Crypto Market Recap Q1, 2023

What a start of the year! 2023 began on a positive note, just like a fresh breath of air after a boring end of the year. The rapid growth of the market quickly brought us to the pre-FTX-crash levels, and now the BTC price is close to June 2022. The tough days of 2022 are now in the past and the market begins to blossom, revealing massive airdrops, new projects, token sales, as well as funds now beginning to increase their investment activity in web3.

Nevertheless, Q1 2023 passed not without problems. Notably, the most problems came from TradFi, rather than from within the cryptocurrency market. The banking crisis not only heavily affected the global banking system, but also revealed Bitcoin’s strengths.

The macro picture is quite controversial. On one hand, the global financial markets are in a fight with inflation, which may lead to a recession. This is a big threat to the markets, including crypto, as it is still mostly an investment instrument. On the other hand, the banking crisis is a threat to financial stability, which may be avoided by printing more money. The Fed has to make a difficult decision, increase the rate to fight inflation or keep it around 6% to be able to increase the money supply.

It is difficult to predict the crypto market’s performance in such conditions. But it is obvious that the problems of the traditional financial system increases adoption of crypto and trust in Bitcoin.

In this recap we cover:

- The state of the crypto market

- Whether the bull market has came or yet to come

- The airdrop season

- DeFi’s recovery

- The Layer 2 rush

- Latest fundraising trends

- Has the NFT market really grown recently?

