2022 Crypto Market Recap Pt. 1: Events That Moved The Market

Key Recap Topics:

- Terra’s collapse and its effect on the market.

- Victims of liquidity crisis.

- Fall of SBF’s empire.

- Hacks and scams flooded the market.

- Is it possible to sanction an open source code? Yes.

- Effect of the Merge of Ethereum.

- Layer 2 craze.

- How “X to Earn” attracts users.

2022 was a challenging year for crypto. The bull market of 2021 quickly turned bearish at the very end of the year. Many new users who came to the market at the bull market’s peak lost a considerable part of their investments after many coins and NFTs fell by 90% or more. During this year, the market has experienced several small ups and many big dips, bankruptcies, and disappointments. For people far from cryptocurrencies, this year may look like the last gasp of blockchain technology.

The financial market has also been in trouble this year but behaved much more stable in the face of rising inflation, macroeconomic problems, and global uncertainty. Amid this, the crypto market looks particularly depressive. However, the crypto market has undergone significant fundamental changes, and as with any other crisis, it got rid of malicious tumors.

In the first part of our annual recap, we will look at the main events that influenced the market.

Terra Collapse: the Momentum of the Fall

The market peaked at the beginning of November 2021, followed by a steady decline, which found some balance in early 2022. Despite the massive hacks that occurred at the very beginning of the year (such as the Wormhole and Ronin hacks, which are covered later), the main event that collapsed the market and caused many subsequent events was the collapse of Terra and UST.

