The State of Crypto Fundraising

Crypto fundraising has become a buzzworthy topic in the crypto community as more and more investors pour money into promising projects. However, recent data shows a decrease in fundraising activity compared to previous quarters. In this blog post, we’ll take a deep dive into the state of crypto fundraising and explore the trends, challenges, and opportunities that are shaping this rapidly evolving landscape.

Key Highlights:

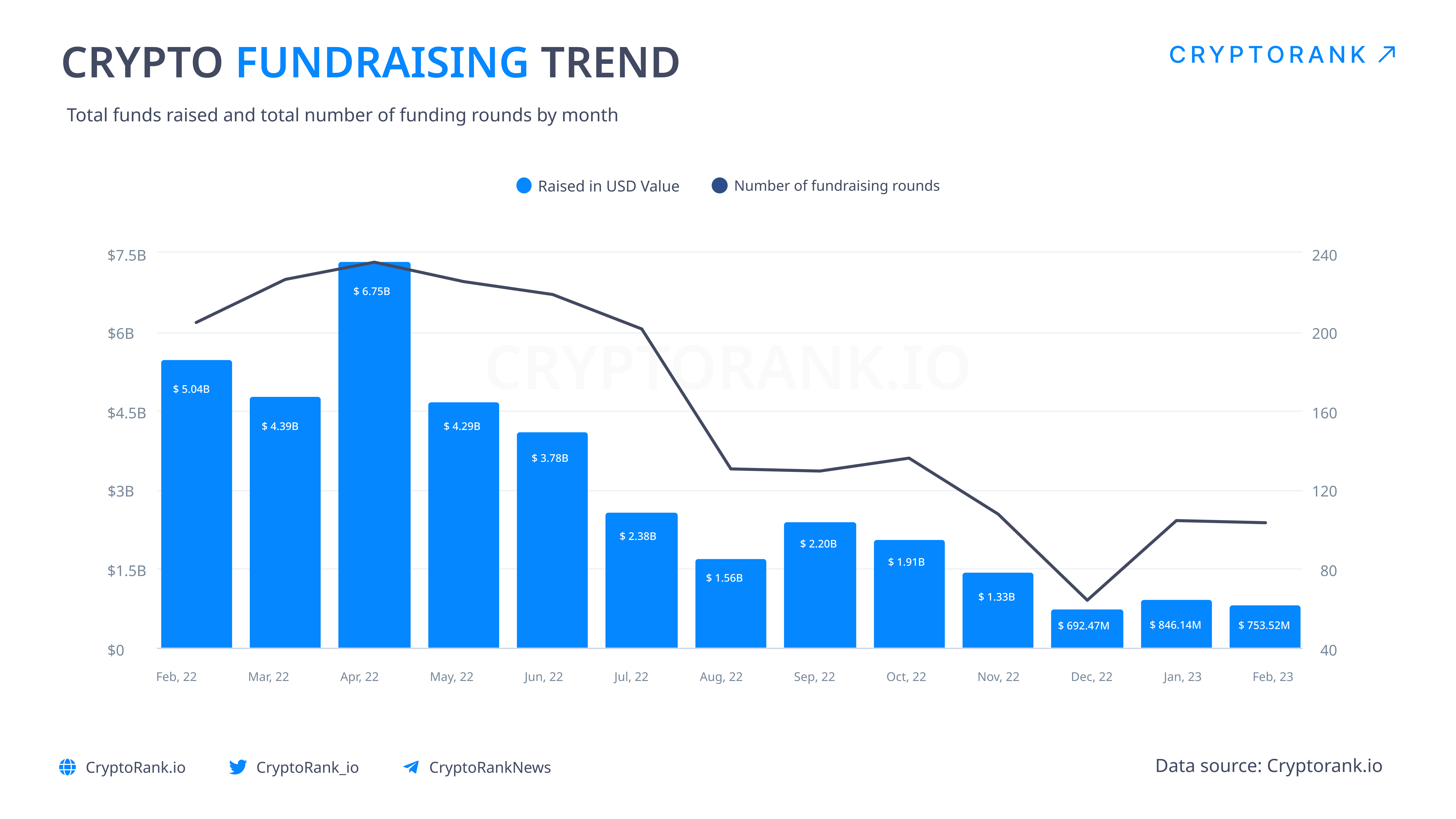

– 197 successful deals with a total value of 831 million USD raised since beginning of the year