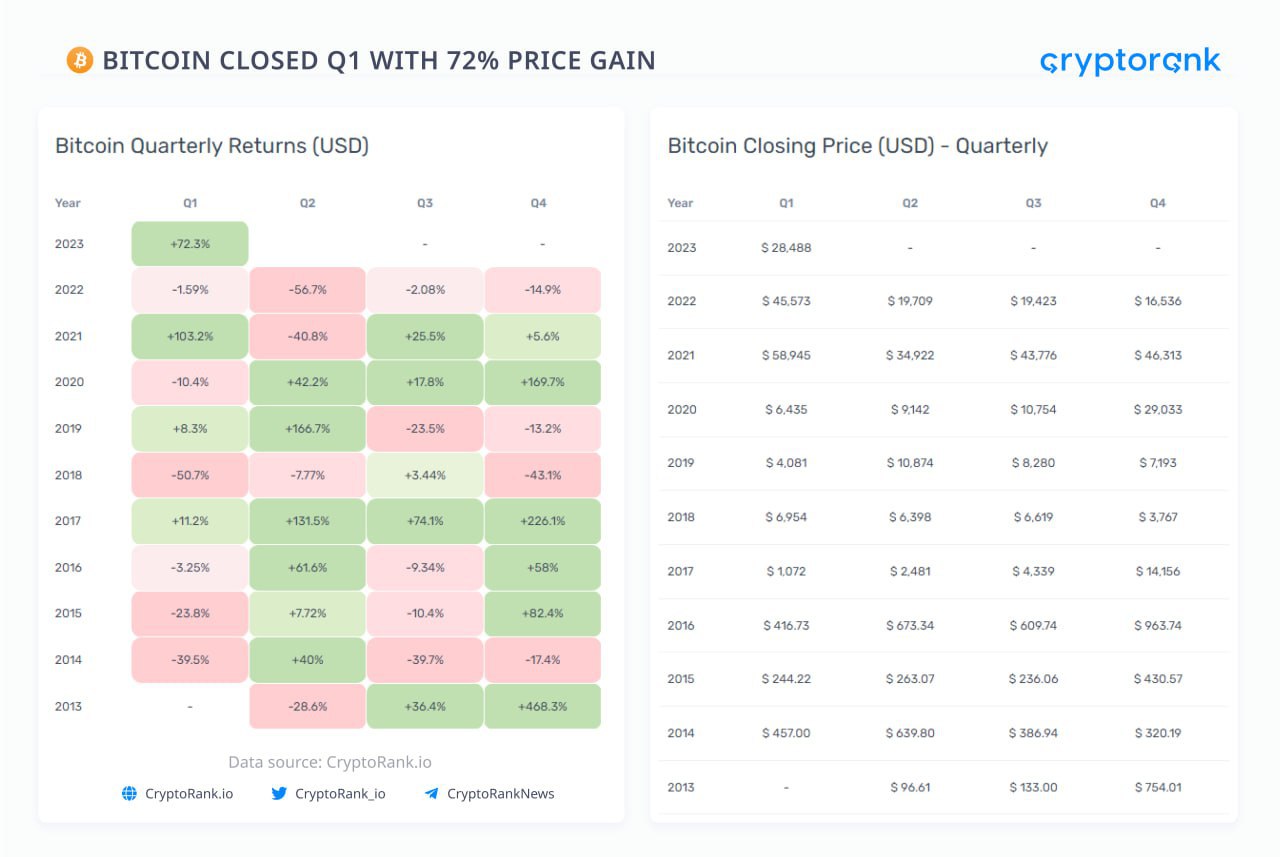

The Bull Market is Around the Corner

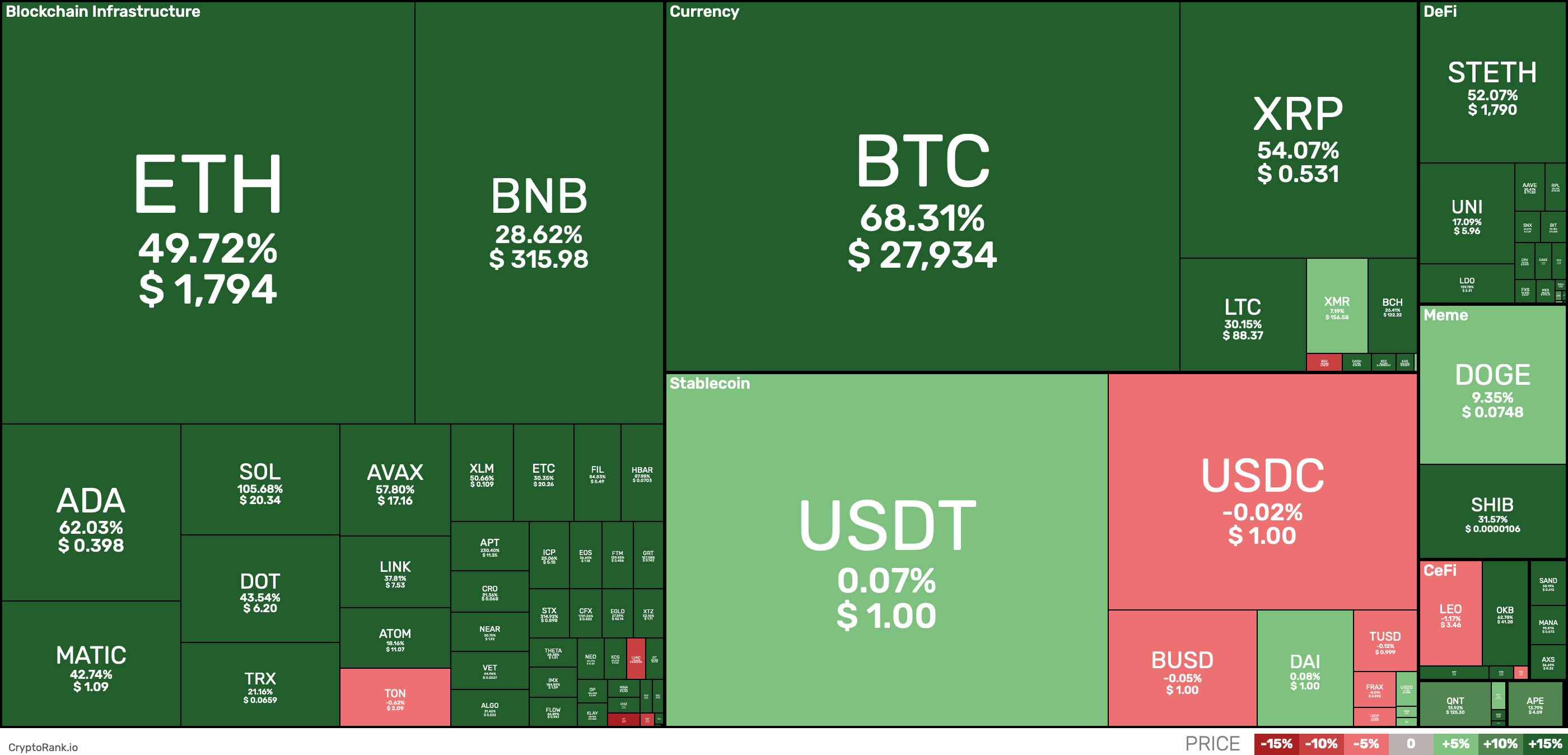

In early 2023 we could see a changing moment, when Bitcoin started to grow after several weeks of low volatility. January was a very successful month for Bitcoin and crypto overall despite the negative events, in particular the Genesis drama. While February was an average month in terms of performance, March brought some new heights for crypto.

Bitcoin was an obvious outperformer among the top-10 in the Q1, but there were also a couple notable top-100 projects. First is Solana, which showed a really bad performance in Q3 due to strong bonds with FTX, but showed 109% gains in Q1. Another one is Lido with +134%, but we will cover it later. The last, but not least is Aptos, which showed an outstanding 230% growth in this quarter. For more info on Q1 gainers, visit https://cryptorank.io/performance.

The notable thing about BTC is how it performed through the weeks of collapsing banks. This was truly the “Bitcoin moment”. At the same time, BTC’s dominance reached one of the highest points in almost a year. The moment that has shaken the traditional financial markets really hasn’t done something significant for crypto, even though USDC de-pegged from $1 and BUSD was banned by the government. Additionally, despite few important suitcases against crypto firms and entities, the market stays strong.

The gainers list is quite diverse and also shows decent numbers this quarter. Due to the market recovery and strong uptrends in particular ecosystems, many projects gained remarkable attention in the quarter, which lead to their price increase.

While the artificial intelligence trend dominated in the narrative, it allowed many mature crypto startups to increase their value. Thus, any project that added “AI” to its name or list of features, gathered new funding or saw an increase in price. DeFi is probably the best performing category of Q1 overall, especially decentralized exchanges. Also it is worth to mention projects based on Layer 2 blockchains (Arbitrum and Optimism), such as Camelot, Radiant Capital, Velodrome, Gains Network, performed better than others.

