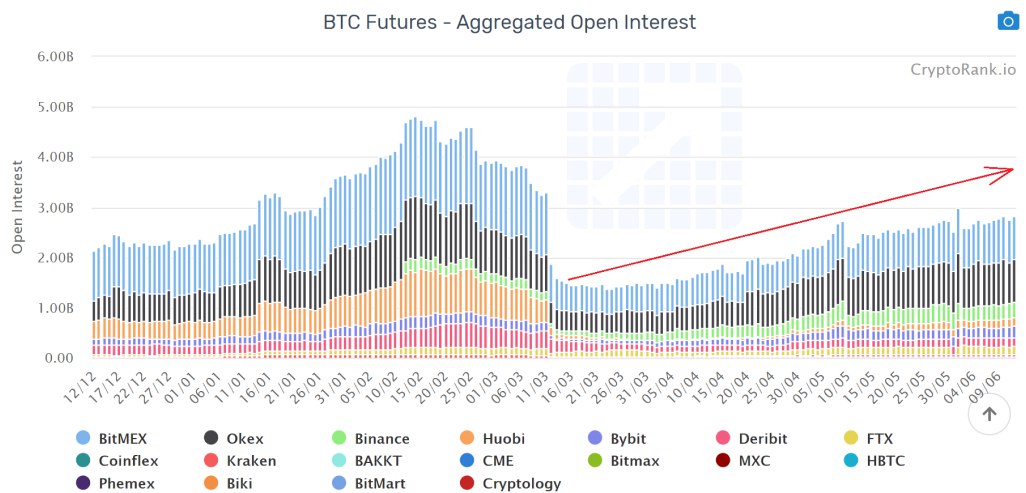

What does the Increase of BTC Futures’ OI Mean?

As CryptoRank previously reported, the total open interest has restored to the pre-crash Black Thursday the ≈$3B level.

By definition, when both the market and OI increase, it means that the number of short players is increasing. While the price is pumping, short players are forced to close their positions, which eventually pushes the price higher.

This was fair for the period of BTC recovery from March till the end of April when shorts increased from 4,200 BTC to 16,300 BTC.

But, starting from May, while OI and price were mostly flatting at their peaks shorts and longs fell from 9,100 BTC and 32,000 BTC to current 5,100 BTC and 25,000 BTC.

Typically, this situation means that traders don’t have a clear view of the market direction.

https://cryptorank.io/derivatives-analytics/btc-futures