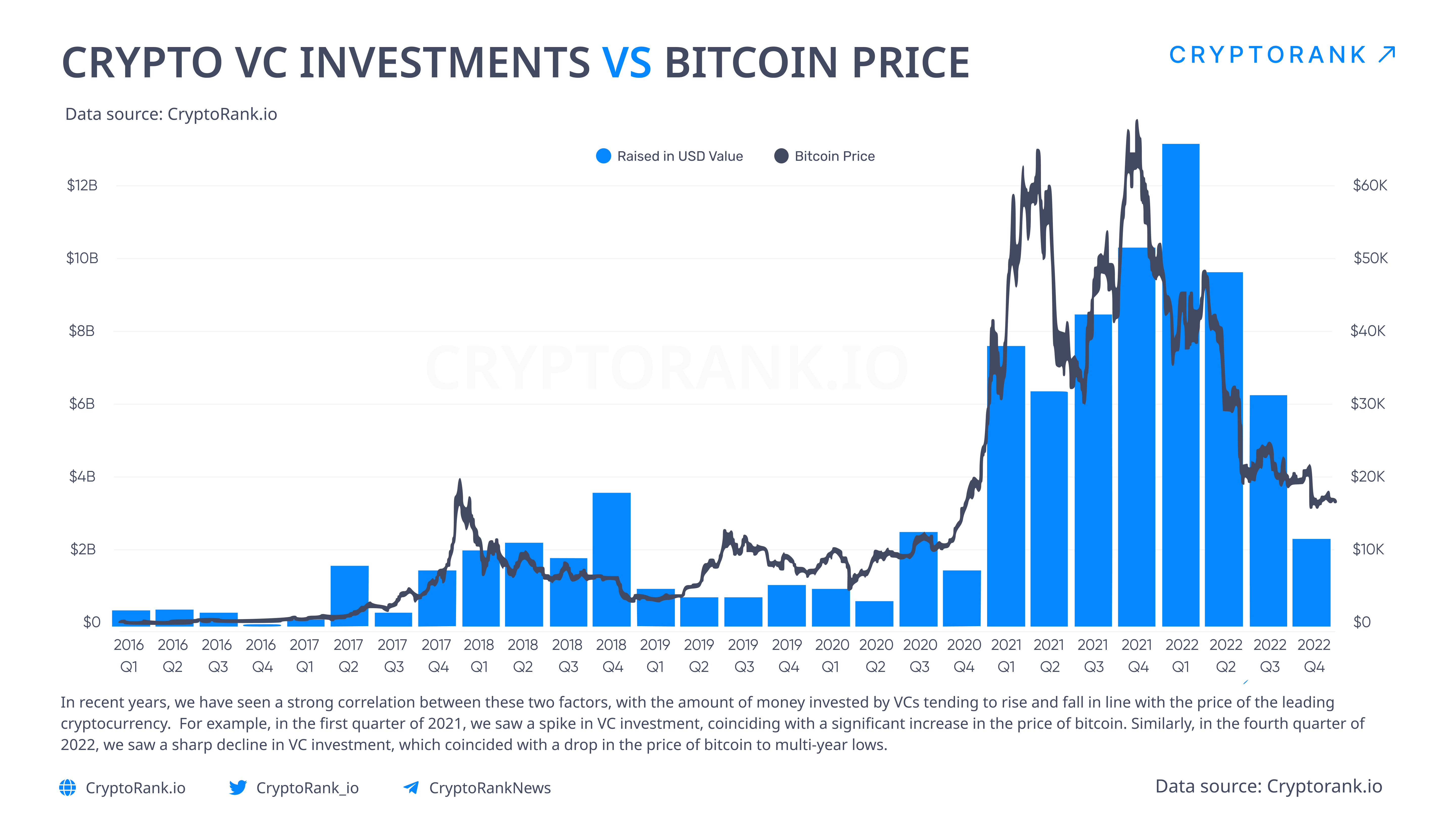

-Strong correlation between amount of money invested by VCs and Bitcoin Price

–Web3, blockchain infrastructure, and DeFi startups received the highest amount of funding.

