2019 was an explosive year for the crypto derivatives market. The number of new derivative products has increased significantly. Many exchanges have already launched the possibility to trade different derivatives for major digital currencies, which allow clients to increase their profits by several times. But this is just the beginning, and we can expect many innovative products to be developed to open up more flexible trading opportunities.

According to our data that is being aggregated from the major derivatives exchanges, the total daily volume of Bitcoin futures is regularly surpassing the mark of $20 billion.

https://cryptorank.io/derivatives-analytics

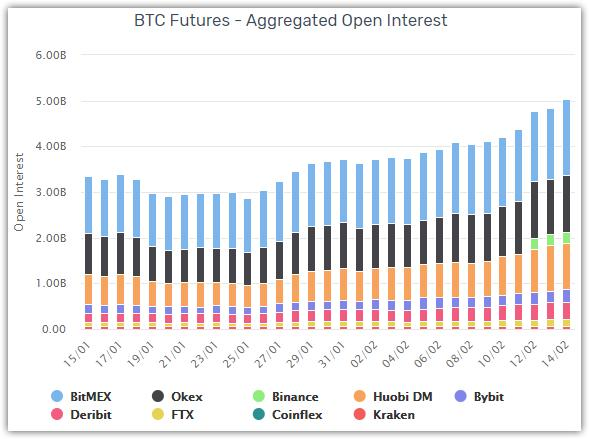

Moreover, aggregated open interest (OI) for Bitcoin futures contracts has exceeded $5 billion on Feb. 14.

Derivatives markets include a variety of financial products like futures, options, swaps, contracts for differences — all of which provide access to the crypto market without touching underlying crypto assets. But what is leveraged ETFs, and what differs leveraged ETFs from futures or margin?

For starters, the ETF definition is as follows: an exchange-traded fund designed to track the movements of a particular underlying asset (for example BTC) or a group of underlying assets. While a traditional ETF generally tracks the securities in its underlying index on a one-to-one basis, a leveraged ETF may purpose for a 2:1 or 3:1 ratio.

ETFs allow potential investors to dip their toe into a crypto market without the related risk of buying the asset itself.

Leveraged ETFs offering is quite popular in the financial world and includes both bullish and bearish exposure to a multitude of sectors, markets, securities, and currencies with different leverage.

Let’s look at an example of leveraged ETFs from the MXC Exchange. MXC launched its innovation derivate product of Leveraged ETFs on December 10, 2019, that allows for 3x leveraged exposure to crypto-assets.

Using BTC3L as an example, for every 1% BTC goes up in a day, BTC3L goes up 3%; for every 1% BTC goes down, BTC3L goes down 3%.

Trading Leveraged ETFs is very similar to trading tokens on the spot market. They are available at ETF Zone.

More than 15 popular assets are available for trading on the ETF platform. The product is in demand, with a high trading volume on each ETF.

MXC uses a dynamic funding rate, that is displayed on the corresponding asset page.

What are the advantages and when it’s best to trade Leveraged ETFs?

Those who can properly manage ETFs can get exceptional returns.

For individual investors, leveraged ETFs are alluring because of the potential for higher returns. Leveraged ETFs are very good to take advantage of quick day-to-day movements.

For professional investors, leveraged ETFs are useful in statistical arbitrage, short-term tactical strategies. As an example, ETF can be used as a hedge to protect a short position.

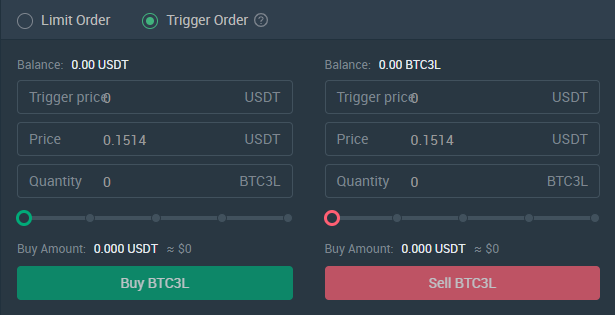

Users can buy leveraged ETFs just like normal tokens on a spot market. Not necessary to manage margin, collateral or liquidation prices. To begin trading, traders have to check the net value only, select the right price, and enter the purchase amount to buy BTC3L.

Leveraged ETF will automatically reinvest profits into the principal. So if the user’s leveraged ETF position makes money, the profit will be automatically put to the principal in the next rebalance period (daily). Сonsequently, the investor’s 3x leveraged ETF product will increase to gain a compound-interest effect.

Conversely, leveraged ETF will automatically reduce the risk if the investor loses money. Unlike the BTC long contract, which will be liquidated in case of price falling by 33%, the leveraged ETF product BTC3L, through rebalancing mechanism, won’t reach zero. The investor will still have some assets.

So investors do not need to worry about the risk of liquidation due to the MXC rebalance mechanism of fund’s investment portfolio.

Also, for futures holders, as an asset price movement, the leverage of contract positions may change, but leveraged ETF has fixed leverage, which is undoubtedly an advantage.

Risk warning: Derivatives trading is subject to high market risk

When placing an order, users should pay attention to the gap between the actual net price of the product and the latest price.

If the user puts the order in the opposite direction, there is a risk that the price will approach zero in extreme conditions. The net value is normally adjusted at 0 o’clock every day, and the extreme market will be adjusted in the intraday.

Conclusion

ETFs are sorely valuable for reducing risk whereas still providing proper exposure in volatile markets, and they’ve long been admitted as an essential tool for cautious investors.

Cryptos is well known as volatile and unstable assets, and the obstacles to entry for new investors can be pretty high.

If an investor doesn’t want to risk putting the money as collateral into a margin to be liquidated by the unscrupulous squeeze then ETFs could be the best decision.