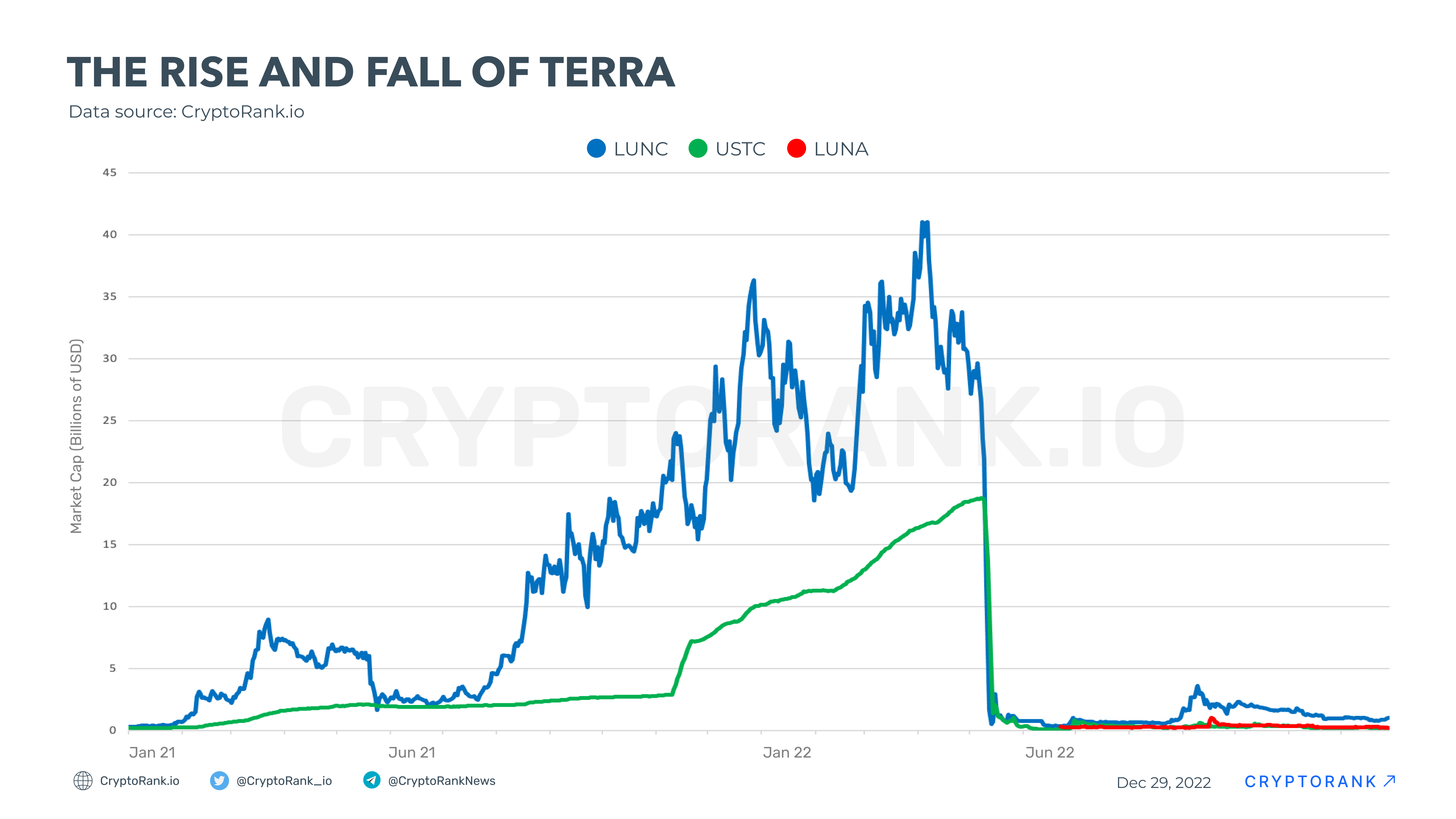

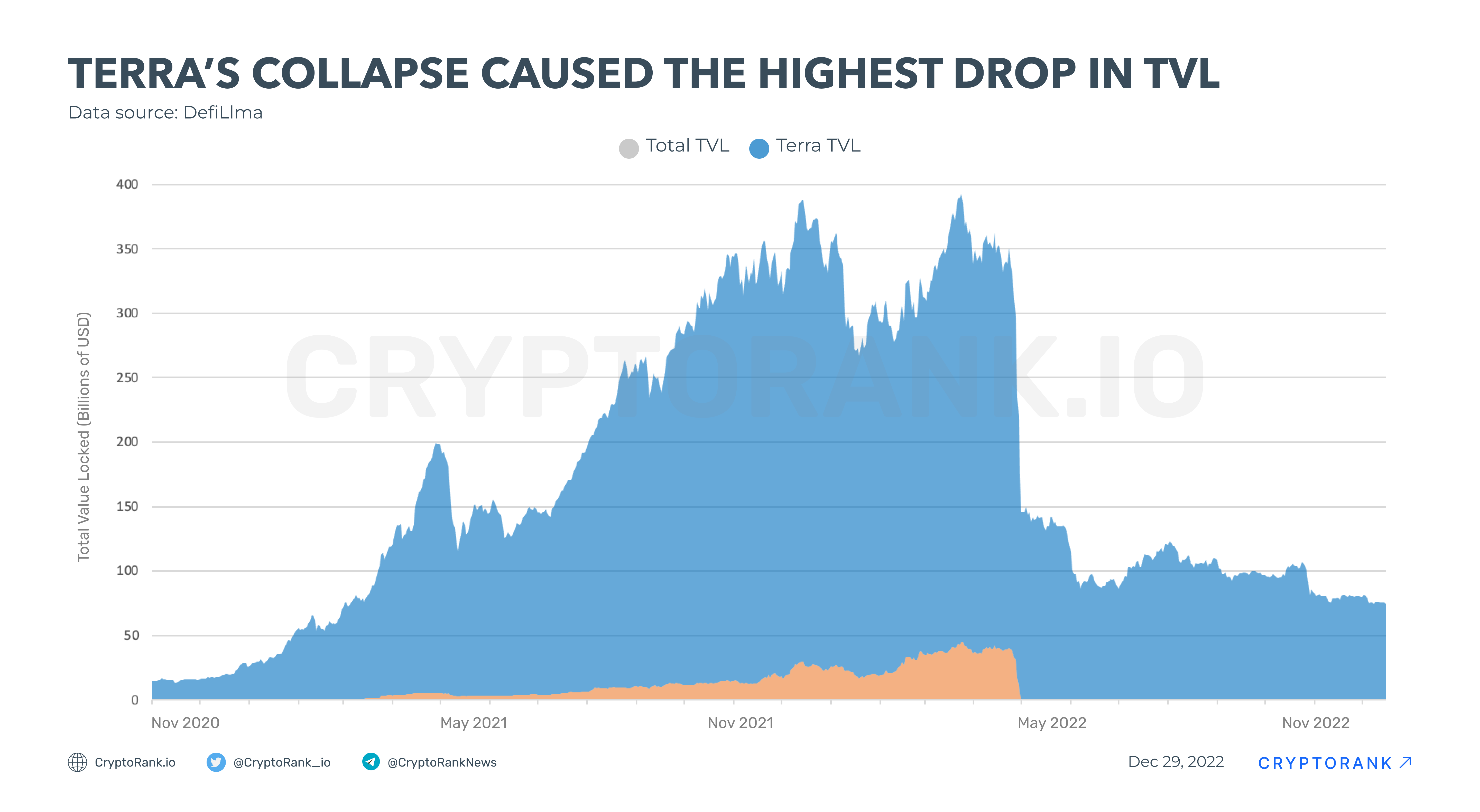

At the beginning of the year, Terra was one of the largest blockchains, ranked second in total value locked. The rapid growth of the LUNA (currently known as LUNC) occurred in 2021, partially due to the popularity of the native stablecoin Terra USD, or UST (presently known as USTC) was growing. The algorithmic stablecoin provided up to 30% of the APY. In short, users had to burn LUNA to mint UST and take advantage of high lending yields. Such activity pushed LUNA’s price higher, which already seemed like a Ponzi scheme. However, as in most Ponzi schemes, some profit, but others lose everything. The same happened with Terra when UST lost its peg after a series of whale-sized sell-offs on May 7.

As a result of the UST collapse, the whole $60 billion Terra ecosystem collapsed, taking the value of two Top-10 tokens to almost zero. It led to a significant market wipeout, put many institutional investors and organizations at risk, and undermined the reputation of decentralized protocols. In addition, it was the biggest decline in total value locked in history.

Three Arrows Capital and Others: Victims of the Liquidity Crisis

In addition to thousands of ordinary people, many major players in the crypto market suffered in the collapse of Terra. It became a starting point for subsequent crisis events, the consequences of which will continue to be discovered for a long time. Terra had many investors among VC funds and CeFi protocols, many of which used Anchor.

