State of Stablecoins Market

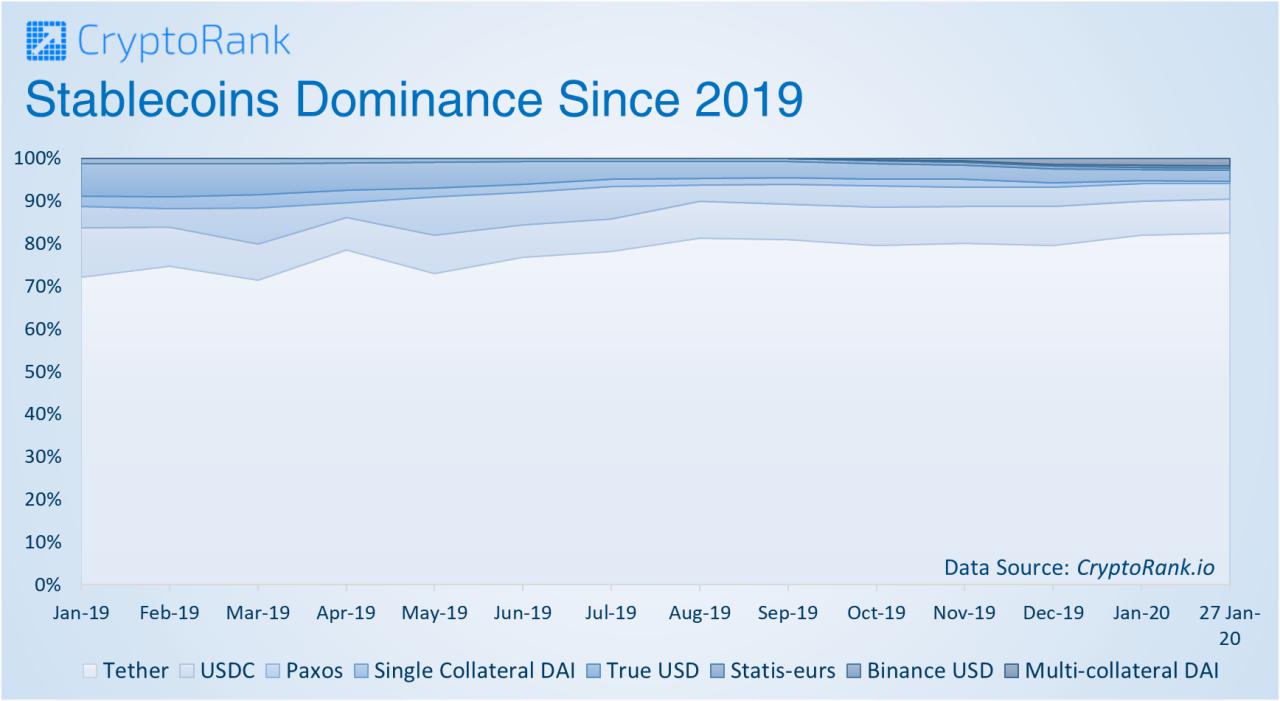

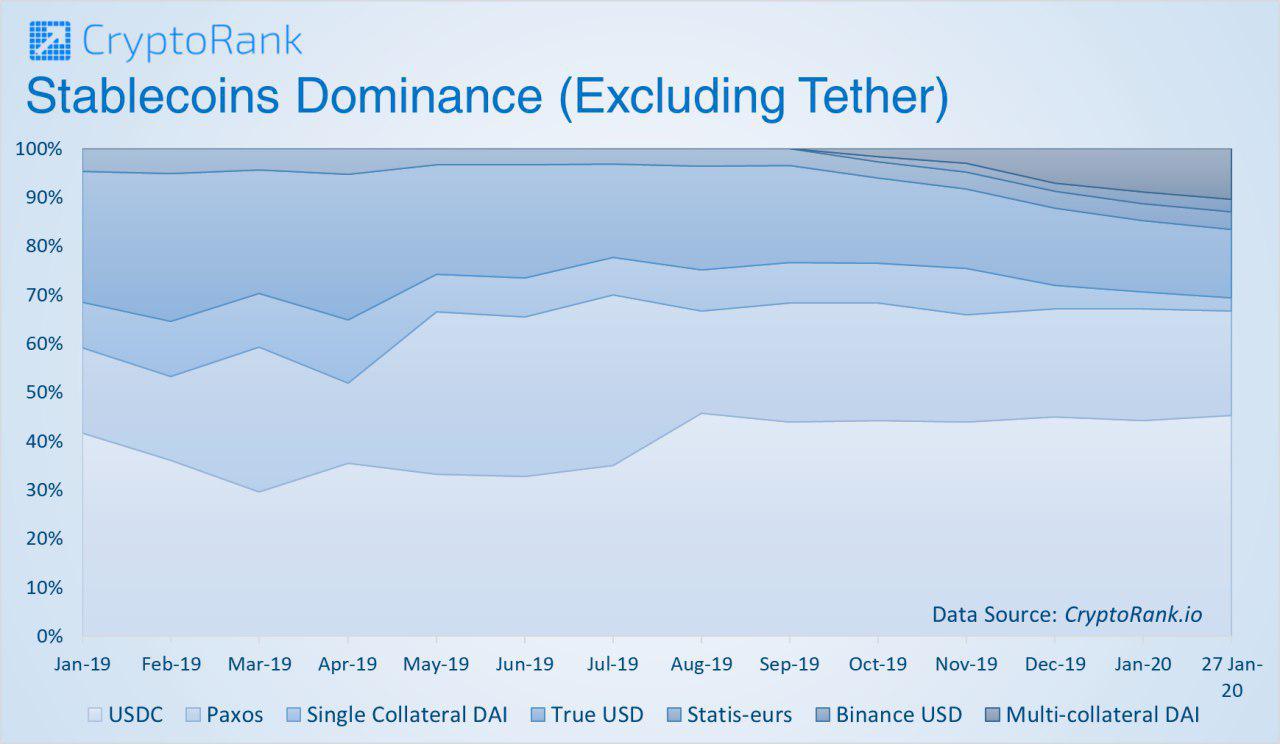

Despite the increase in the number of stablecoins in 2019, Tether dominance has increased from 72.2% to 82.5%.

Tether is the most liquid stablecoin at the moment despite claims of ‘fractional banking’ and legal issues around its parent company iFinex and the cryptocurrency exchange Bitfinex.

Also, Tether has launched Its Gold-Backed Stablecoin $XAUT, its current market cap: $ 6,299,545

The second and quite strong position, continues to hold stablecoin USDC, whose dominance decreased from 11.6% to 7.9%, market cap: $ 443,365,724.

The third-place goes to Paxos. Its market share dropped from 4.9% to 3.7%. Market Cap: $209,589,284

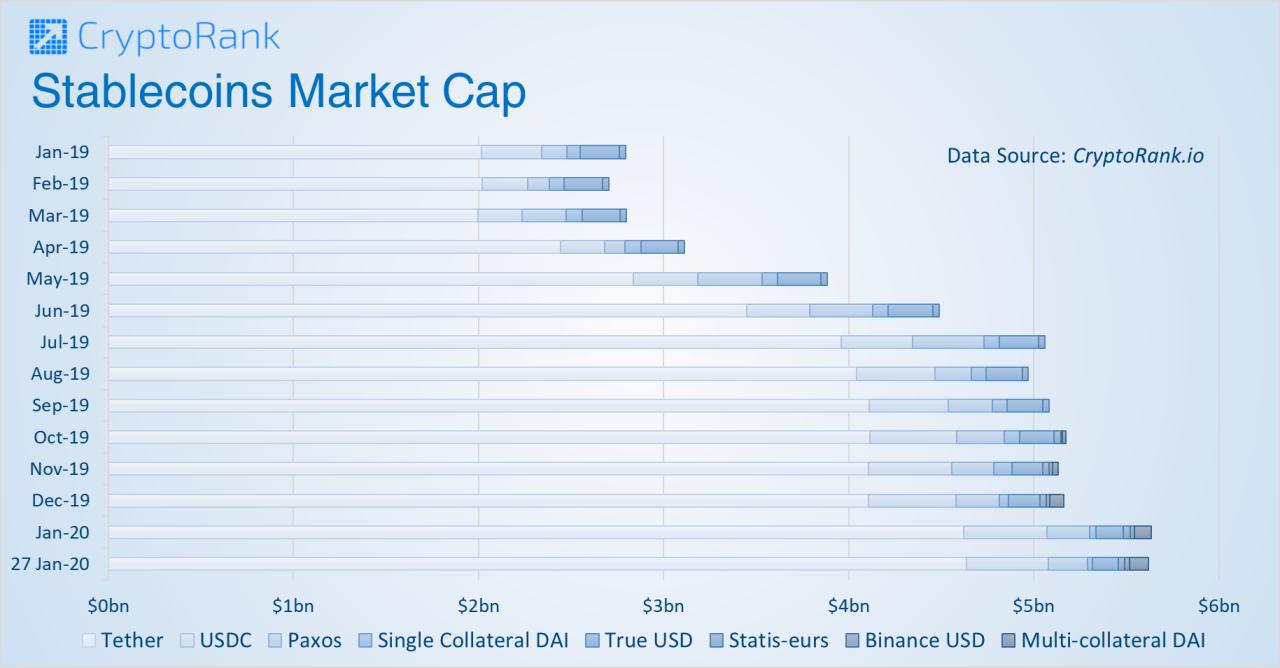

Among the top gainers, the one that stands out is Multi-collateral DAI.🔥🔥. DAI is a token of the Maker Protocol, which includes the Dai Savings Rate (DSR) and additional collateral asset types. This token was launched in the second half of 2019 and has almost replaced Single Collateral DAI.

Binance stablecoin(BUSD) was also launched in the second half of 2019, but so far, it managed to capture just 0.4% of the market share, but the trend is positive.

Other players are also entering the market, but their share is still small, so we have not mentioned them in this report.

You can find these сoins using the stablecoins filter on CryptoRank website.

The market cap of the analyzed stablecoins increased from $2,794.5bn to $5,617.7bn since the beginning of 2019. The growth is 101.02%

2020 will be an explosive year for the stablecoin market because almost everyone is interested in launching their digital assets:

– Central bank digital currencies (CBDCs)

– Big tech companies

– Banks and financial institutions

– Governments

Even the G7 issued a report on stablecoins – G7 Working Group on Stablecoins

A successful launch of new stablecoins will certainly have a positive impact on crypto adoption and on the price of cryptocurrencies.