It was a bullish month for the cryptos. CryptoRank’s team collected the most significant market updates and trends that are worth noting for consideration. Look into the latest market intelligence and in-depth reports on popular blockchains and digital assets.

Highlights from the last month’s report

- Bitcoin price logs one-year high above $12,000

- The Ethereum price surged to a two-year high of $443

- Capitalization of the cryptocurrency market rose to its highest peak in 2020 of $393.92B

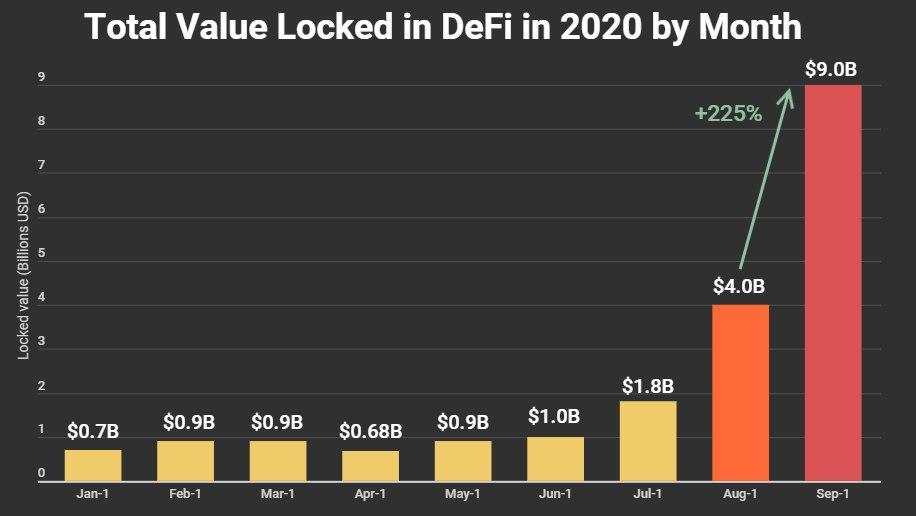

- The total Value locked in DeFi hit $9B

- The current supply of stablecoins crossed $15B

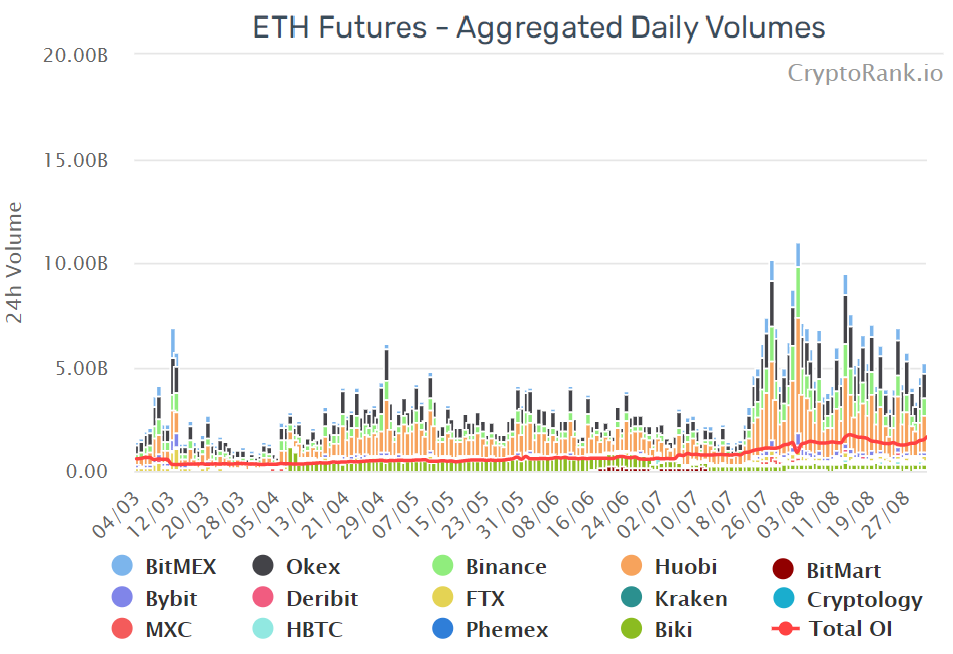

- Open interest on Ethereum futures surpassed $1.5B and daily volume reached $11B