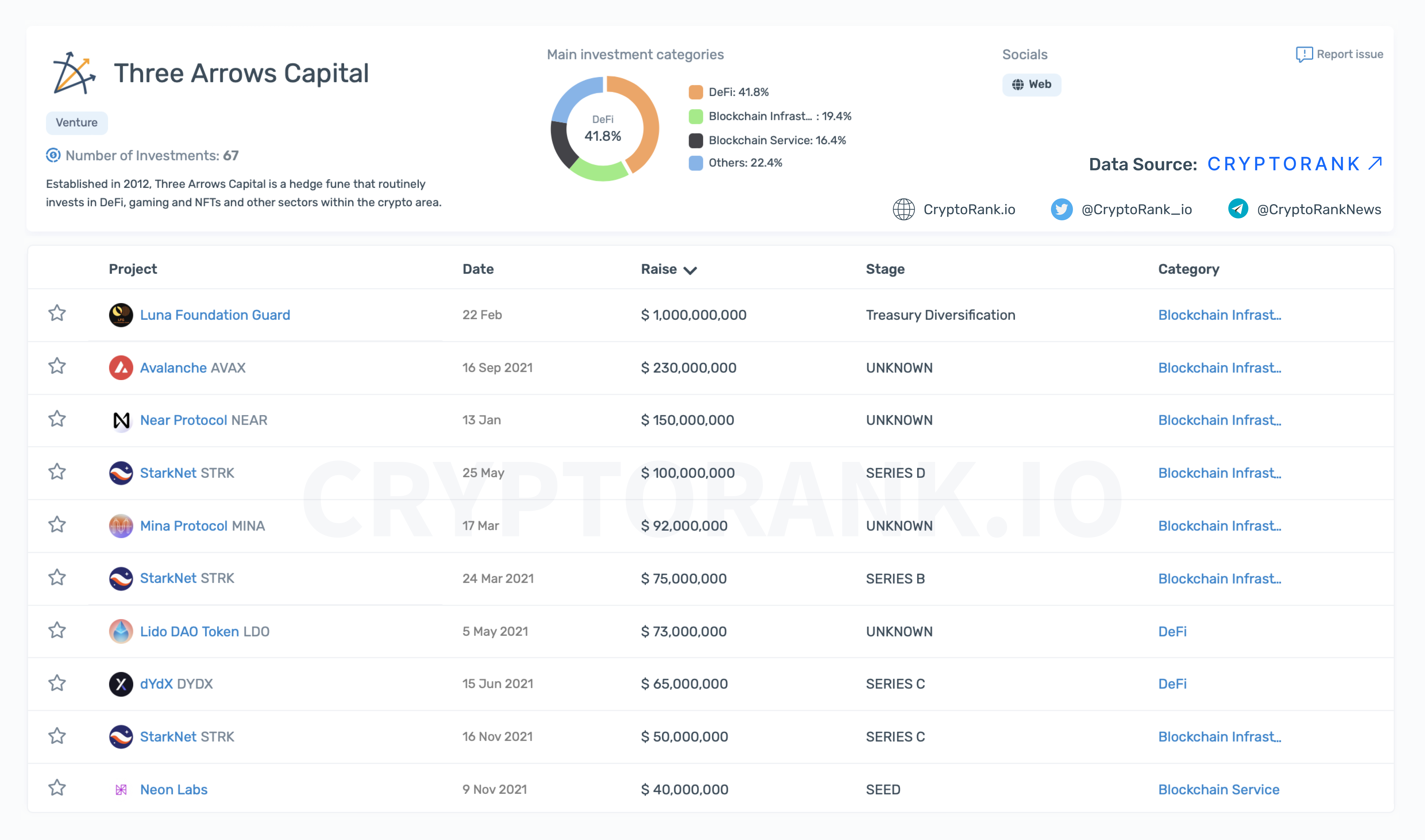

About a month after the collapse of Terra, one of the leading crypto hedge funds, Three Arrows Capital, announced that it had some minor problems. The fund was suspected of liquidity problems and misuse of clients’ money. Later was revealed that the fund had large debts to crypto lenders such as Voyager Digital, Babel Finance, Genesis Global Trading, BlockFi, FTX, and others. 3AC failed to pay its debts and filed for bankruptcy in early July.

Three Arrows Capital has participated in fundraising rounds of some of the biggest crypto projects, including the notorious Terra. You can check 3AC’s investment portfolio on CryptoRank.io.

Some of 3AC’s creditors were forced to close withdrawals and declare bankruptcy. The first victims of the Three Arrows collapse were Voyager Digital (which recently sold its assets to Binance US for more than $1 billion), Babel Finance, and BlockFi, but not limited to. The bankruptcy procedure and the sale of the fund’s assets may take years, creating negative pressure on the entire market.

The sequence of events that began with Terra, and continues to this day, has affected many companies. BlockFi and Voyager received emergency funding from FTX and Alameda but anyways declared bankruptcy later. Many other companies, including DeFi projects, were forced to declare bankruptcy, shut down, or halt further development and community support due to the large-scale crisis in the crypto market.

Celsius has become another victim of the liquidity crisis. CeFi crypto lender halted withdrawals on June 12, citing market conditions. Celsius had invested in Terra; as its investments became insolvent, it had to declare bankruptcy. Among the borrowers are projects such as Maker, Compound, Aave, and Genesis. Returning money from borrowers to Celsius can take a significant amount of time.

The Collapse of FTX Exchange

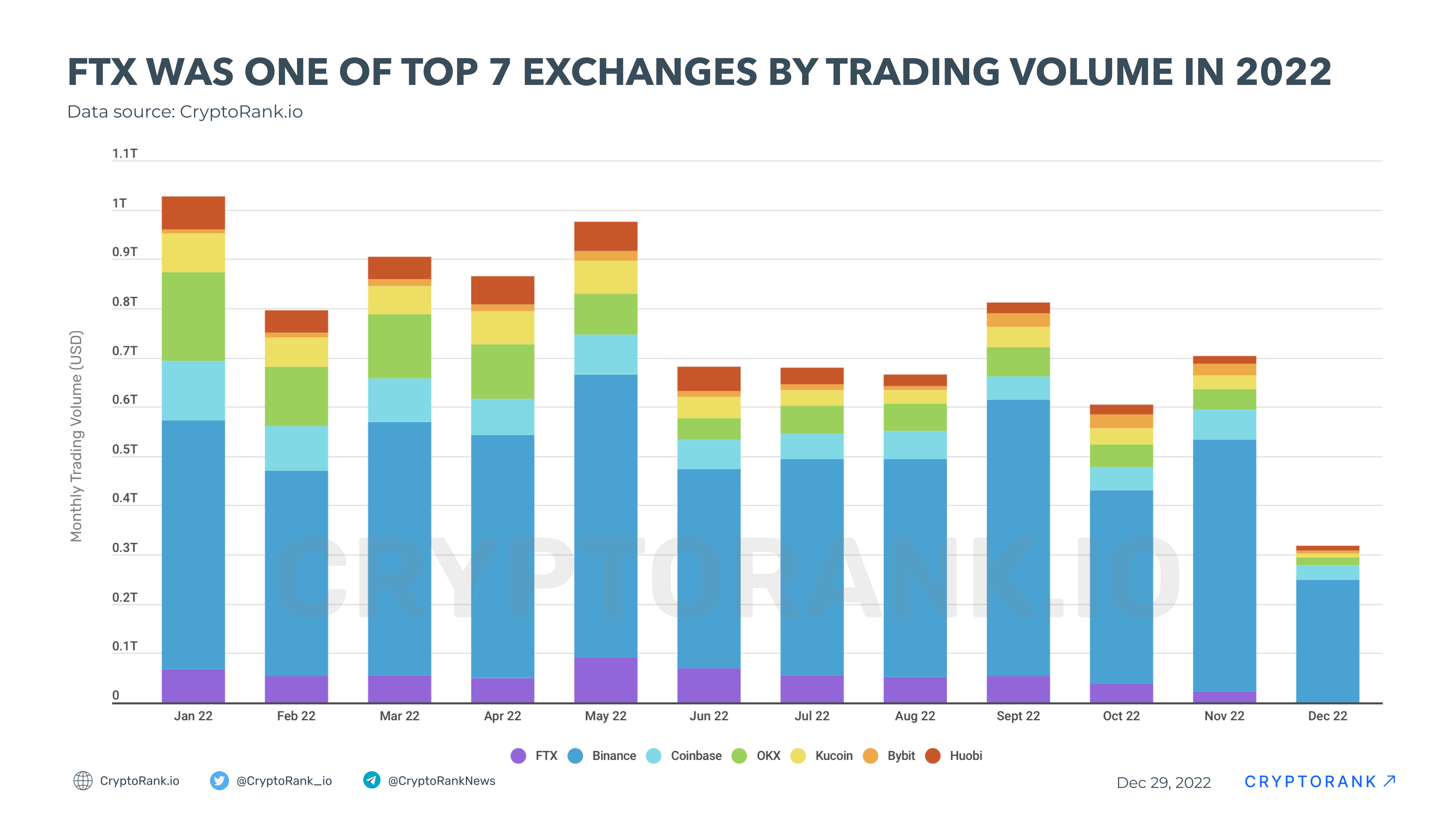

FTX’s bankruptcy likely was the loudest event of 2022. It has received massive coverage in various media: from niche crypto blogs to leading Wall Street newspapers. The accident seems quite controversial, though its effect on the market was heavy; nevertheless, it tempered the crypto world.