The Airdrop Season has Begun

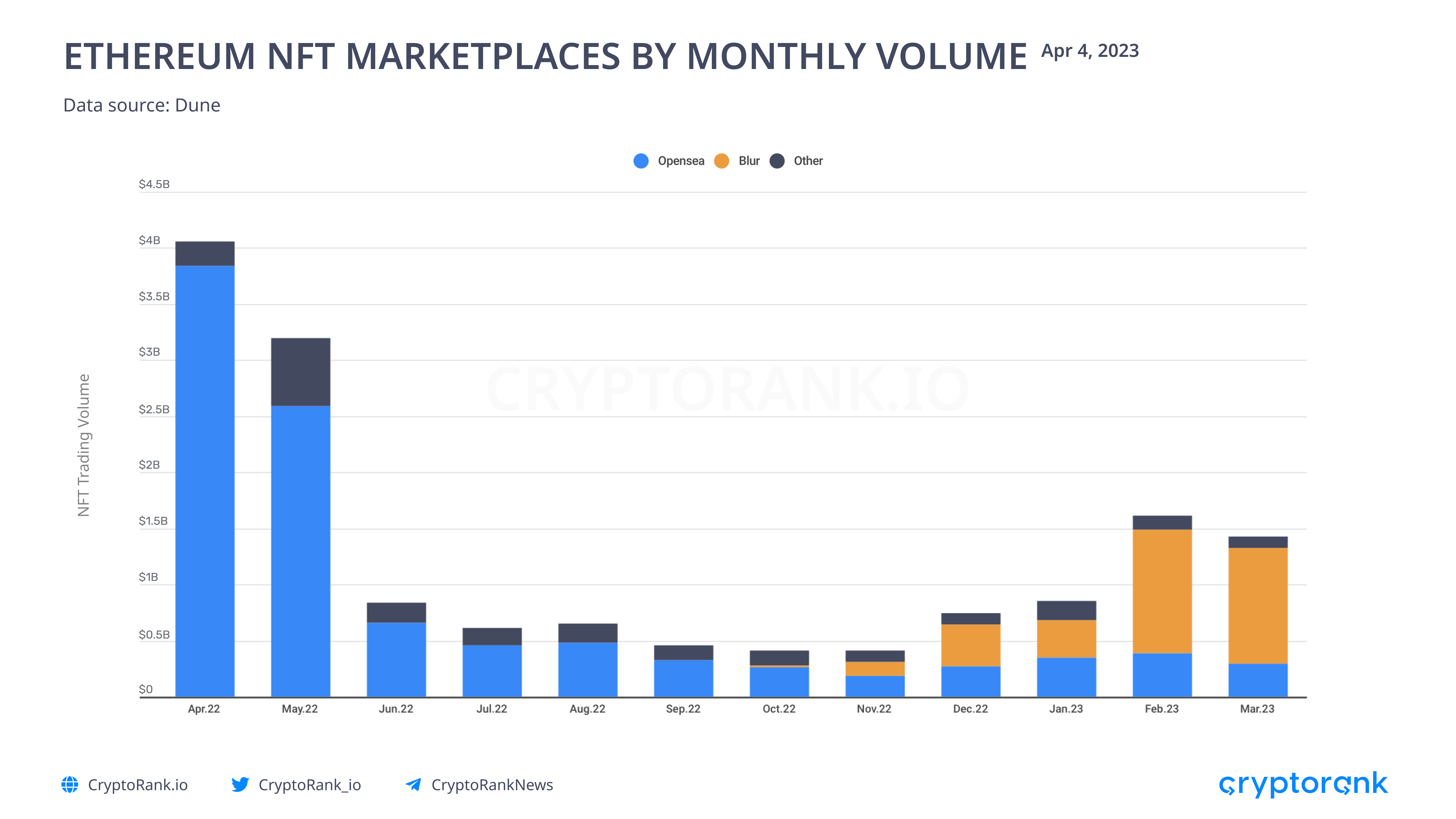

February was marked by a major event in the crypto community. This was the first big airdrop in a long time. Blur, one of the biggest NFT marketplaces, airdropped about $300 million worth of tokens.

Blur chose a way of engaging with the community and rewarding loyal NFT traders. This decision definitely was worth it, both for Blur and the users. Blur became the largest NFT marketplace, surpassing OpenSea. Loyal users received not only a huge airdrop, but also Blur had many incentivizing activities during the past months to attract and retain new users.

March was even more impressive in terms of airdrops. In the middle of the month Arbitrum announced the airdrop plan and launch of the DAO. Arbitrum’s airdrop gathered a lot of attention, for a good reason, it has become the biggest airdrop ever. ARB quickly got into the top-50 and holds a strong position in the chart.

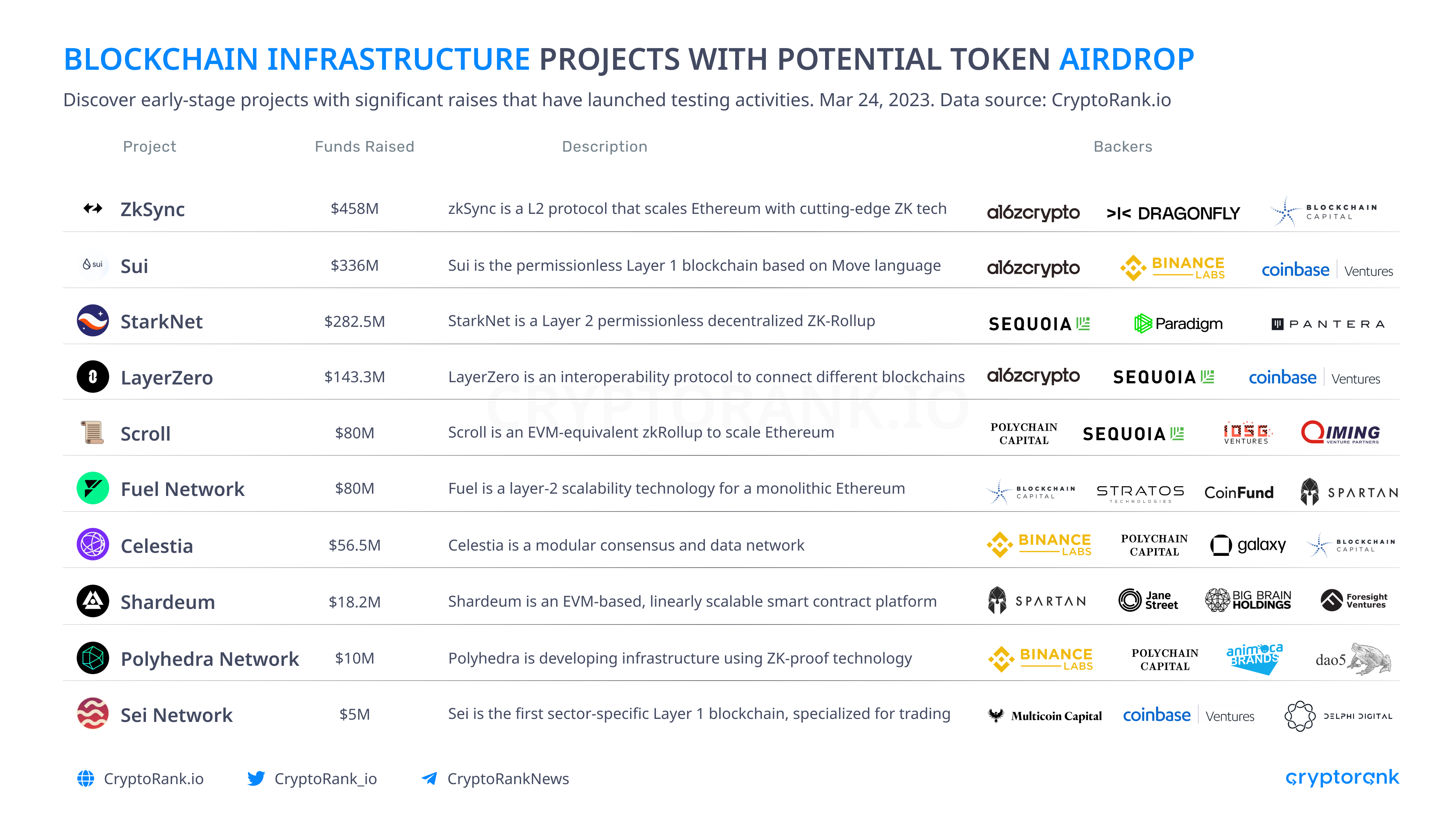

The growth of airdrop activity is a very strong boost to the crypto market. It attracts new users and old ones become more active, the increase in activity increases project fees. Blockchain infrastructure projects are primarily of interest to potential airdrops because they represent the backbone of crypto.

