Watchlist or Manual Portfolio: Making the Right Choice

Interested in catching every market movement? CryptoRank offers for you two exciting features to follow the market trends: Watchlists and Manual Portfolio. Let’s compare them, identify their advantages and disadvantages and find out which suits you the best!

Watchlists support any project on CryptoRank, including ICO/IDO/IEO, untracked listings or recent funding rounds. Therefore, you can add any crypto, even that one that you bought during a token sale, and now expect its TGE. With watchlists, you’ll be the first to get information about early stage projects market data!

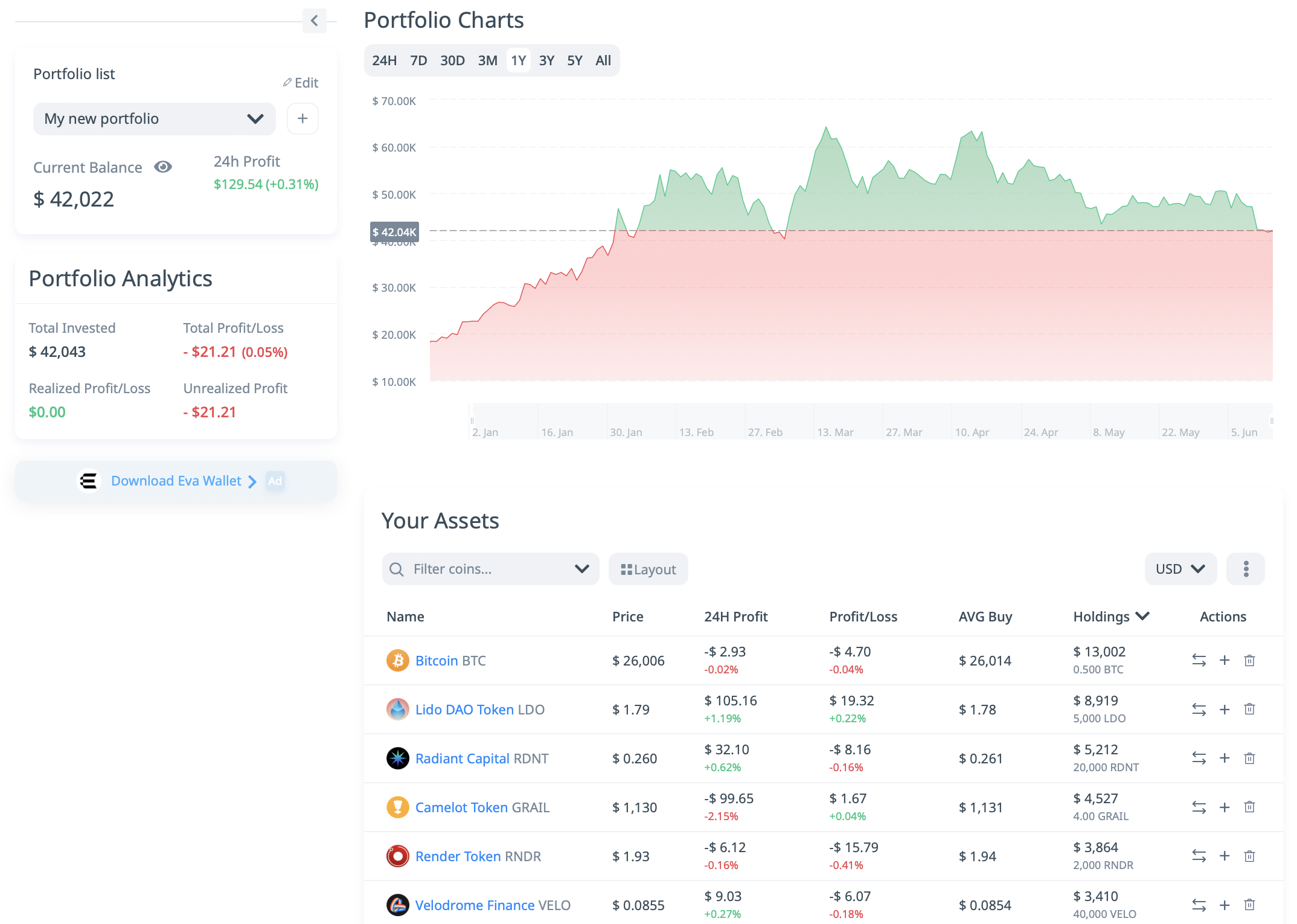

Manual portfolios track holdings but also offer watchlist-like features. While setup requires more inputs (amount, price, etc.), it provides enhanced analytical capabilities. They also can serve as mockup portfolios for testing strategies. Detailed charts display portfolio value and allocation pages provide valuable insights.

To make it easier for you, we made a short list of pros and cons of both features:

Watchlist pros:

– More Layout customisation options

– Better for performance tracking

– Supports projects with untracked data

Watchlist cons:

– The number of tokens cannot be specified

Manual portfolio pros:

– Big holdings chart

– Allocation settings and visual breakdown

– Profit analytics

Manual portfolio cons:

– Takes extra steps to set up

– Less flexible Layout

Both Wathclists and Manual Portfolio are shareable, thereby making it easier for the team to work with market analysis. Create watchlists and portfolios and share them with your friends!

How to Choose the Right Tool?

Manual Portfolio offers the best suite of analytical tools if you’re already invested in crypto and want to improve your portfolio’s performance. You can easily track the performance of your portfolio and adjust it based on the analytics.

Meanwhile, watchlists are best for users who are actively researching the market and looking for a tool with the best analytical capabilities. Thanks to highly customisable layouts, watchlists on CryptoRank can give you a lot of insight into the performance of projects.

The Bottom Line

To summarise, both features are equally useful and should be based on your own preferences. If it is important for you to be able to track projects that have not yet been released to the market, Watchlists is your choice. If accuracy, strategy testing and allocations are important to you, choose Manual Portfolio.

Visit CryptoRank to try out these features now!

Manual Portfolio: https://cryptorank.io/portfolio

Watchlists: https://cryptorank.io/watchlist