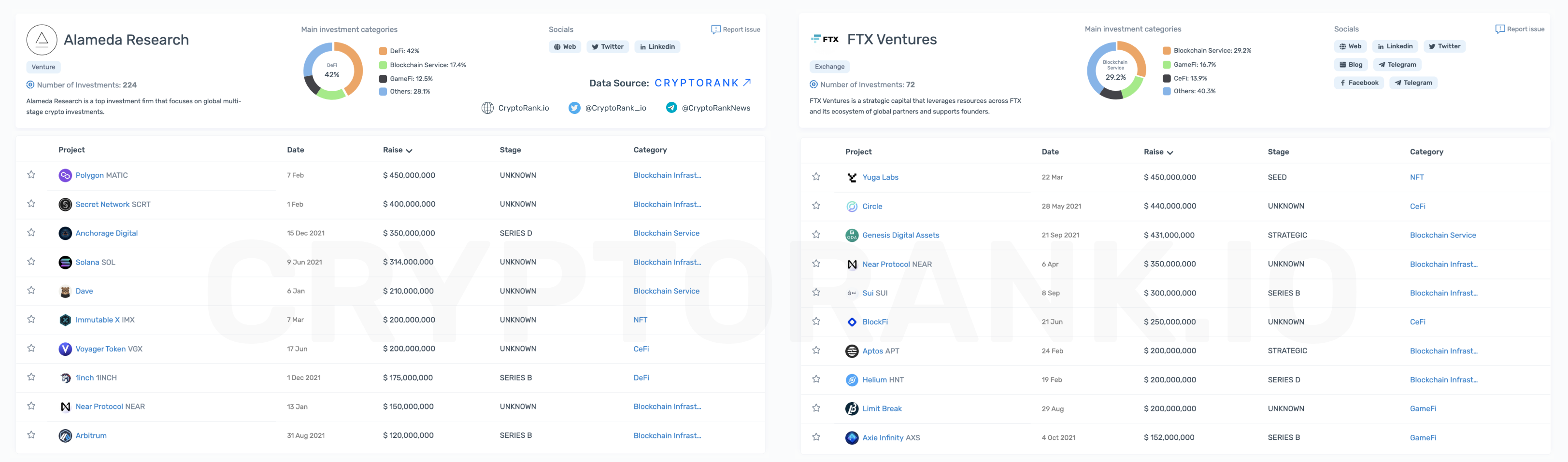

FTX was one of the largest exchanges after Binance, trusted by millions and heavily promoted everywhere. One of its entities, Alameda Research, appeared as one of the top crypto VC funds, with a diverse portfolio and a significant impact on the market. Moreover, the founder of both companies, Sam Bankman-Fried (SBF), managed to create an image of the most generous billionaire. However, the curtain fell in just a few days, and the hidden became obvious.

The fall of Alameda Research likely began with the collapse of Terra, or earlier, in the spring of 2021. The once-successful fund quickly became a victim of market volatility and caused colossal damage.

As a result of the collapse of the exchange, not only many ordinary users suffered but also institutional investors. A tremendous amount of money has been lost, and bankruptcy will last many years. Some of the affected companies have already declared bankruptcy and closure, and many may still close. It was a solid blow to the cryptocurrency industry, but you can find a positive in any negative. In addition, many projects in the Alameda Research portfolio and even the entire Solana ecosystem have become subjects of sales (or will become).

Many users have thought about the security of centralized exchanges. As a result, many exchanges have published Proof of Reserves – a set of wallets to confirm the availability of client funds. Another positive change is the sharply increased interest in decentralization and self-custody.

The collapse of FTX showed that in a rapidly developing crypto industry, you should not blindly trust anything and anyone. Always, even if we are talking about a registered organization, DYOR.