- Ethereum gas fees hit an ATH and outperformed Bitcoin as DeFi boom continued

- The daily transaction count on the Ethereum network reached a two-year high of 1.29 million

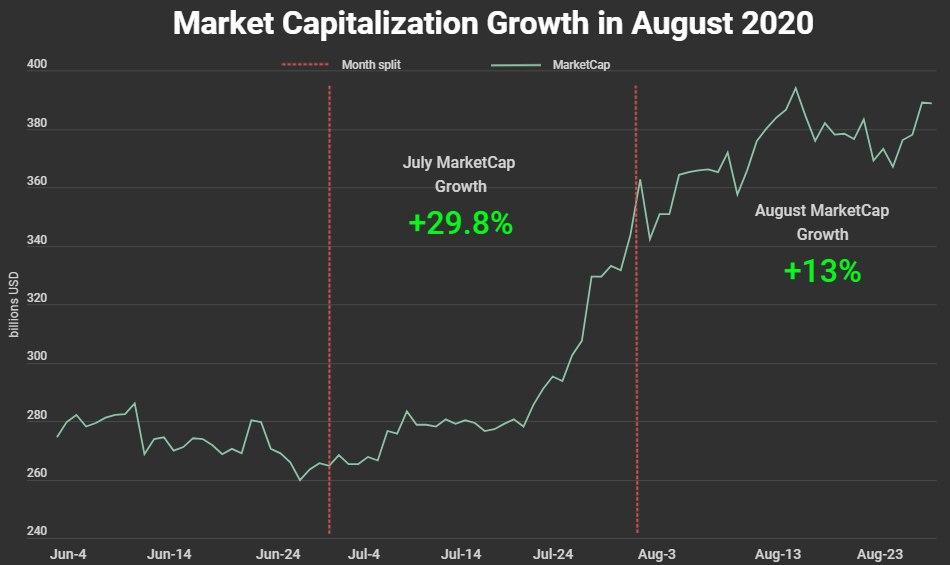

Market Capitalization

In August 2020, the capitalization of the cryptocurrency market increased to its highest peak of the year of $393.92B which represents a growth of about 13%. This is less than the month earlier (+29.8%), but still an impressive mark.

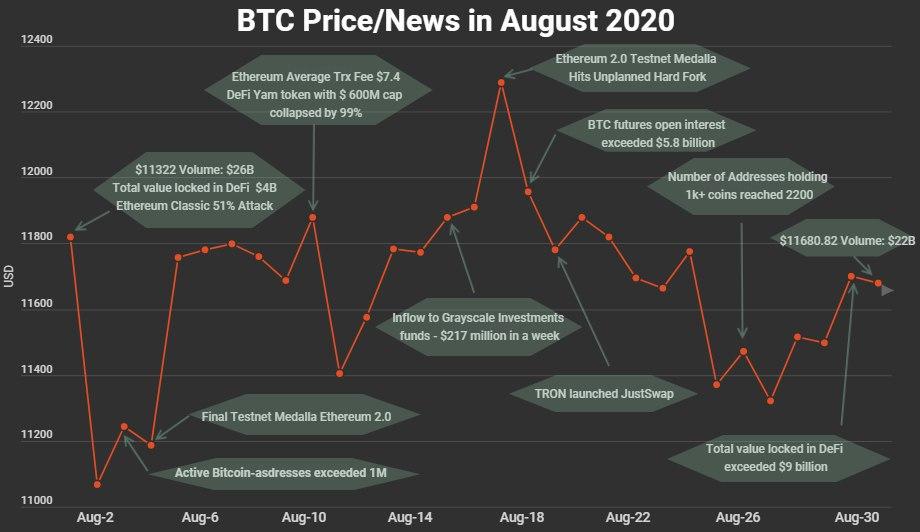

During the entire month of August, the Bitcoin price held above $10,000 and logged a one-year high above $12,000.

