Latest Crypto Venture Fundraising Trends

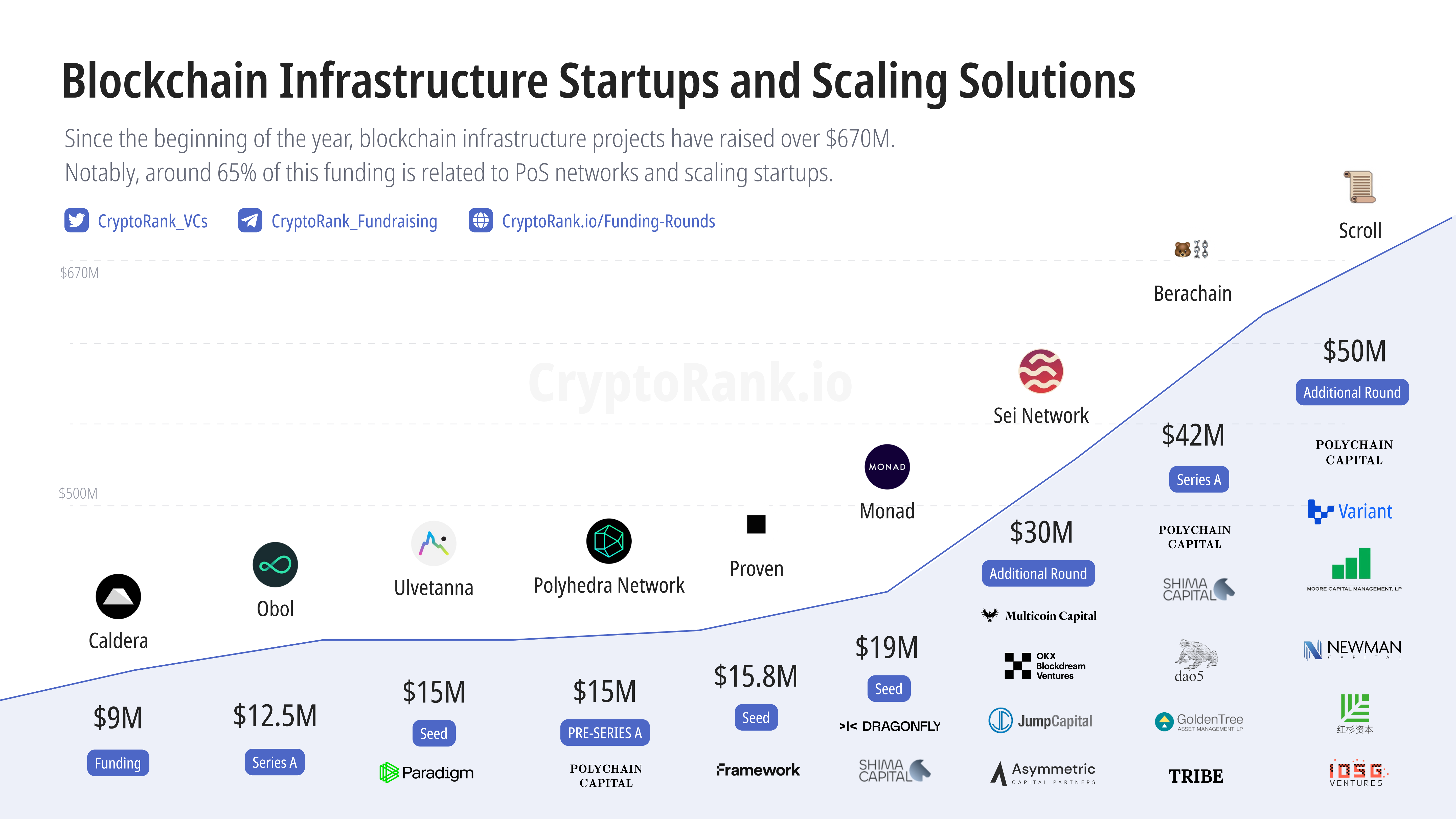

The blockchain ecosystem is in a constant state of flux, with investment patterns adapting to the ever-evolving landscape. In the current year, an impressive sum exceeding $670M has been allocated to blockchain infrastructure projects. A significant portion of these funds, approximately 65%, is directed toward Proof of Stake (PoS) networks and scaling startups.