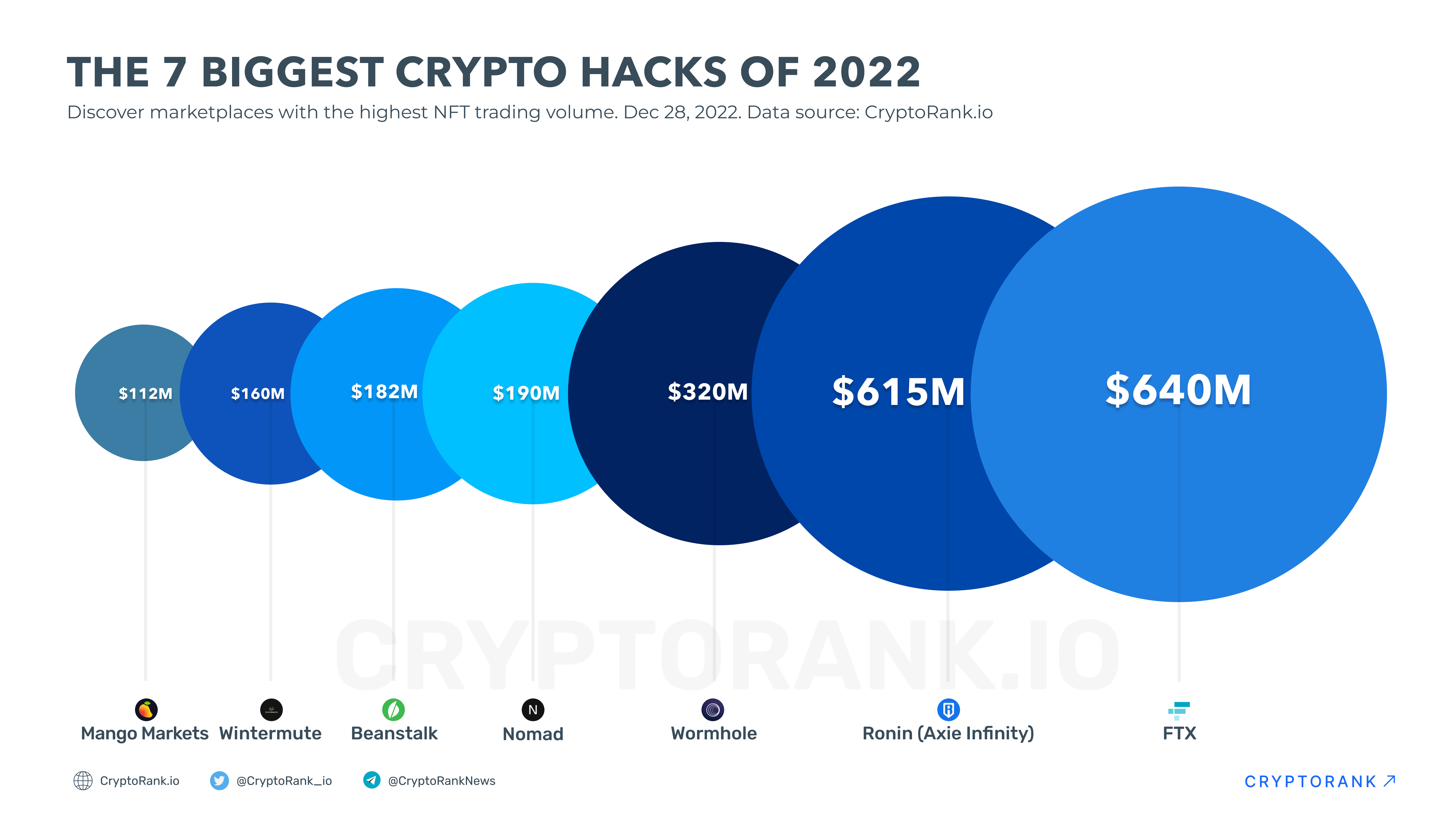

The Year of Hacks

Another negative truth that draws attention is the number of hacks and exploits in 2022. Another record set this year was the number of hacks and stolen funds in crypto. The central drama took place in October, which was unofficially called “Hacktober.”

In the first 11 months, hackers and scammers stole over $4.3 billion in cryptocurrency, according to Privacy Affairs. DeFi, as one might expect, is the main target for hackers. Another type of victim is cryptocurrency bridges; many have vulnerabilities, and hackers could use them. Resistance to attacks and hacks is one of the main reasons hindering further development and adoption of DeFi.

The biggest DeFi exploits include the cross-chain bridge BNB Token Hub ($566M, but 80-90% of which were returned), Ronin, an Ethereum sidechain for Axie Infinity ($552M), Wormhole bridge ($326M), and much more. Unfortunately, most of the stolen funds have gone, and only a tiny part was returned by the hackers or recovered. Luckily, many CeFi crypto institutions tend to cooperate with hacked projects and lock drained funds.

Unfortunately, the rapid development of DeFi is only sometimes accompanied by the development of security. As a result, both users and developers of DeFi protocols suffer. The negative effect is amplified by the interest of regulators, who find it easier to state the idea of a complete ban than to create an infrastructure that increases security.