At the same time, the stablecoins market capitalization reached a peak of $15.6 billion, which is an increase of more than a quarter. In previous months, stablecoins and crypto market cap did not have a stable positive correlation, but in August we can observe one in these two indices.

The main attention of market participants was focused on the rapidly developing sector of DeFi, Ethereum Classic 51% attacks, Ethereum network congestion, and the launch of the Ethereum 2.0 Testnet Medalla.

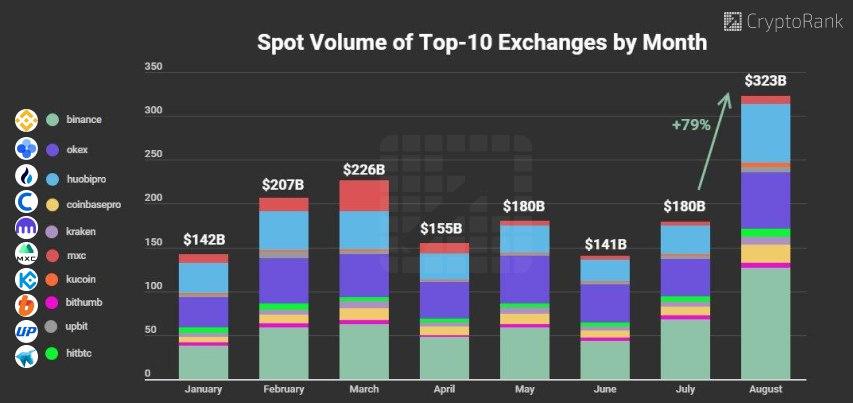

Both centralized and decentralized exchanges demonstrated an impressive increase in volume

In August 2020, we can observe an extremely positive uptick in spot trading volumes. The monthly adjusted volume of the top-10 exchanges showed significant growth of 79% from July volumes.

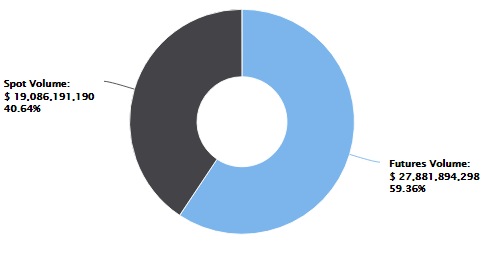

As a result, the share of daily futures volume decreased from 73.2% to 59.36% vs spot markets.

Futures VS Spot 24 Volume*

*Adjusted Spot Volume of the top 100 Exchanges listed on CryptoRank. Adjusted volume approximately corresponds to the real trade volume on the exchange, taking into account website traffic, market depth, frequency, and size of transactions. Full details are available in our methodology.