The hunt for airdrops will probably mark a market recovery before a new bull run begins.

DeFi Rises From the Dead

Along with the market growth, DeFi began recovering. So far, DeFi TVL grows much slower than the market, mostly because the altcoins lag behind Bitcoin in their growth. However, the emergence of new trends is already a sign of recovery.

Liquid staking is the new trend in DeFi. Staking is a key element of Proof-of-Stake networks. Also, it is a significant source of income of thousands of validators and delegators. The upcoming Ethereum update, Shapella, will enable staked ETH withdrawals, which will only increase the popularity of liquid staking.

Decentralized liquid staking providers became a very popular instrument for many DeFi users. Their obvious benefit is that the user receives a derivative coin that is pegged to the amount of staked coins. The biggest ones are Lido and Rocket Pool, which showed outstanding performances in the first months of 2023.

Liquid Staking protocols have surpassed Lending and Borrowing protocols in terms of combined TVL, now the second after DEXs. Seventy eight protocols have a total over $16 billion TVL combined. Compare this to DEXs’ 759 protocols and $19 billion TVL.

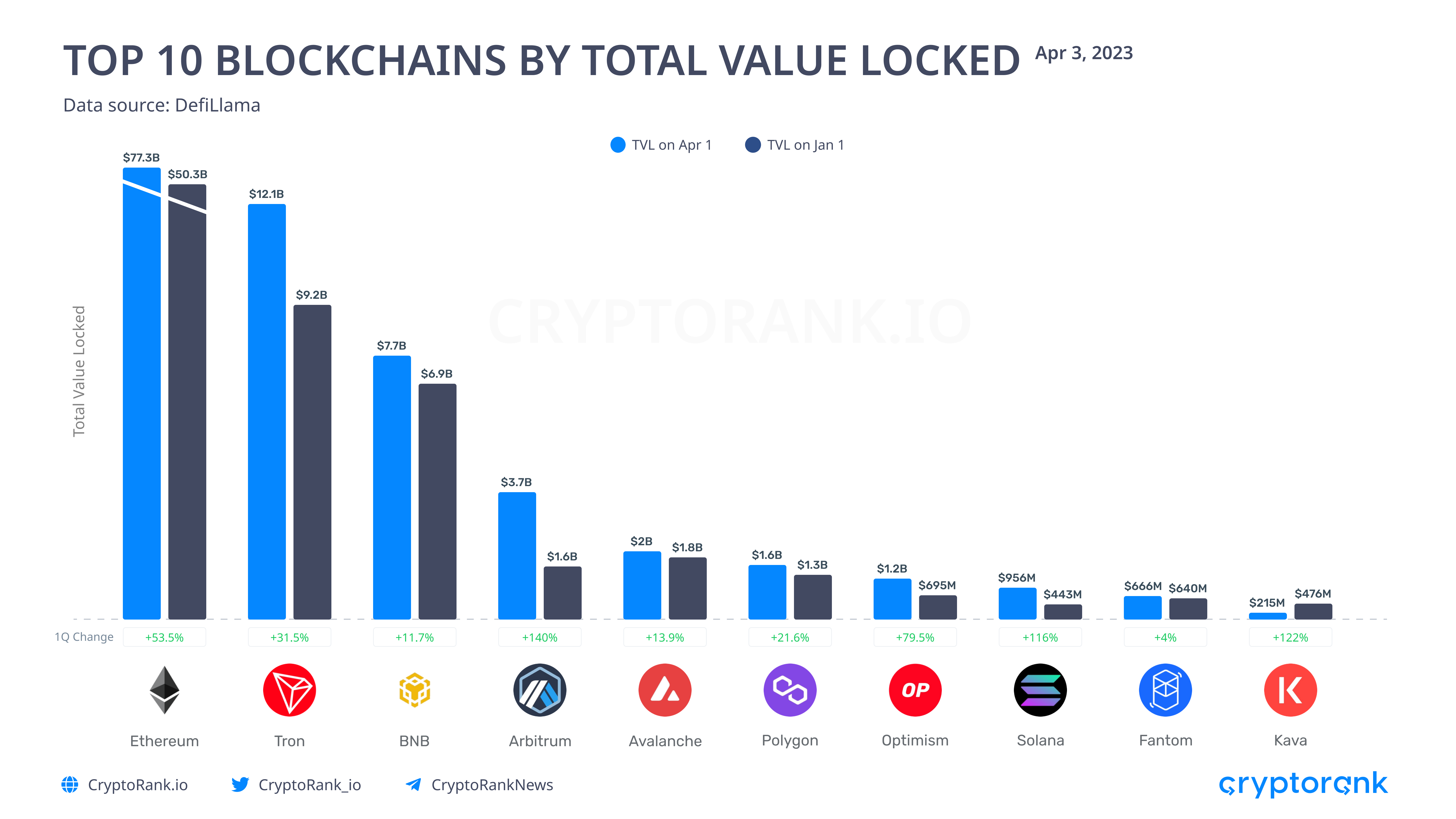

Speaking of the quantitative indicators of DeFi recovery, the total value locked increased by nearly 40% since the beginning of the year. While Ethereum retains the leading position among blockchains with a significant gap from Tron and others, Arbitrum, Solana and Optimism showed a notable gain in TVL in Q1 2023.