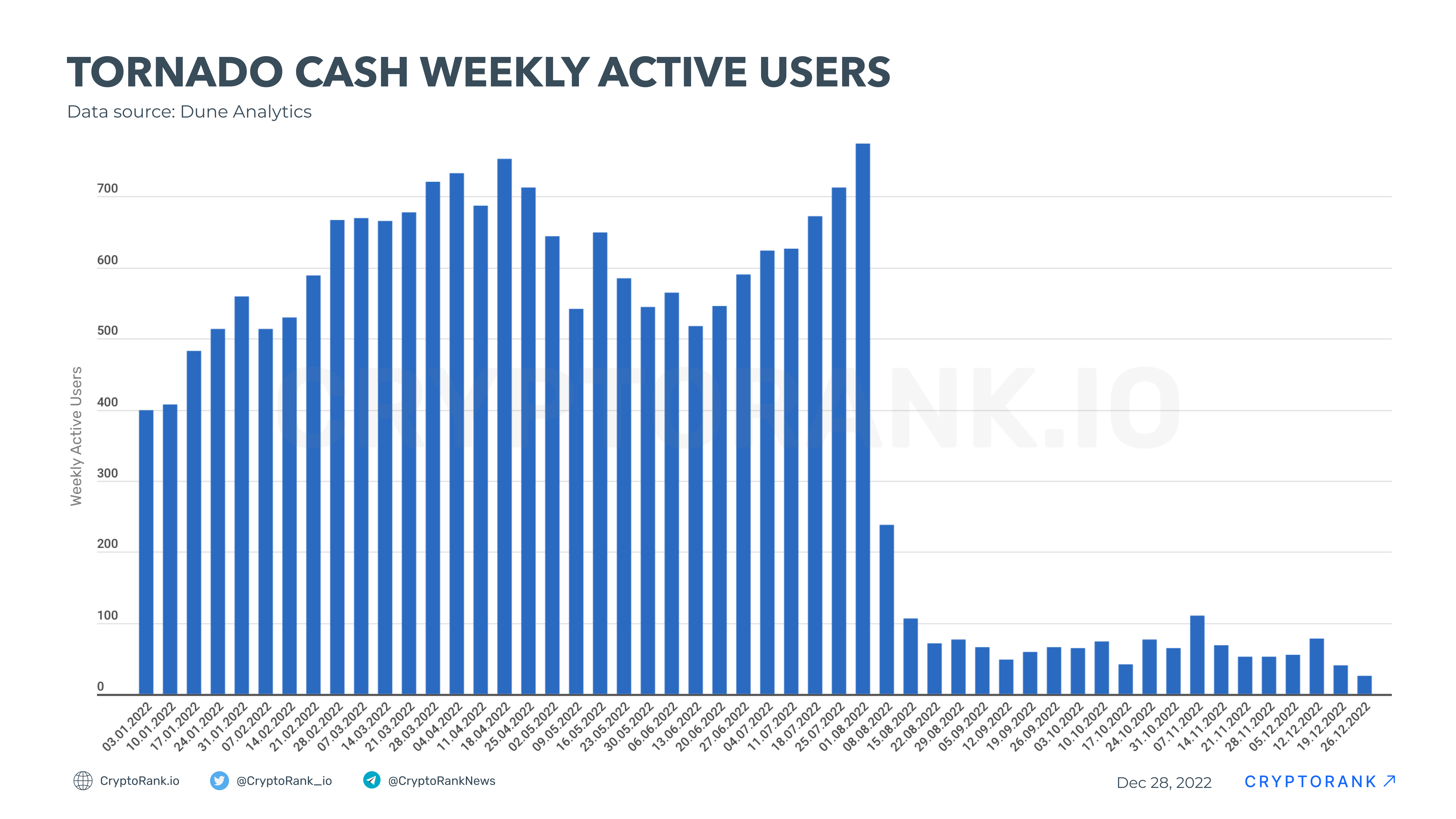

U.S. Treasury’s Office of Foreign Assets Control Sanctioned Tornado Cash

Tornado Cash, one of the biggest crypto mixers (a protocol that helps users obfuscate their on-chain transaction history), was used in many exploits (including the Ronin hack), criminal schemes, and money laundering. US Treasury sanctioned Tornado on August 8. It was the first precedent when regulators had to apply sanctions against open-source code, not a specific organization.

Tornado’s ban had a massive reaction in the crypto community. The number of Ethereum blocks compatible with OFAC already exceeds 50% on average, suggesting that Ethereum can censor any unwanted transaction.

* * *

Crashes, numerous hacks, and the situation around Tornado Cash signalize that regulators began actively eyeing the crypto industry. The active interest of regulators can be assessed from two sides. On the one hand, it can make the blockchain more secure and accessible, attracting many users, companies, and institutional investors. On the other hand, strict regulation may be perceived negatively by many current supporters of crypto and decentralization (users and developers), thereby slowing down the development or even destroying the industry as we know it today. In any case, it is evident that the regulation of cryptocurrencies is inevitable (the process began a long time ago), and soon we will see the first serious decisions.

Bear Market is the Best Time for Development

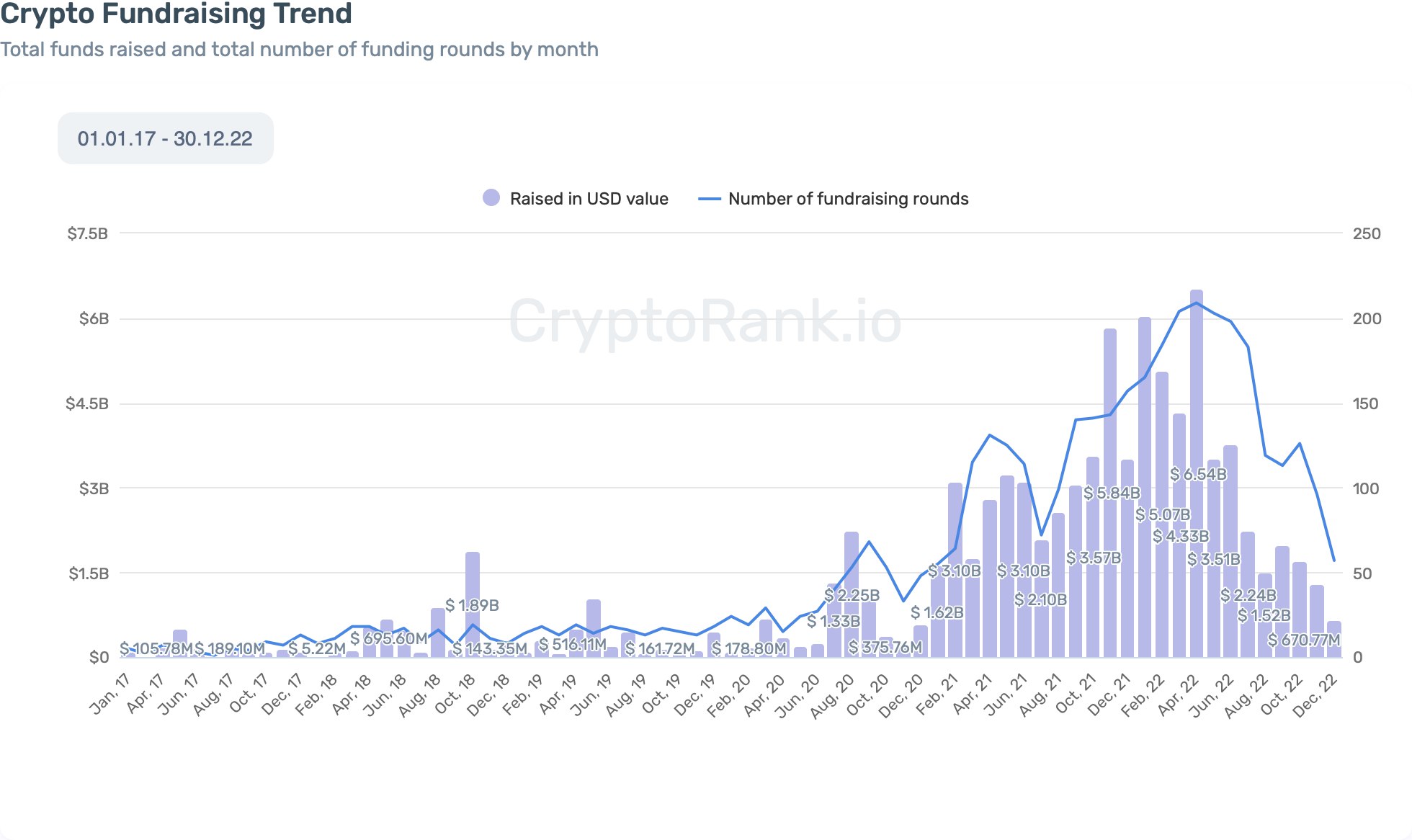

Despite the poor market conditions, the crypto industry continued its development. And the numbers can prove it. While the overall market’s size and volume significantly decreased this year, crypto fundraising activity showed significant growth.