This blog post will explore the most notable trends in crypto venture fundraising, providing valuable insights into the current state of the industry.

Key Takeaways:

- Expansion of institutional investment

- Significant investments flow into PoS networks and scaling startups

- Rising interest in Web3 and DeFi projects

The blockchain infrastructure space has experienced a remarkable funding uptick within just five months. From 4 fundraising rounds that generated $104M, the sector leaped to 14 rounds in April 2023, accumulating an impressive $318M. This translates to a 205.8% increase, reflecting the growing enthusiasm of investors eager to support the development of robust, scalable blockchain technologies.

Among the top fundings in this space:

Ethereum L2 Scroll achieves a $1.8 billion valuation after its latest funding round, attracting investors such as Polychain Capital, Sequoia China, Bain Capital Crypto, Moore Capital Management, Variant Fund, Newman Capital, IOSG Ventures, and Qiming Venture Partners.

Berachain secures $42 million to launch another Layer 1 blockchain. Polychain Capital led the funding, with participation from Hack VC, Shima Capital, Robot Ventures, Goldentree Asset Management, and others.

Trading-focused blockchain Sei raises an additional $30M, pushing its valuation to $800M. Investors in the new round include Jump Crypto, Distributed Global, Multicoin Capital, Asymmetric Capital Partners, Flow Traders, Hypersphere Ventures, and Bixin Ventures.

