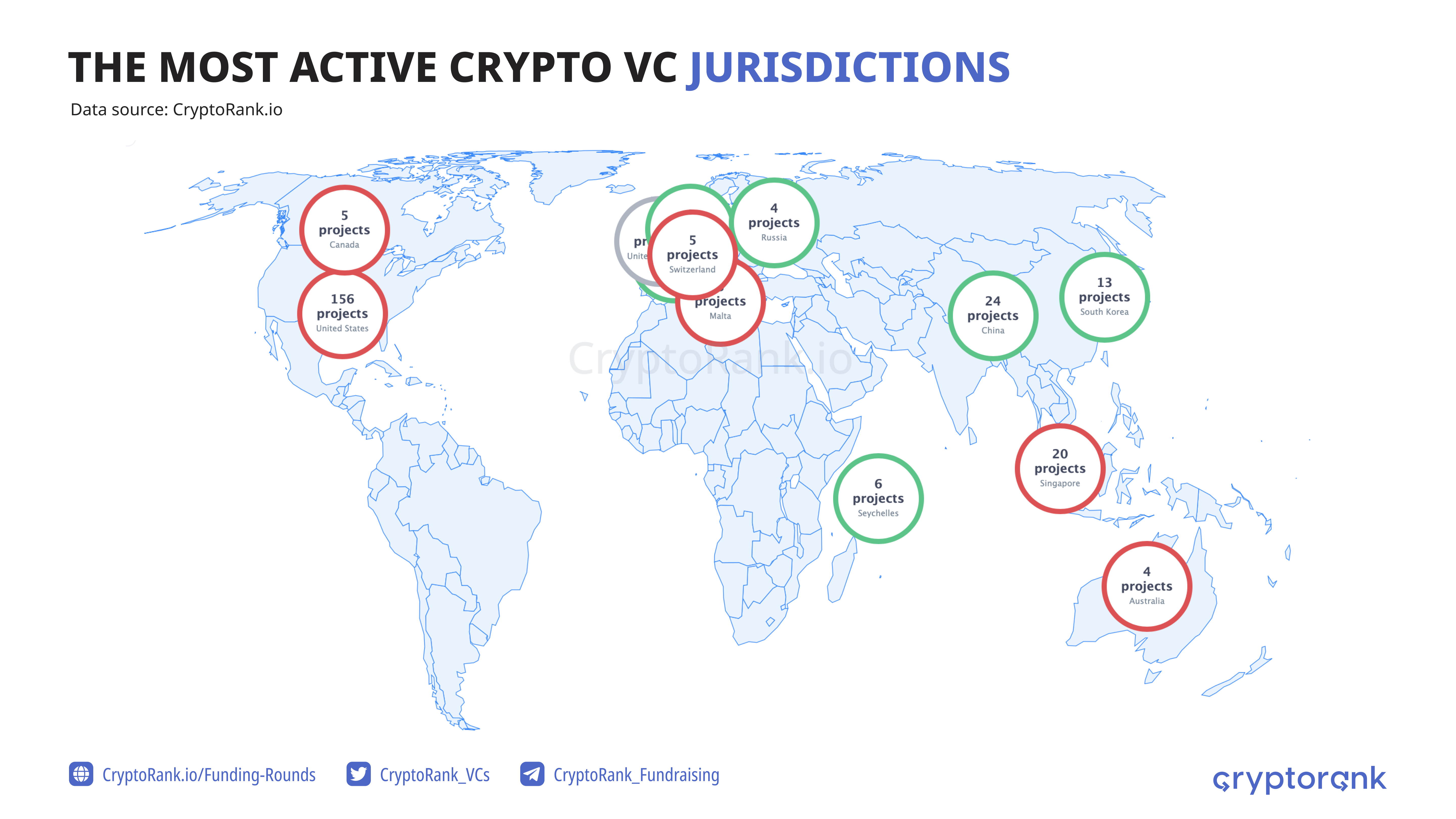

In July, US-based funds exhibited the most activity in the crypto market, followed by China, Singapore, and South Korea. Notably, Asian countries are currently among the most favorable markets for cryptocurrency projects.

In one of our previous articles, we discussed the growing popularity of Asian countries among blockchain project founders and developers. This trend continues to gain momentum, particularly in light of the legal uncertainty facing the US and European countries, further strengthening the position of Asian countries.

The Bottom Line

The crypto market did not experience any serious shocks in July. The majority of projects continued to develop, and investors have become more cautious, adopting a wait-and-see approach.As we mentioned in the report for the first half of the year, we should expect a recovery in the growth of activity in the crypto fundraising market. However, the slight increase observed in July is not yet an indicator of the beginning of a recovery trend. As long as the markets remain uncertain, investors are not ready to take decisive action. But with the emergence of clearer regulations and the resolution of pressing problems, everything may change.