Most Crypto-Friendly Jurisdictions in 2023

The SEC’s lawsuits against the “crypto titans” – Binance and Coinbase – mark a clear trend in the crypto industry. Regulation is here and now all players in the cryptocurrency space must adapt to survive in the new environment.

The most painful fact is that the world’s largest economy and venture hub, the United States, could become hostile territory for crypto startups. The future is unclear, but for now, crypto projects are looking for a “safe haven” with friendly crypto regulation and clear policies in this area. The most recent example is Andreessen Horowitz (a16z) with its plan to open the office in the United Kingdom.

Looking for a place to launch or register your crypto startup? In this article, we explore the most crypto-friendly jurisdictions and what makes them tick.

What is a Crypto-Friendly Country?

A crypto-friendly country creates a policy framework that is conducive to the development of crypto and crypto-related services in the legal sphere. Crypto-friendly countries create favorable conditions for crypto startups to flourish: no or reduced taxes, protection of customers from fraud, official regulation of crypto-related activities such as trading or investment. This will make the conditions for crypto operations in the country attractive for projects and investors, and the country could become one of the “crypto-hubs”.

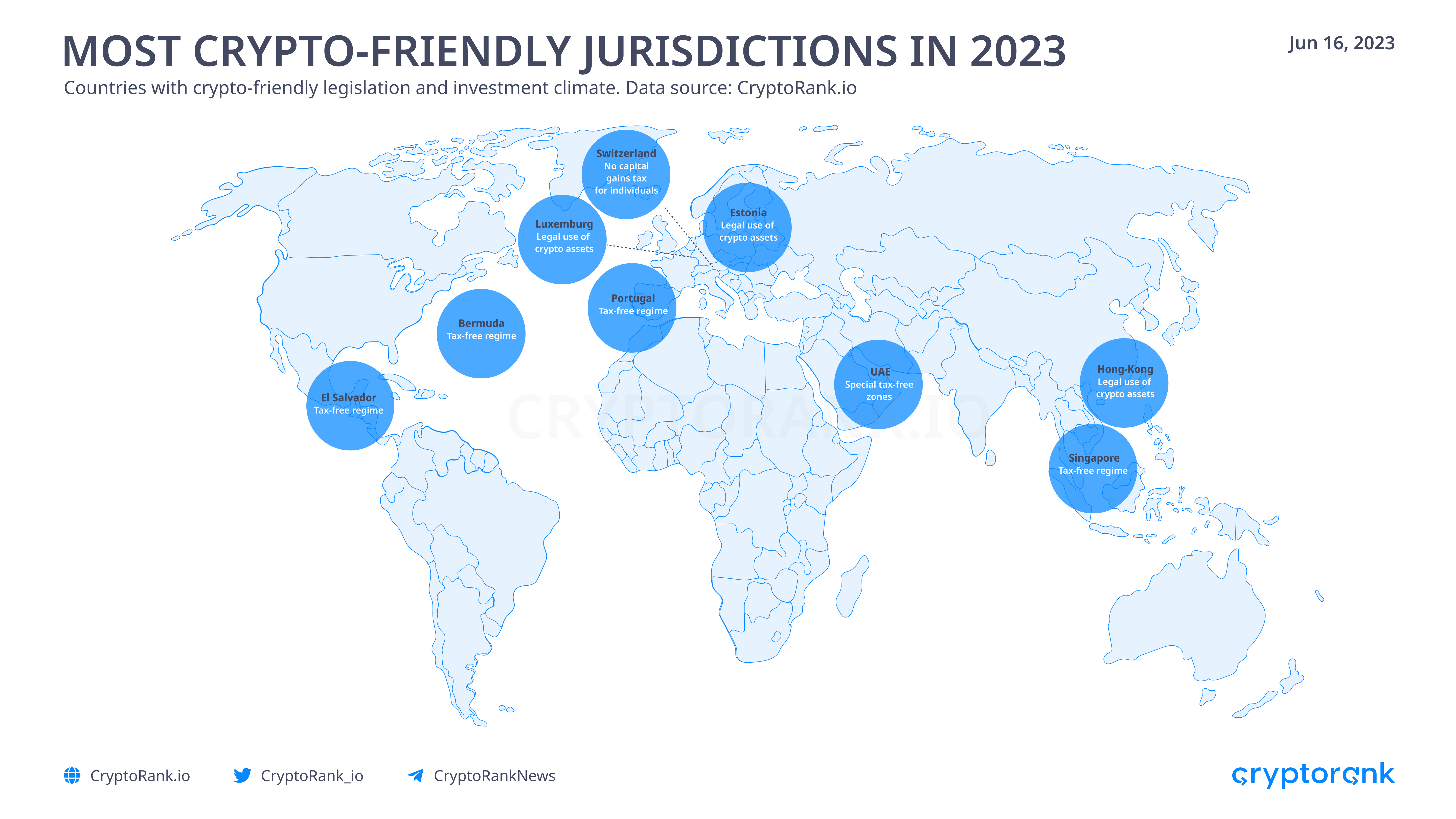

The Most Crypto-Friendly Jurisdictions

- El Salvador. El Salvador will be the first country to officially recognise Bitcoin as a payment unit in 2021. BTC can be used to pay for goods and services in this country. El Salvador is also attractive to foreign investors due to its tax-free regime for crypto activities. Future plans in the crypto space include the provision of crypto-backed bonds and the active promotion of BTC as a payment unit in the country. Despite IMF criticism, President Nayib Bukele is determined to continue his crypto-friendly policies.

- Hong Kong. Hong Kong is making an impressive bid to become a new Asian, or even global, crypto hub. Amid uncertainty over crypto regulatory policy in the US, Hong Kong announced in 2023 that it would make all crypto activities fully legal for all citizens. It also proposed a licensing system for companies, making it legal to provide crypto-related services in the country. Many crypto companies have already expressed interest in opening an office in Hong Kong, including “big names” in the industry such as Huobi and Gate.io, with more applications expected.

- Singapore. Singapore is a leading economy of the rapidly developing Southeast Asia region and a well-recognized fintech hub. Singapore was traditionally one of the most crypto-friendly jurisdictions attracting investors and companies from other countries. The state doesn’t collect taxes from crypto-companies and has no taxes on capital gains from cryptocurrencies. Another feature of Singapore crypto-regulation is that the Monetary Authority of Singapore (MAS) considers crypto operations as barter trades and see Bitcoin as an intangible property.