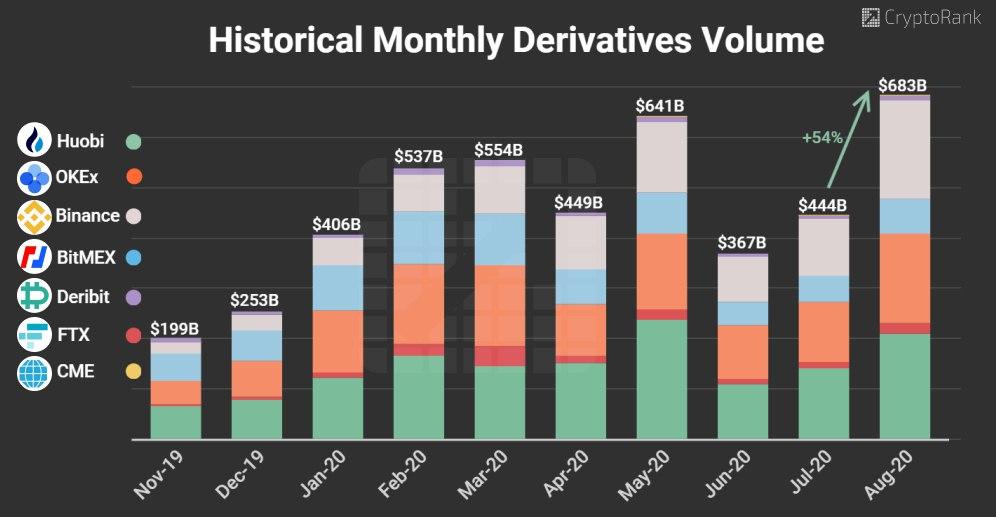

Derivatives Overview

A new all-time high was set at the $683B level, which means a 54% increase compared to July’s $444B.

The top derivatives exchanges by monthly volume were:

- Huobi: $139B —> $208B or +49%;

- Binance: $114B —>$194B or +70%;

- OKEx: $119B —> $177B or +49%;

- BitMEX: $50B —> $70B or +40%.

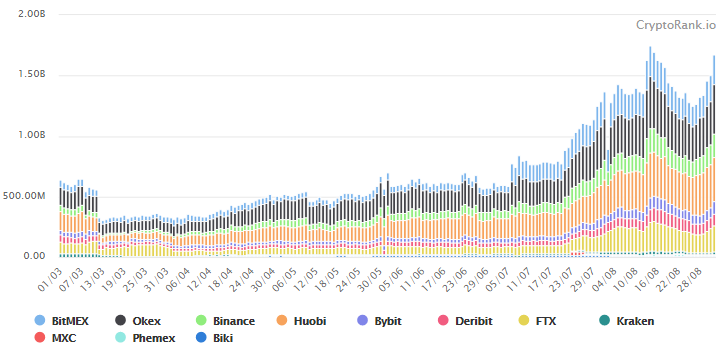

The explosive growth of the DeFi sector, together with the market uptrend, triggered a significant increase in Ethereum futures, which led to an open interest record of over $1.5B.

Ethereum Futures Aggregated Open Interest Growth in August

Moreover, the daily volume of Ethereum futures reached an ATH of $11B on August 2.

Decentralized Finance (DeFi)

The incredible growth of DeFi in the Ethereum ecosystem coupled with catalysts such as farming led to the impressive growth of the total value locked (TVL) in DeFi of $9B.

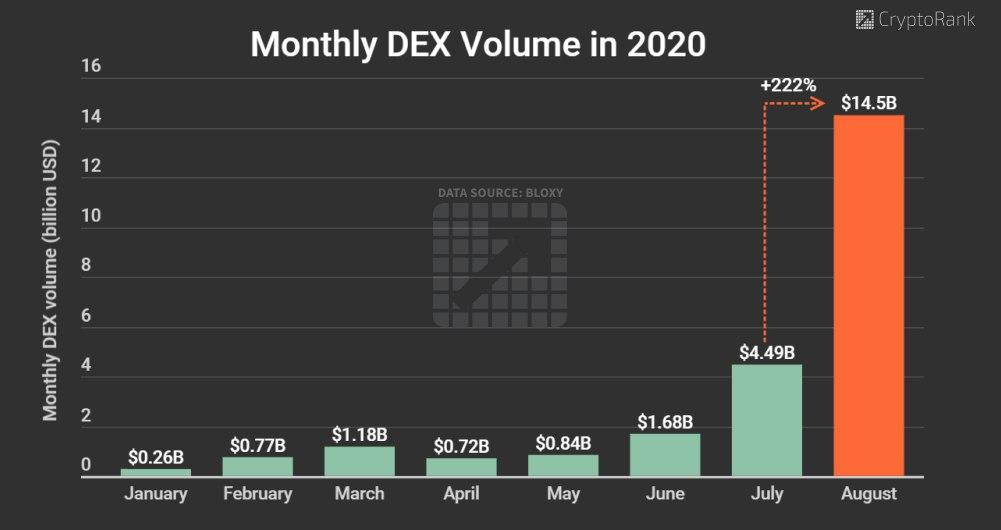

Consequently, volume on decentralized exchanges has shown stable growth in recent months. But in August 2020, the growth of volume on DEXes was impressive and reached $14.5B from $4.5B in July, as the intense enthusiasm for decentralized finance (DeFi) applications continued to spread.