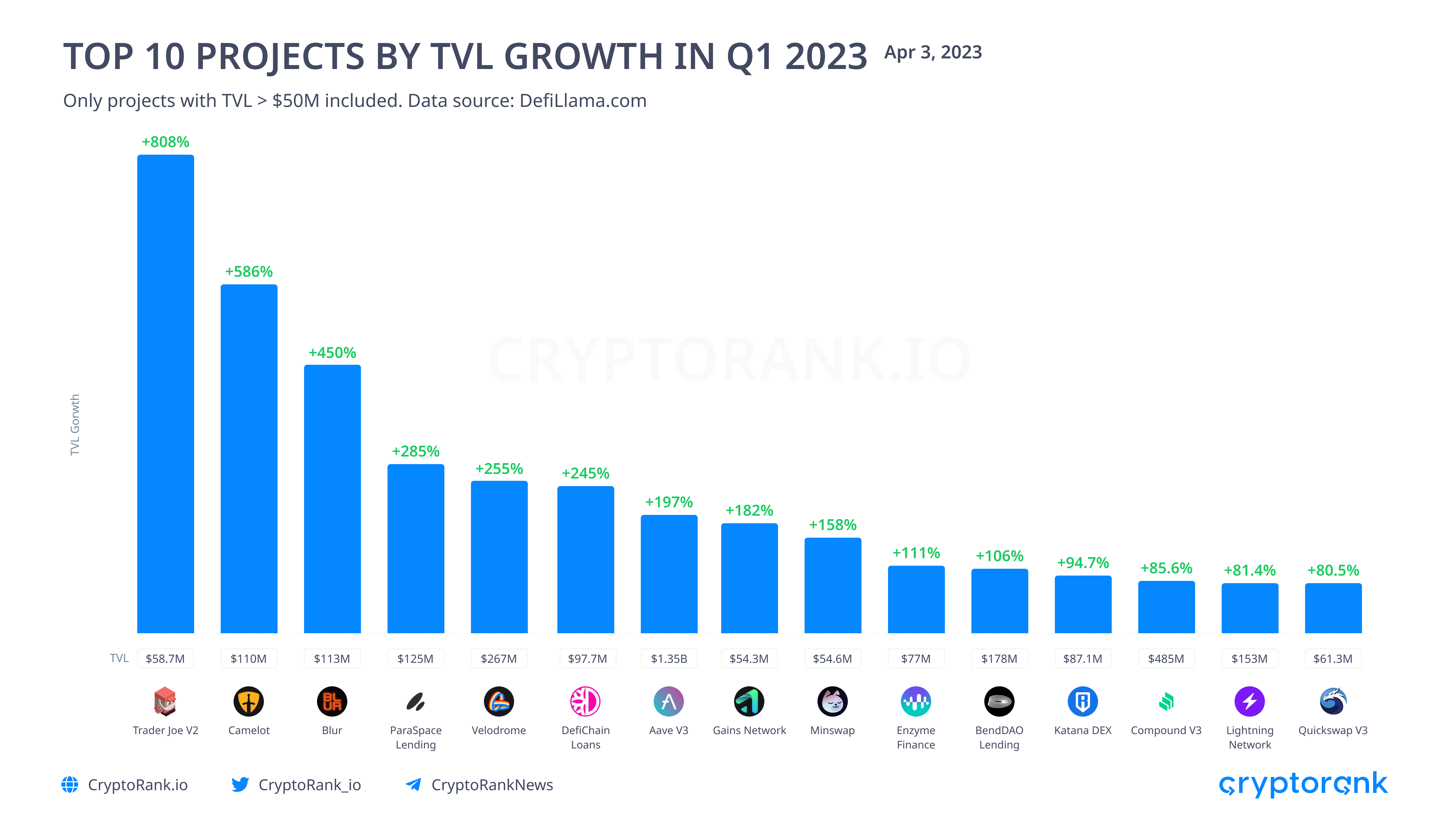

It is worth mentioning protocols with significantly increased TVL in 1Q 2023. These are mostly projects that have launched on new networks and that gained a lot of attention. Also, protocols based on Layer 2, like Camelot, Velodrome, and Gains Network, saw a significant increase in total value locked. One of the top 15, Lightning Network, showed an outstanding performance due to growing adoption of Bitcoin as a means of payment.

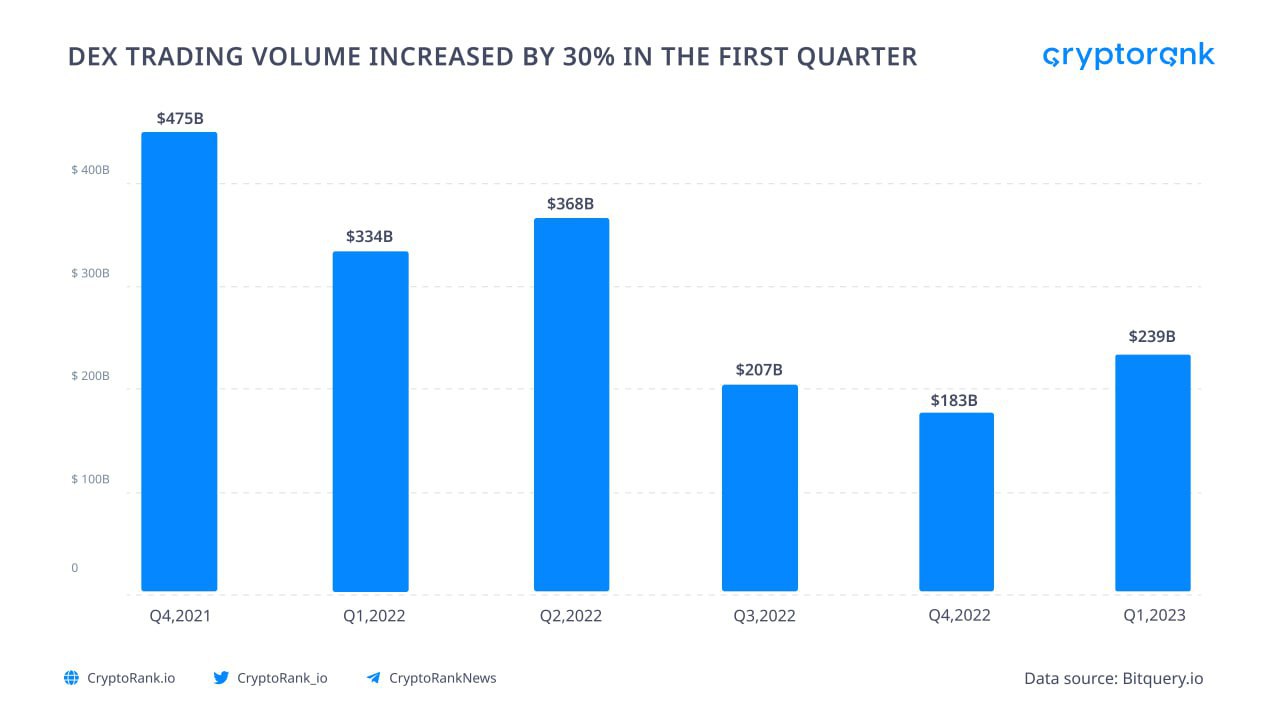

DEX trading volume also showed an increase by approximately 30% in the first quarter of 2023 after 2 quarters of decline. DEX/CEX ratio also increased, and now sits around November 2022 level. In current market conditions decentralized exchanges have great positions, which allows them to continue their growth. Few factors push their usage up, such as low gas fees (which is temporary) and growing awareness of web3 users. DEX/CEX ratio is still 4% away from the ATH of January 2022. However, the growing popularity of blockchain may push this indicator to the new all-time-highs.