- Portugal. Portugal is one of the most crypto-friendly countries in Europe. Crypto assets are tax free in this country that makes it an attractive place for crypto traders and investors. Portuguese authorities try to create favorable conditions for digital business transformation and innovations that also include blockchain technologies.

- Estonia. Estonia is recognized as a European crypto-hub. Cryptocurrencies use is legal in this country. Estonia also became a home for many crypto companies and crypto-startups. Operations with BTC and other crypto assets are taxed the same way as other corporate activities in the traditional business.

- Switzerland. Switzerland is the oldest crypto-hub in Europe. Swiss banks became the first to offer their services for crypto companies. Swiss authorities classify BTC as an asset, but if you trade or store crypto on your own account, you will not pay capital gains tax. Switzerland also has its “Crypto Valley” in the city Zug. This area provides favorable conditions for crypto companies to start business and is a home for many blockchain and fintech startups.

- United Arab Emirates. UAE is rapidly developing as a fintech center and aims to become the leading blockchain hub. Operations with crypto assets are legal in the country and the government is actively developing crypto-regulation laws to make all processes connected with crypto and blockchain clear. UEA is also known for its friendly tax law and special zones for digital assets companies.

- Malta. Malta traditionally was a crypto-friendly country. Crypto assets are used for trading purposes in Malta and the government passed a number of laws to regulate digital economy and blockchain technologies in the country. Malta doesn’t have capital gains tax. Also there are crypto-friendly banks in Malta.

- Luxemburg. Luxemburg sees crypto assets as currency and it is legal to use crypto in this country. Cryptocurrency exchanges and other crypto companies follow the same rules as other financial organizations in Luxemburg.

- Bermuda. In 2018 Bermuda signed a Digital Assets Business Act and became a crypto-friendly country, where investors can trade and invest in digital assets legally. Bermuda is tax-free for crypto and doesn’t collect income or capital gains taxes that makes it an attractive jurisdiction for crypto companies. Bermuda Stock Exchange also launched one of the first BTC ETF in 2021.

Crypto regulation is still gaining momentum and it is difficult to predict its future shape. While some countries are overtly unfriendly, others are providing a comfortable environment for crypto companies and investors to operate. However, most countries have not yet decided on a policy towards crypto assets and are still in the process of developing legislation to regulate the industry.