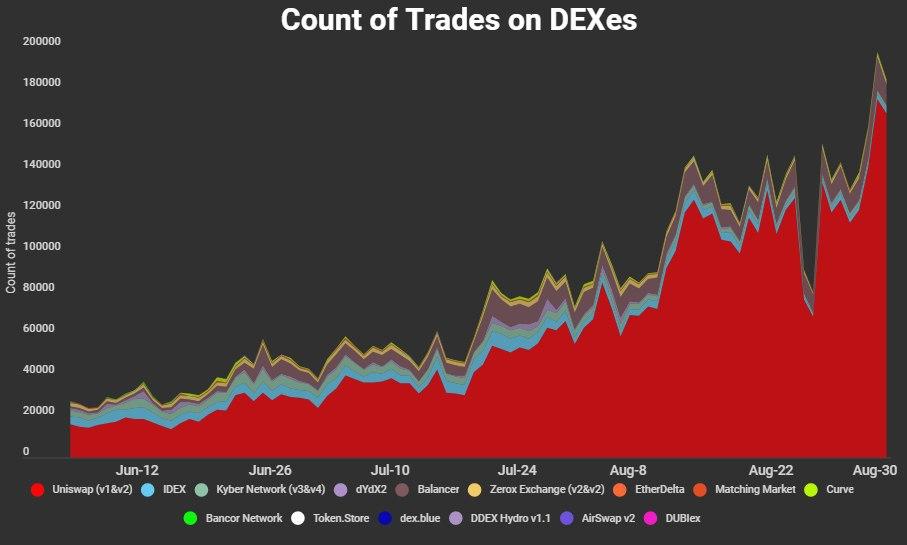

Additionally, the number of trades on DEXes also increased significantly, almost reaching 200,000 transactions per day.

The leading decentralized exchange platform, Uniswap, reported a 283% volume increase in August, reaching $6.7 billion. The number of trades on Uniswap increased from 60% at the beginning of August to 90% at the end of the month.

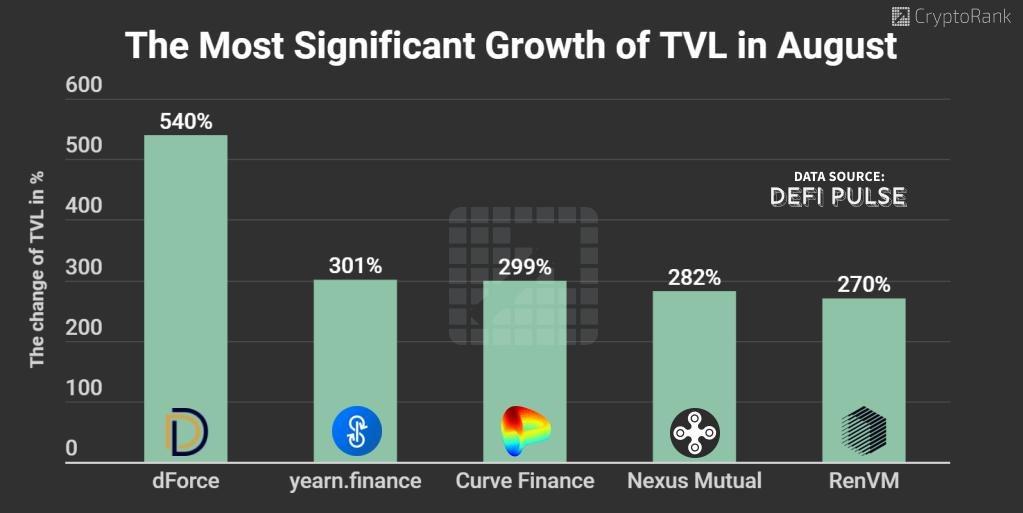

The Highest Growth of TVL by Projects in August 2020

dForce demonstrated the most significant growth of total value locked in August.