The Layer 2 Rush

In 2022, the adoption of Layer 2 blockchains began. In 2023, the adoption among crypto users may finally happen.

Optimism was the first project that gained attention of the general crypto public with its significant airdrop in 2022. Later the same year, Arbitrum, another optimistic rollup, announced its incentivizing activity, the Arbitrum Odyssey, which even broke the network’s capabilities. The launch of these L2 blockchains was right on time. Users loved it; all the features of Ethereum, but faster, with lower transaction costs and better capacity.

This year, the Layer 2 game changed again with airdrop from Arbitrum. Arbitrum was quickly developing through the H2 2022 and many projects launched on the network, even the biggest ones. Arbitrum was already one of the most popular blockchains among many users, even without clear airdrop plans.

The craze around Arbitrum’s airdrop made a perfect moment for other projects to launch their mainnets and testnets. Right after the ARB airdrop, zkSync announced the launch of the first zkEVM maninet, zkSync Era. This gathered a lot of attention, and drove transaction numbers to the moon. Few days later, Polygon launched its long-anticipated zkEVM as mainnet beta. There are several more L2 projects that are dragging attention not just from the crypto community, but also from major VCs.

Different companies followed Polygon’s expansion strategy and developed their own zero-knowledge technologies, including blockchains. ConsenSys, one of the biggest crypto companies, recently released its zkEVM public testnet “Linea”. The fact that Coinbase launched its L2 network Base is a reminder that it is still the early era of Layer 2, and there will be many more interesting rollups.

Fundraising is Trending Upwards

As it has become more obvious to investors that crypto is moving in the right way (rising and shining), the VCs and token sale launchpads act quickly to leverage this opportunity.

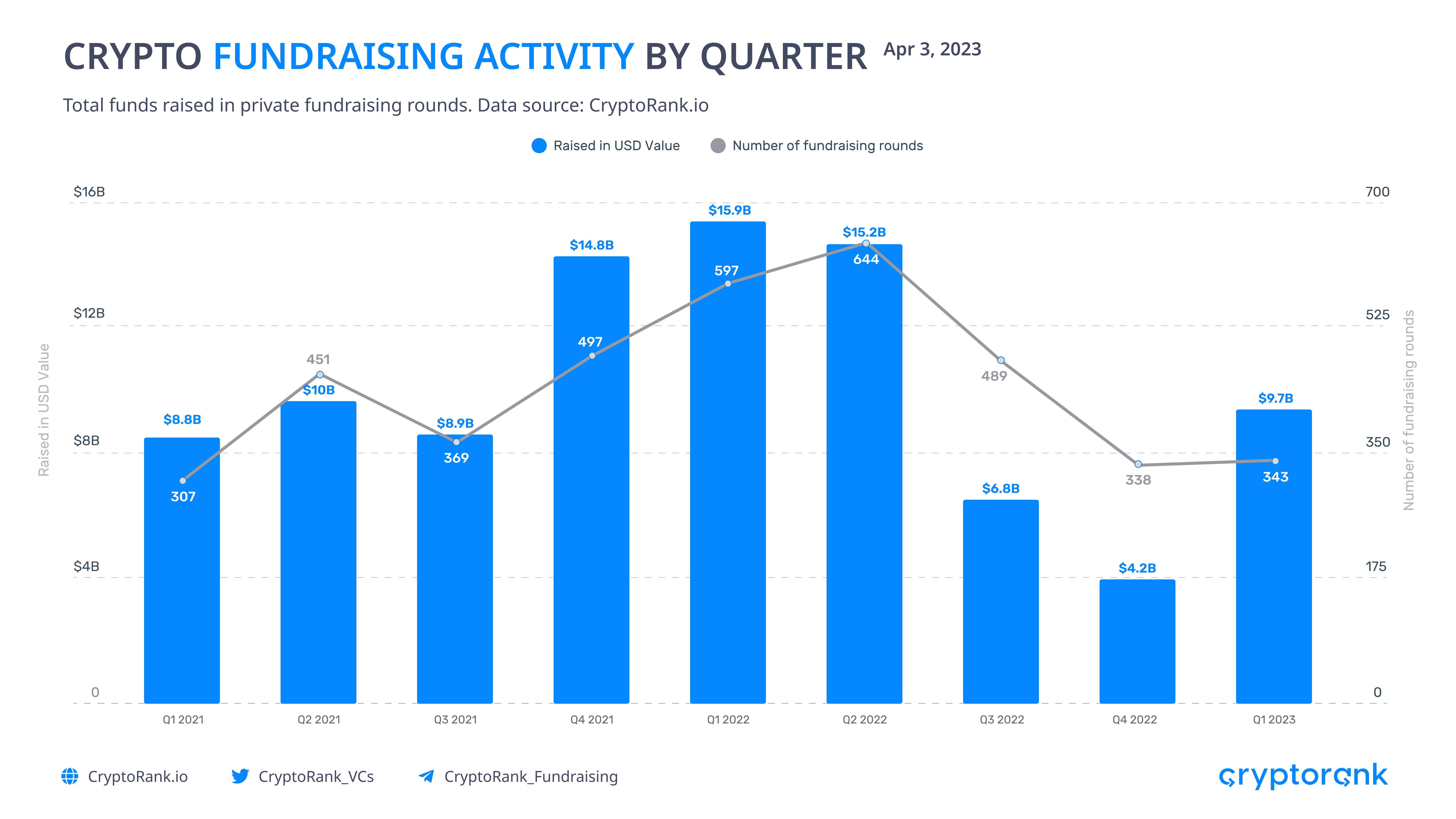

After the FTX collapse, the fundraising dramatically decreased, mainly because Alameda was shut down and there were no more investments with turnover money. In January, the fundraising activity showed a decent growth compared to December, and March was even better.

The overall trend has also switched to infrastructure and service projects with a clear application in current terms.

What happened in the public fundraising field is even more interesting. Token sale activity saw a relief in February 2023, with more and more successful launches. An upward trend has finally begun, and in March the monthly raise exceeded those of May.