Ethereum Completes the Merge and Transitions to Proof of Stake

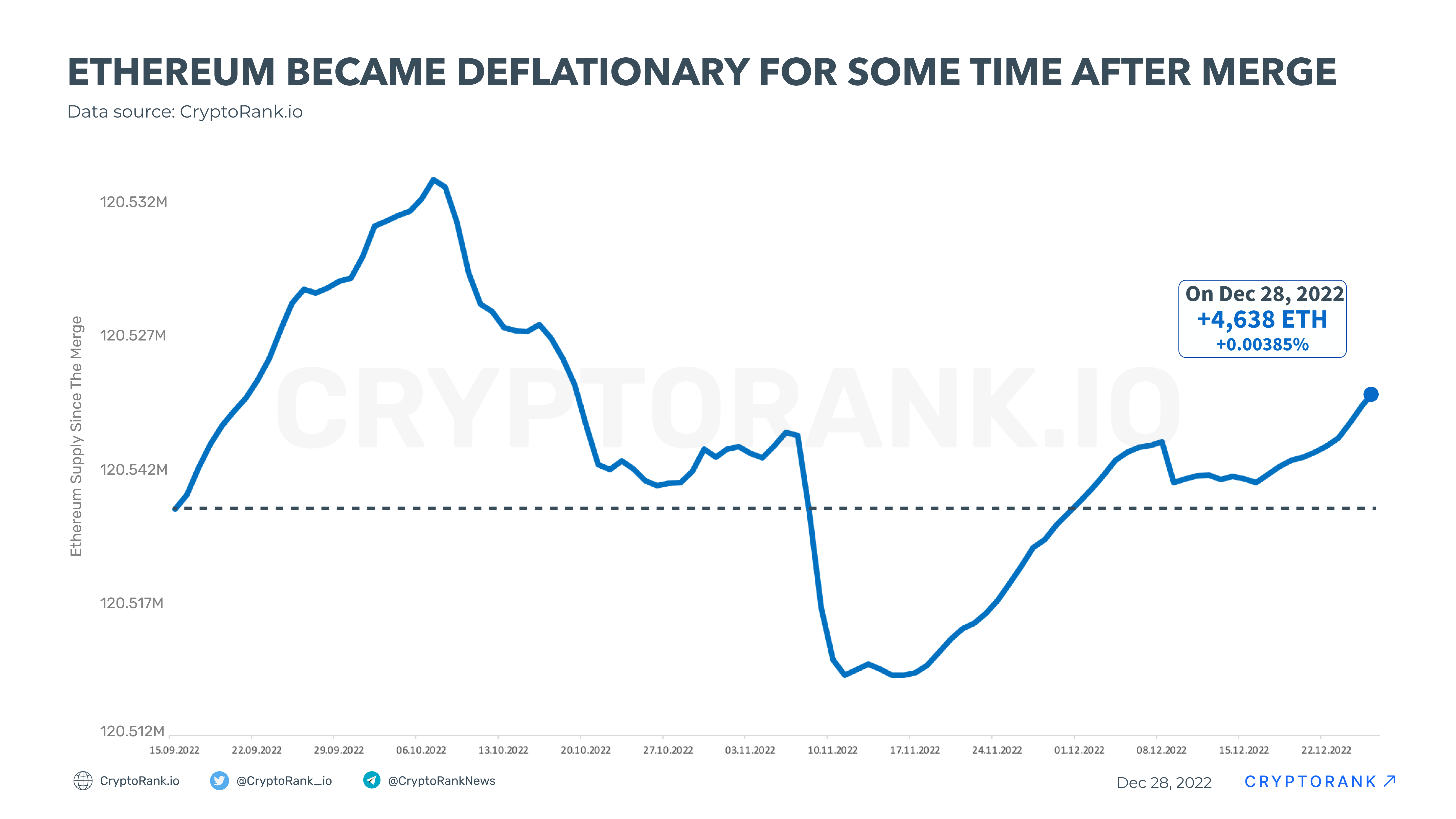

On September 15, 2022, Ethereum transitioned to Proof of Stake, the so-called The Merge. This highly anticipated event ended an era of Ethereum mining (Proof of Work), increasing its efficiency and security.

The approximate date of The Merge was announced in July. Upon news of the event, a very strong month was recorded. Indeed, the exchange rate of the coin increased by +57.7%, which was Ether’s best performing July in history. In anticipation of the event, after it was initially announced, the coin showed very strong growth, but after the merge was completed, Ethereum’s price fell, pulling many other coins with it.

The Merge was accompanied with several Proof of Work hardforks (ETHWand ETHF). These coins were airdropped to all holders of the original Ethereum, with miners given the option to switch their rigs to any of the new networks. However, the performance of these networks turned out to be much worse than the expected forecast. It should be noted that the oldest Ethereum hardfork, Ethereum Classic, showed very good growth, even before the Merge. This can be partially attributed to some miners switching their equipment in advance, resulting in the sharp growth of Ethereum Classic’s hashrate.