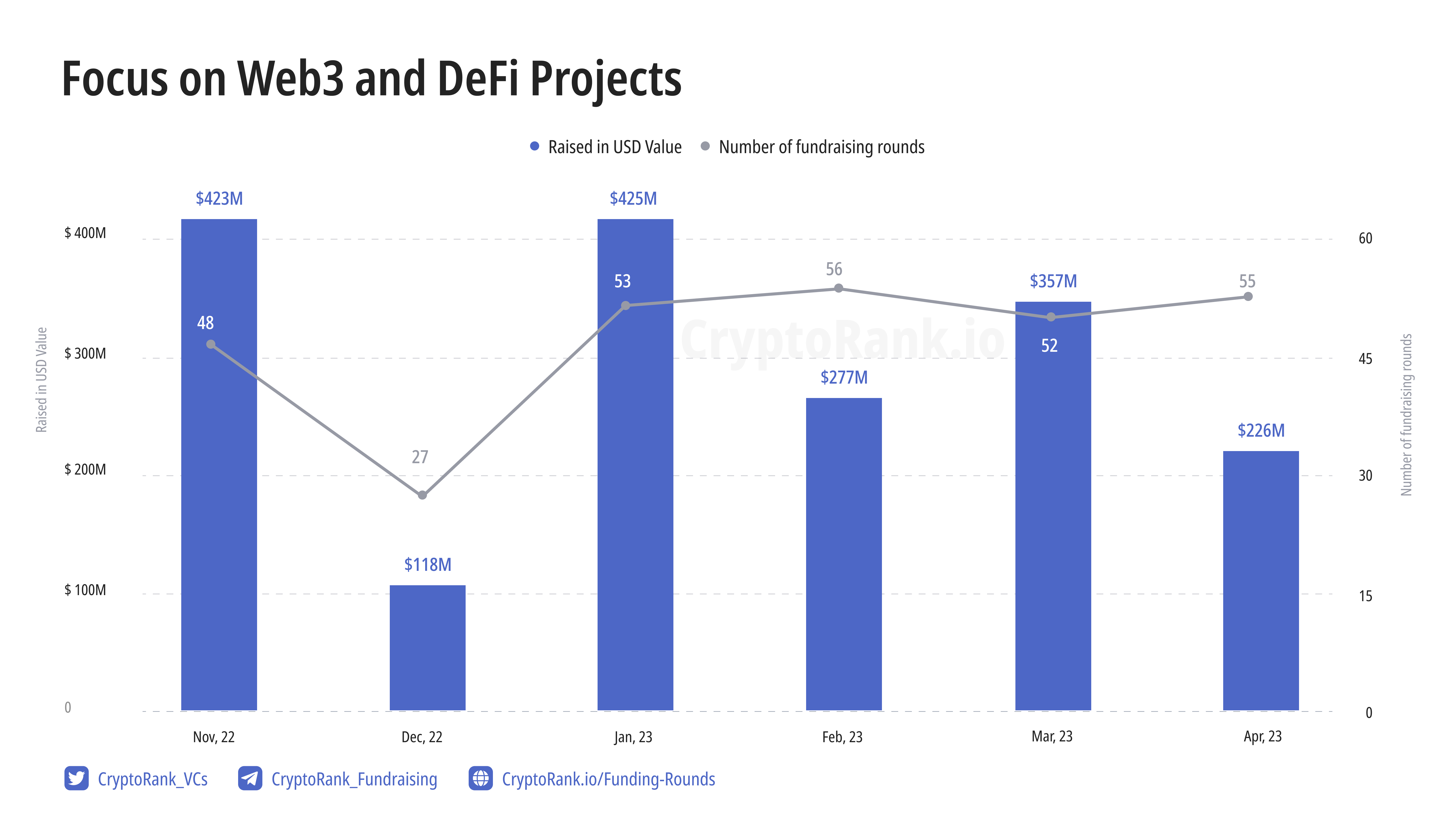

A comparison of the data from December 2022 to April 2023 shows a noticeable shift. In December 2022, 27 fundraising rounds garnered $118M, while by April 2023, this number had nearly doubled to 55 rounds, raising $236M in total.

This remarkable growth can be attributed to the increasing recognition of the potential of Web3 and DeFi projects in reshaping the financial landscape and empowering users with greater control over their digital assets. As the blockchain ecosystem evolves, it’s crucial to keep an eye on these emerging trends and their long-term impact on the industry.