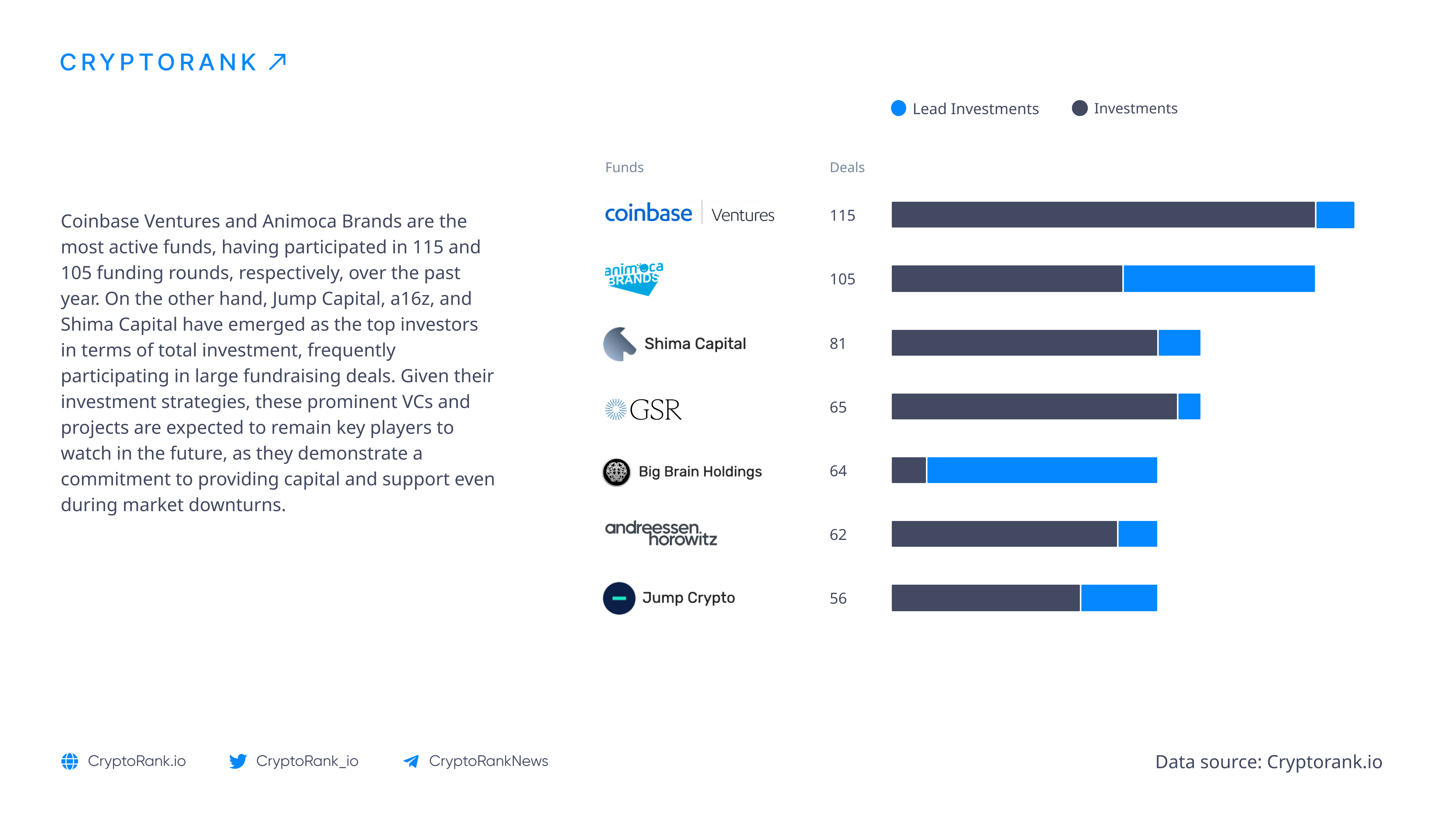

–Coinbase Ventures, Animoca Brands and Shima Capital were is the most active funds

Venture capital firms have increasingly shown interest in the crypto space, with many investing heavily in bitcoin and other cryptocurrencies. As such, it is not surprising to see a strong correlation between the amount of money invested by VCs and the price of bitcoin. For example, in the first quarter of 2021, we saw a spike in VC investment, coinciding with a significant increase in the price of bitcoin. Similarly, in the fourth quarter of 2022, we saw a sharp decline in VC investment, which coincided with a drop in the price of bitcoin to multi-year lows.

Despite the volatility of the cryptocurrency market, VCs continue to pour money into the industry, betting on its potential for long-term growth. This is evidenced by the increase in the number of funding rounds that took place last months.

Since the beginning of 2023, there has been a significant increase in both the number of funding rounds and the amount of capital raised, with 195 funding rounds raising a total of $1.5 billion. This suggests a strong and growing interest in investment opportunities in various industries. It will be interesting to see how this trend develops throughout the rest of the year.