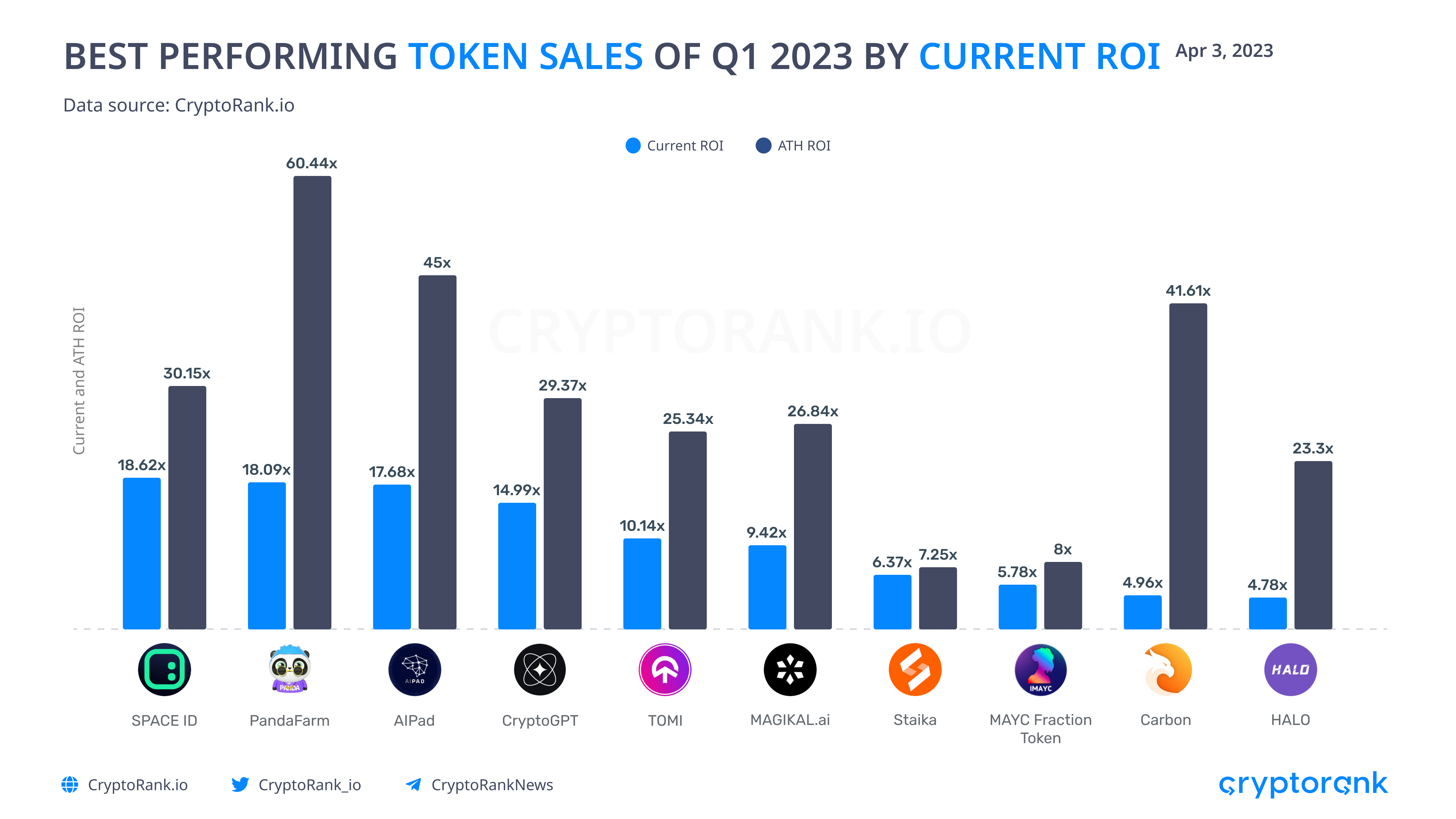

While IEOs (in particular Binance Launchpad, Bitget, and Gate.io Startup) brought the highest returns to token sales participants, the number of IDOs significantly surpasses the number of IEOs. The top 10 projects by current ROI reveals that AI projects once again were one of best performers. Notably, Space ID showed one of the best performances, prowing the capabilities of Binance.