- dForce $5M —> $32M or 540%;

- yearn.finance $198M —> $794M or 301%;

- Curve Finance $277M —> $1.1B or 299%;

- Nexus Mutual $17M —> $65M or 282%;

- RenVM $40M —> $148M or 270%.

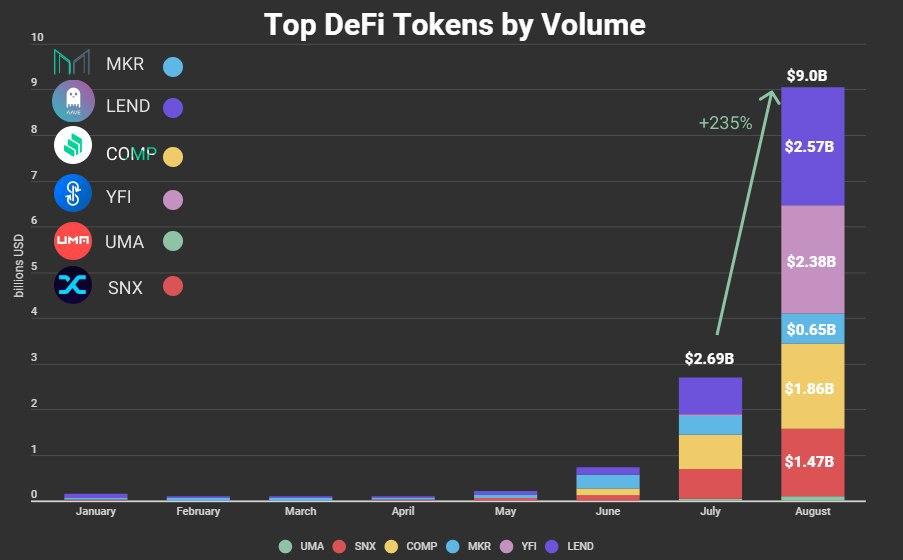

Moreover, the trading volume of DeFi Tokens hit ATH in 2020 of $9B, representing the high interest from the community.

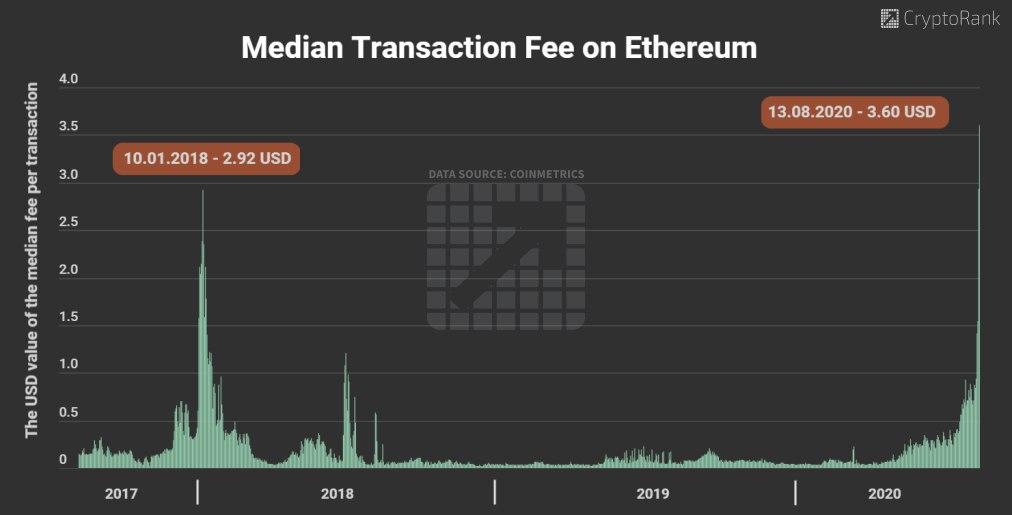

Medium Transaction Fee on Ethereum Hit ATH

In August 2020, the Ethereum network experienced an increased hash rate. As a result, transaction fees started to approach record highs due to the sudden spike in transactions and heightened activities on DeFi platforms.