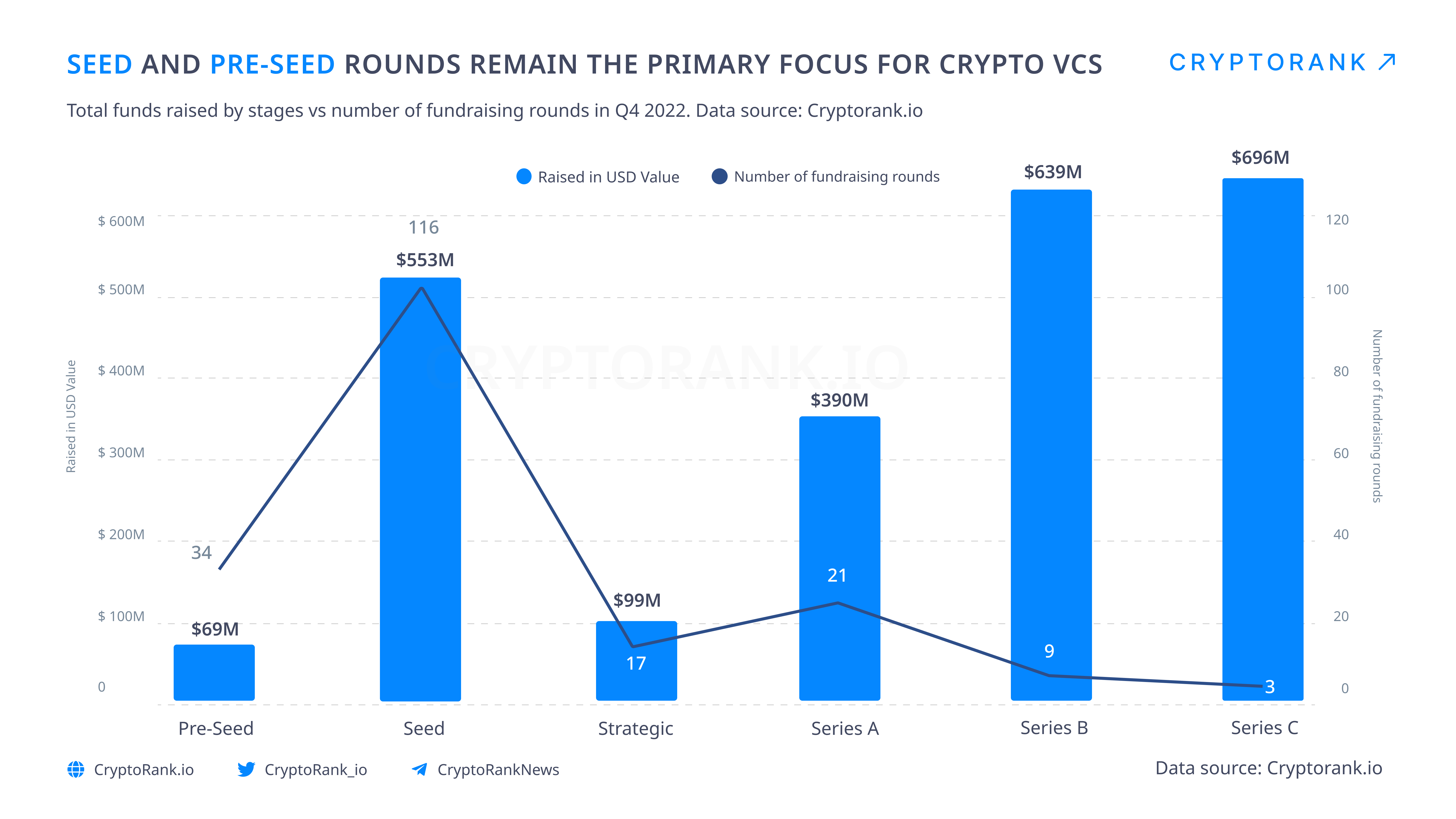

VCs are continuing to focus on early-stage funding rounds, with a combined total of 622 million USD raised in Q4 for pre-seed and seed rounds. On the other hand, later-stage rounds like Series A, B, C, and D tend to have fewer successful projects and bigger total capital raised. However, as the crypto market expands and higher-quality projects emerge, we may see a shift towards more funding in post-seed rounds.

It is clear that these top VCs and projects will continue to play a major role in shaping the crypto landscape. Their investment strategies show a commitment to providing both capital and support during market downturns, which is crucial for the long-term success of any project.

While the crypto market may be volatile and unpredictable, it is clear that there are players who are committed to investing in its future. Whether you are an entrepreneur seeking funding or an investor looking for opportunities, keeping an eye on these top VCs and projects is a wise move. They are likely to continue leading the way in terms of innovation and growth in the years to come.