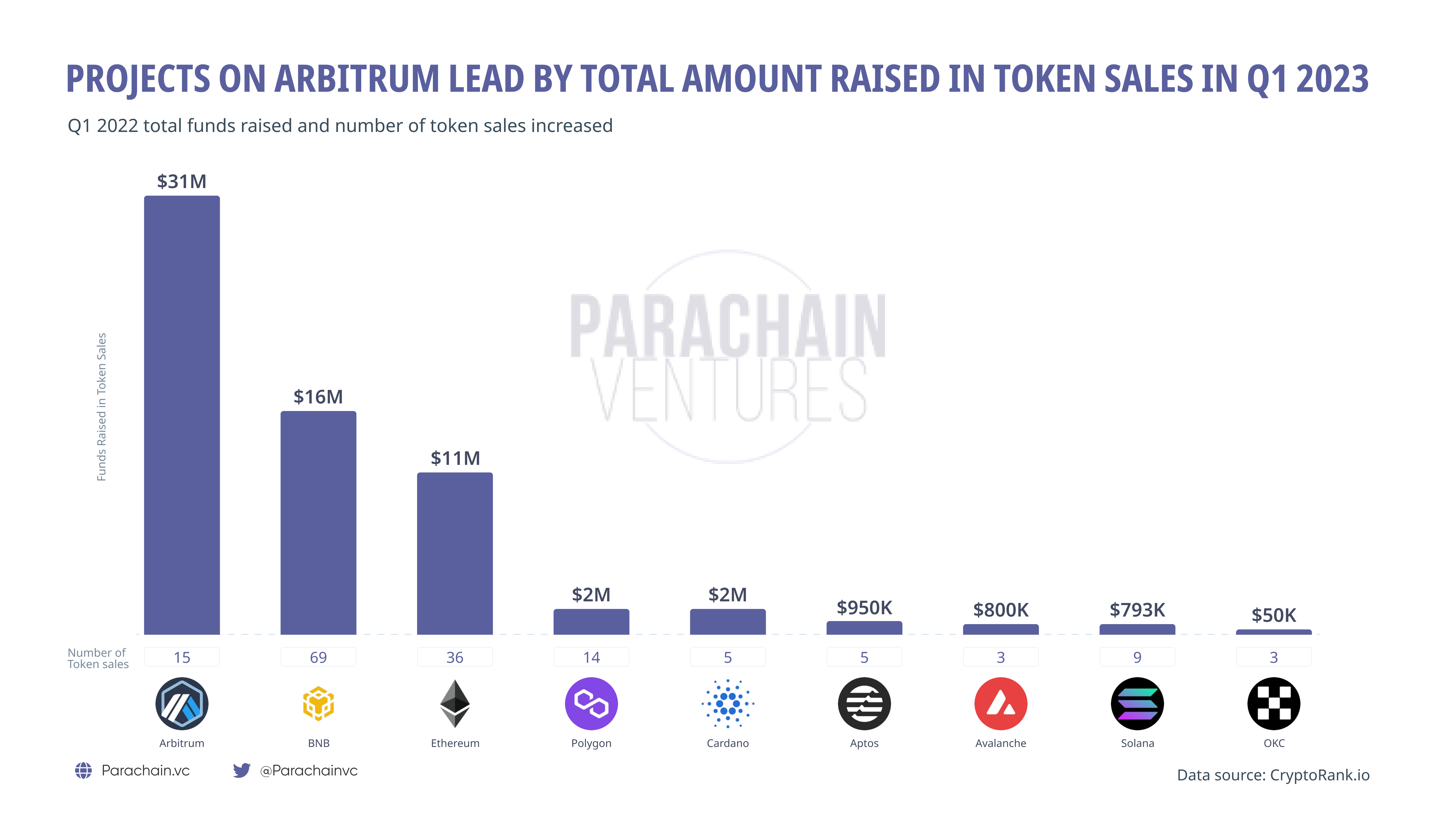

Projects on Arbitrum lead by total amount raised in token sales in Q1 2023, mainly due to several really successful token sales on Camelot. However, BNB Chain and Ethereum surpass Arbitrum by the number of projects that held a public sale during the quarter.

NFTs Are Still Struggling Despite Increased Volume

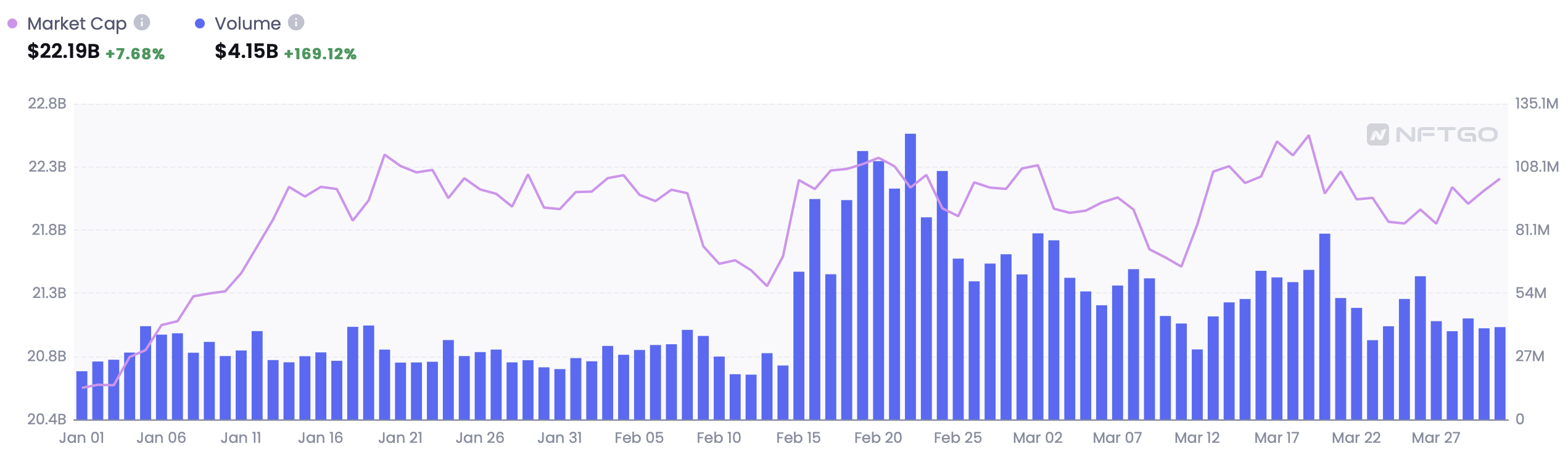

While Bitcoin, altcoins, and DeFi continue to grow, the NFT market remains the same except for an increase in trading volume. The increase in trading volume is mostly caused by Blur’s airdrop, but they are still quite high. Sadly, the significant increase in price (denominated in ETH) hasn’t happened, as many were expecting it with the increased liquidity.

As mentioned above, the total NFT market cap just slightly reacted to the huge increase in trading volume.

The NFT market is not yet ready to continue its growth partially because it was heavily pumped in 2021 and continues to cool-off. However, the NFT adoption goes along with the market recovery, but towards the use of non-fungible tokens by non-crypto brands and corporations.

The Bottom Line

Right now crypto is experiencing one of the best moments in a long time. The market momentum at the start of the year was captured, allowing critical levels to be broken. Further events confirmed the market’s readiness for growth, as even Bitcoin reacted to the negative news just by a small decline, which did not last long. Of course, the volume is still relatively low and low volatility is worth considering, but the change compared to late 2022 is clear; markets are awakening.

In some ways, the market has boosted itself. There has been a chain of events triggered by positive expectations. Blur’s airdrop gave a boost to other projects (ex. Arbitrum) and drophunters, which stimulated increased activity and prices. This, in turn, reinvigorated fundraising, both the growth of private fundraising and the increase in the number of public sales and their success (returns). On top of that came a contradictory macro picture, which developed a very good moment for crypto. Actually, this became one of the most interesting moments in the history of cryptocurrencies.

Meanwhile, the next Bitcoin halving is approximately 1 year away, but challenges are not behind yet. It is more important than ever to watch for a global macroeconomic picture. Crypto steadily becomes an essential part of the global economy, with more and more entities choosing to work with crypto, even though governments might be against it. Problems on financial markets may affect the crypto market too, mainly damaging the valuations of crypto startups as one of the riskiest types of investments. However, in such times, cryptocurrencies might show their strengths and therefore, take a solid place in the global payment system.