Ethereum nodes are running near their limits. Also, there is the constant threat of DoS attacks that are much slower to process than regular blocks, slowing the chain to a crawl. The median transaction fee hit all-time high (ATH) of $3.60. The previous ATH of $2.92 was during the ICO mania in January 2018. Simultaneously, the daily transaction count on the Ethereum network reached a two-year high of 1.29 million, which is the closest number to the ATH of 1.34 million on January 4th, 2018.

Token Sales Restarted

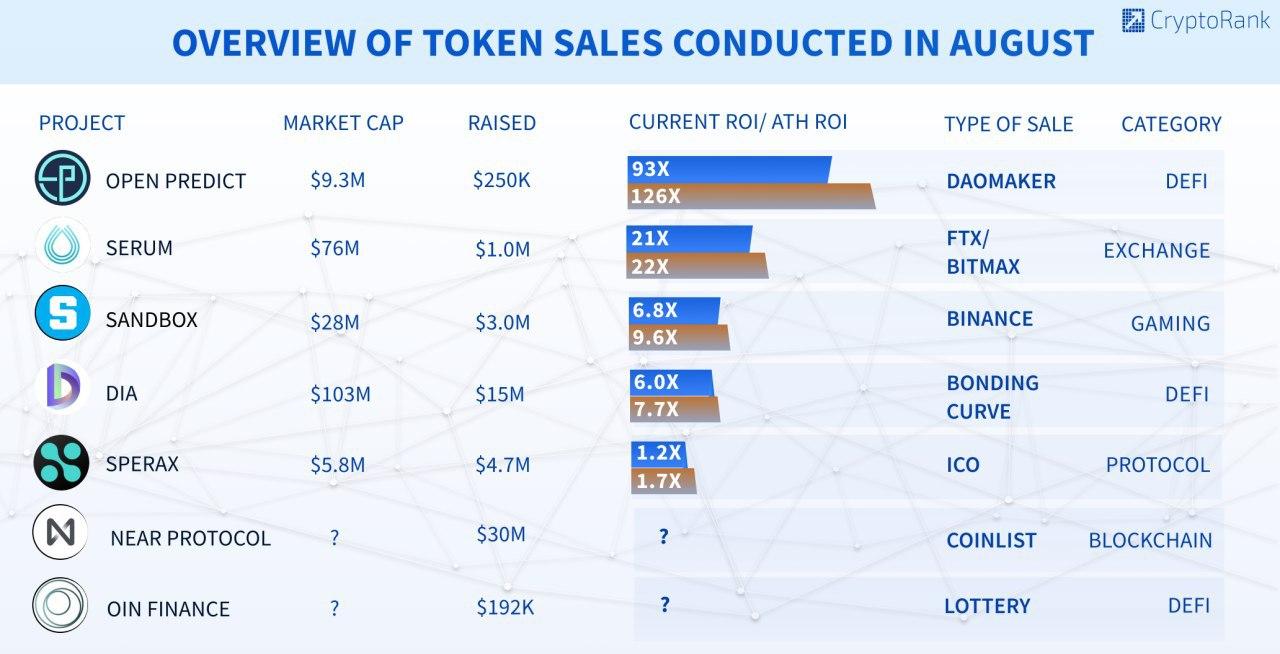

August was a quite strong month for many cryptocurrencies trending the crypto market upwards again. Major exchanges have restarted IEOs on their platforms in response.

Here is the overview of the most popular token sales in different forms: IEO/ICO, lottery, and bonding curve.

The latest market intelligence and in-depth reports in our Telegram channel and Twitter