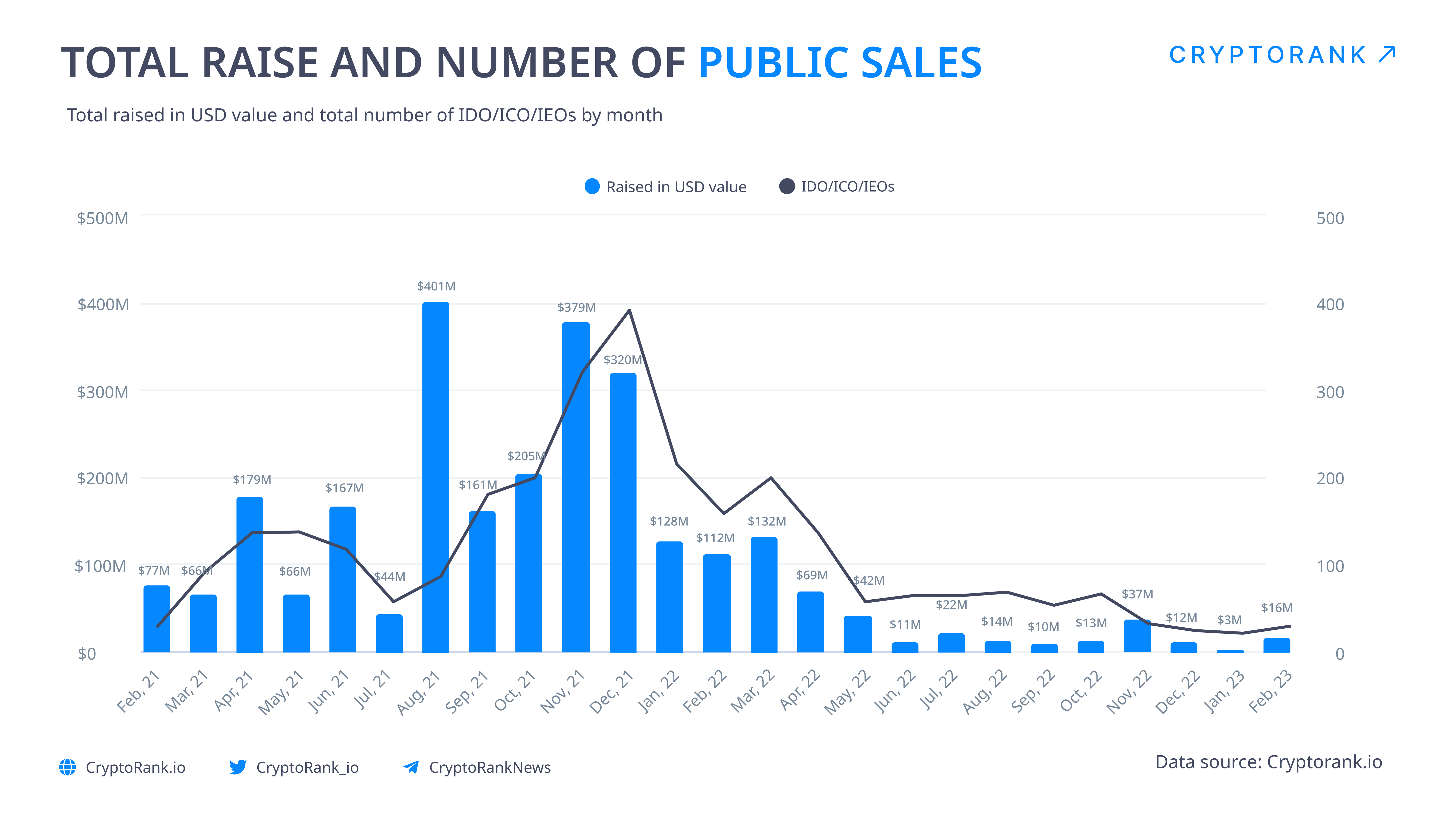

Despite challenging market conditions, projects are still able to secure funding through launchpads. However, IDO, ICO, IEO fundraising have been at record lows since the beginning of 2021.

Launchpads have become a popular alternative for projects to raise funds, while traditional fundraising methods such as IDO, ICO, and IEO have declined. This could indicate a shift in the way projects approach fundraising in the cryptocurrency industry.

To keep up-to-date on crypto VC deals you can visit the funding rounds page on CryptoRank: https://cryptorank.io/funding-rounds

Follow us on Twitter and Telegram for more insights !