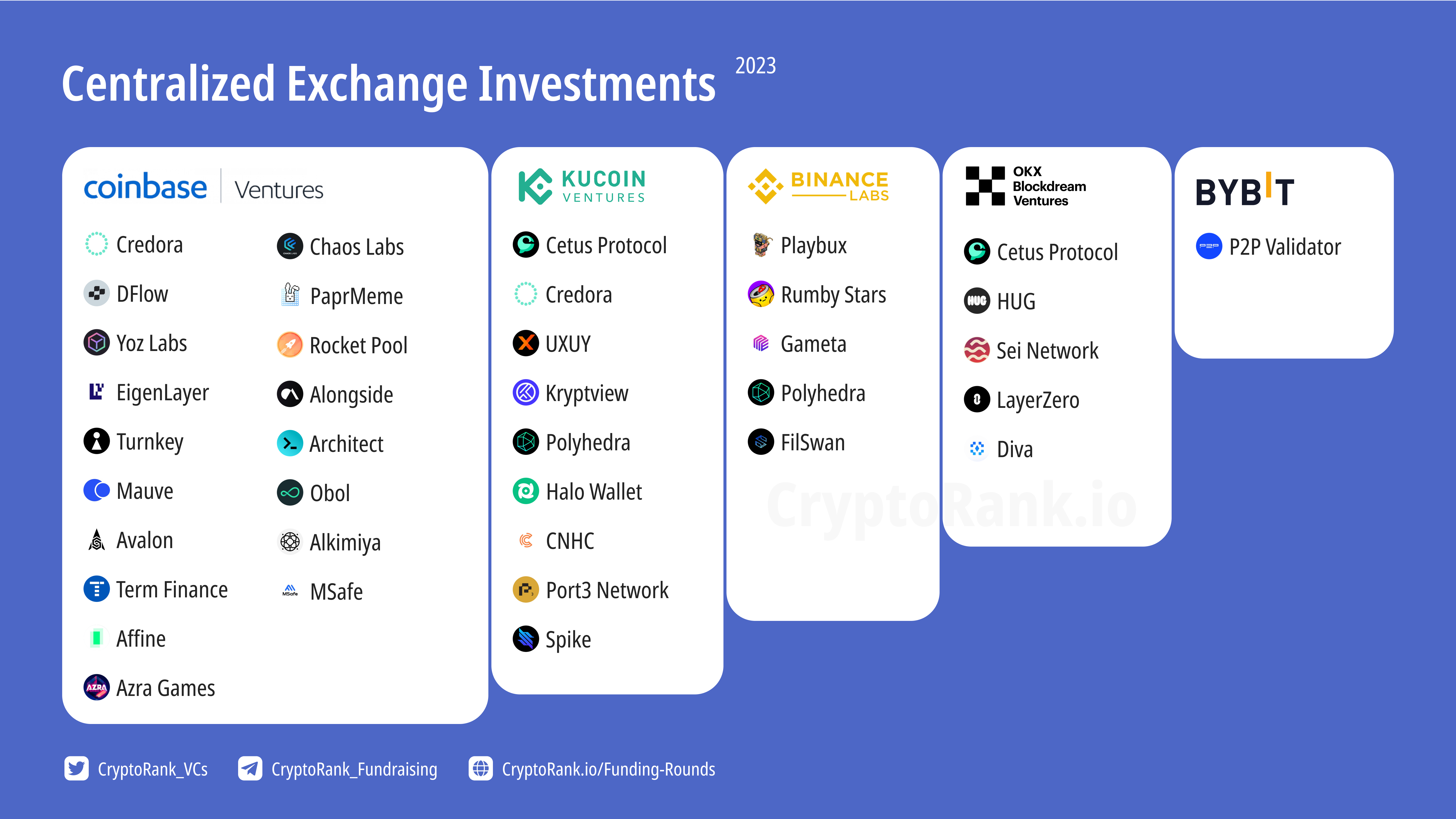

Coinbase Ventures took the lead as the most active participant in 18 funding rounds. Following closely behind are KuCoin Ventures and Binance Labs, both demonstrating a strong interest in supporting the growth of the cryptocurrency ecosystem. It is essential to track these entities, as they are major influencers in the blockchain ecosystem. Their investments drive significant advancements and shape the future of the crypto landscape.

Notable recent investments by these prominent players include:

LayerZero Labs raised $120 million in a Series B funding round at a $3 billion valuation. Investors in the latest round included Andreessen Horowitz’s crypto arm, Christie’s, Sequoia Capital, and Samsung Next. The round had 33 total backers, including BOND, Circle Ventures, and OpenSea Ventures.

EigenLabs, the team behind the re-staking protocol EigenLayer, closed its $50 million Series A funding round. The round was led by Blockchain Capital, with participation from other investors such as Coinbase Ventures and Polychain Capital.

P2P Validator, a non-custodial staking provider, raised $23 million in Series A funding from investors including Jump Crypto, Bybit, and Sygnum.

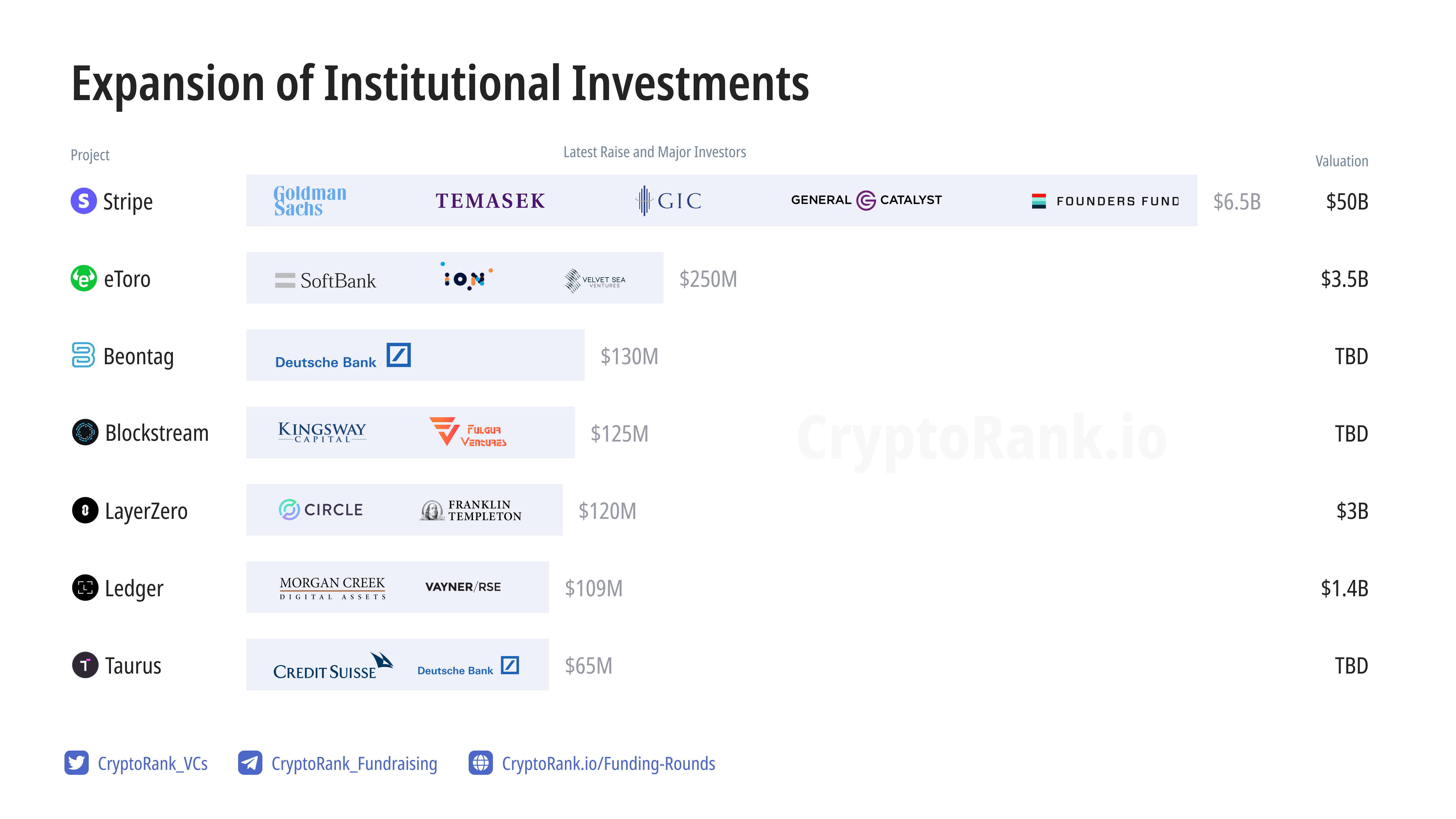

With major players entering the market, the overall investment in blockchain infrastructure projects has surged. This increased institutional participation signals a maturing market, as traditional investors recognize the potential of blockchain technology to disrupt various industries.

One notable example of this trend is Stripe, a company that builds economic infrastructure for the internet. Stripe has recently signed agreements for a Series I fundraise of more than $6.5 billion (€6.15 billion) at a staggering $50 billion (€47 billion) valuation.

In summary, the most recent blockchain fundraising trends reveal a dynamic industry that continues to attract significant investment. With a spotlight on PoS networks, scaling solutions, Web3, and DeFi projects, the future of blockchain technology is poised to be both thrilling and transformative.