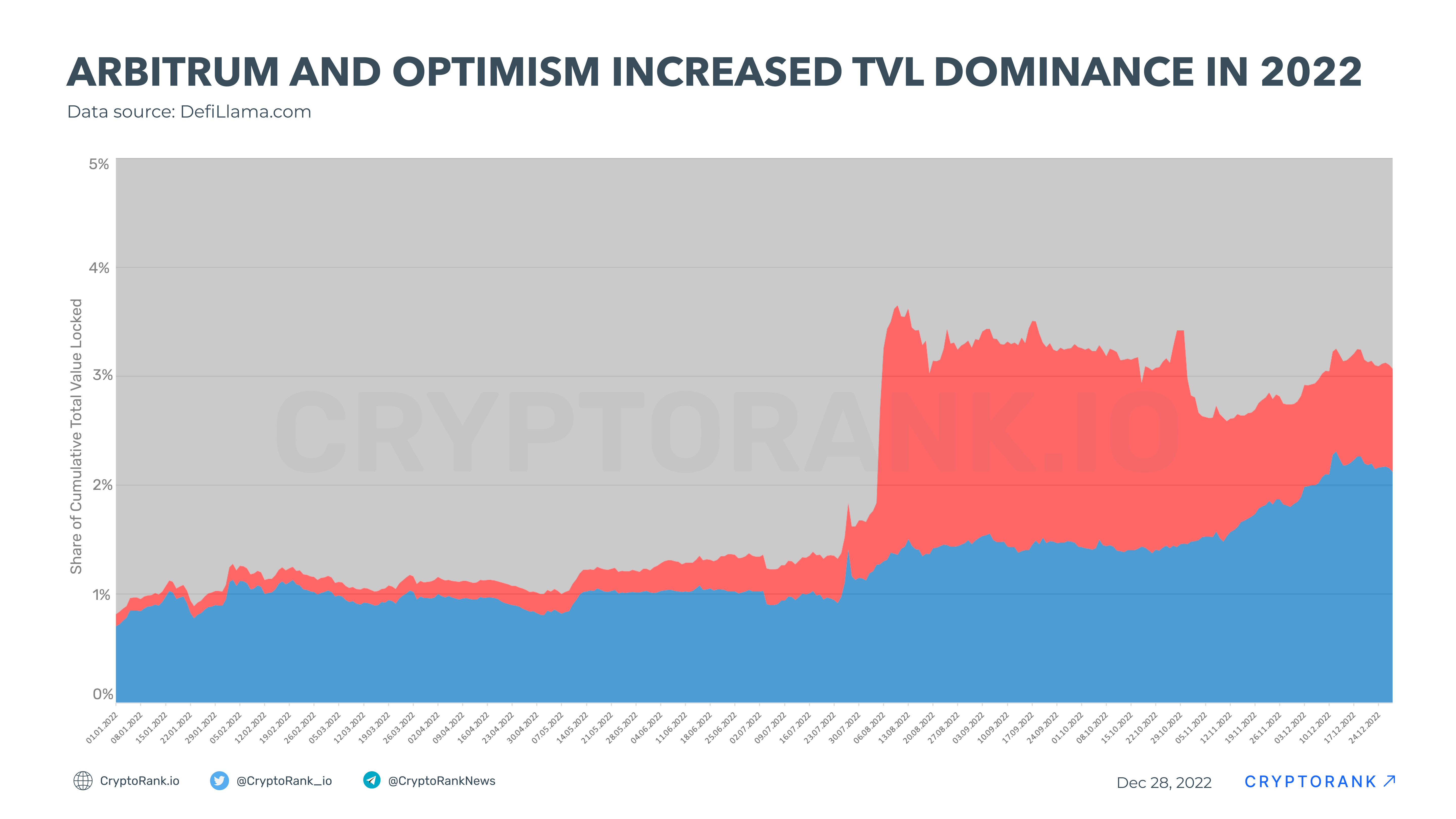

Optimism and Arbitrum Drive Layer 2 Scaling Solutions Popularity

The Layer 2 projects have seen an unusual increase in interest this year. One of the main reasons was the airdrop of Optimism tokens (OP), followed by interest in projects that still have to release their token: Arbitrum, StarkNet, and zkSync.

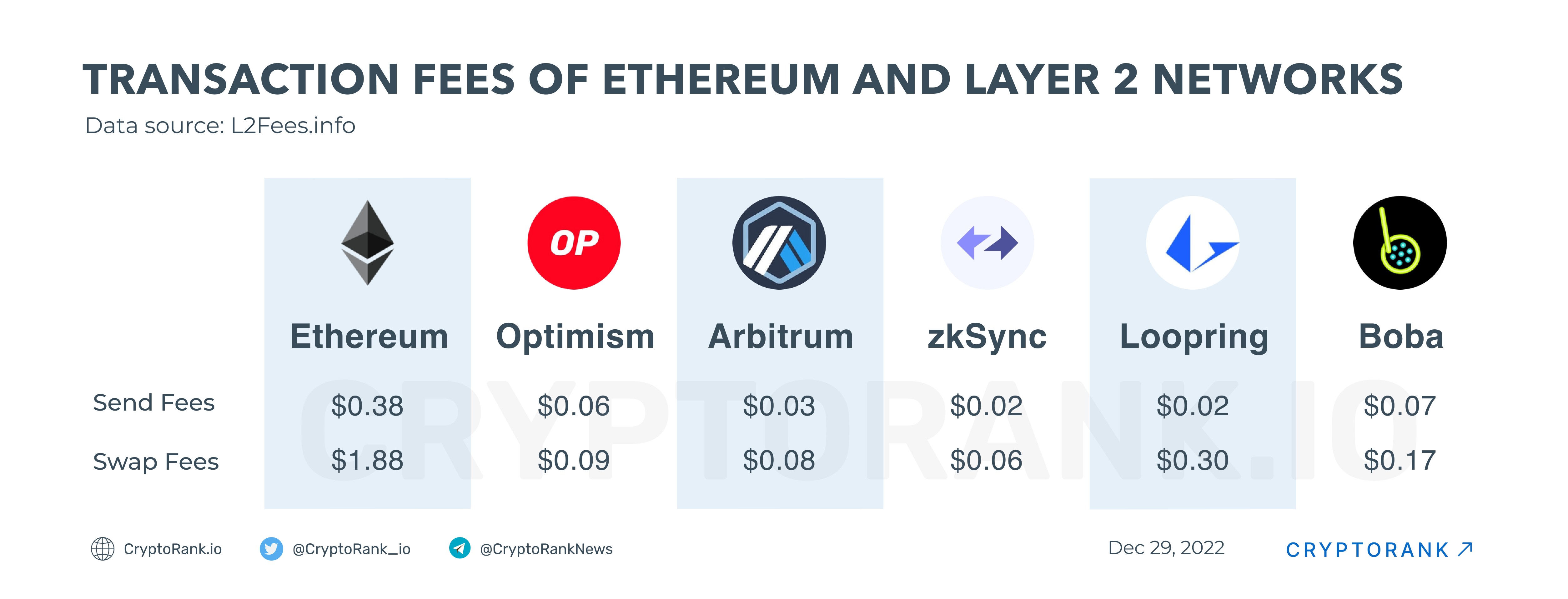

The global market decline undoubtedly harmed some factors, such as Total Value Locked (it is worth noting that the share of Layer 2 TVL in total TVL has grown significantly this year, but still relatively small compared to Ethereum’s). However, even though Ethereum switched to Proof of Stake (which increased its scalability), the demand for high-quality Layer 2 solutions has stayed the same but has even increased. One reason is that the Ethereum network fees have stayed the same after the Merge, while L2 scaling solutions can offer significantly lower fees.

Next year, there may be another leap in the adoption of Layer 2 blockchains because of the launch of the long-awaited zkSync and Polygon zkEVM, as well as the anticipated release of the Arbitrum and StarkNet tokens. Considering this, another year of growth of on-chain activity in Layer 2 is possible. It will positively impact both the cryptocurrency market and the Ethereum ecosystem.

The New GameFi Model: X to Earn

GameFi has already proven capable of snowballing, finding new users, and bringing them to Web3 from Web2. This year we saw another confirmation of this fact, this time in the Move to Earn format.

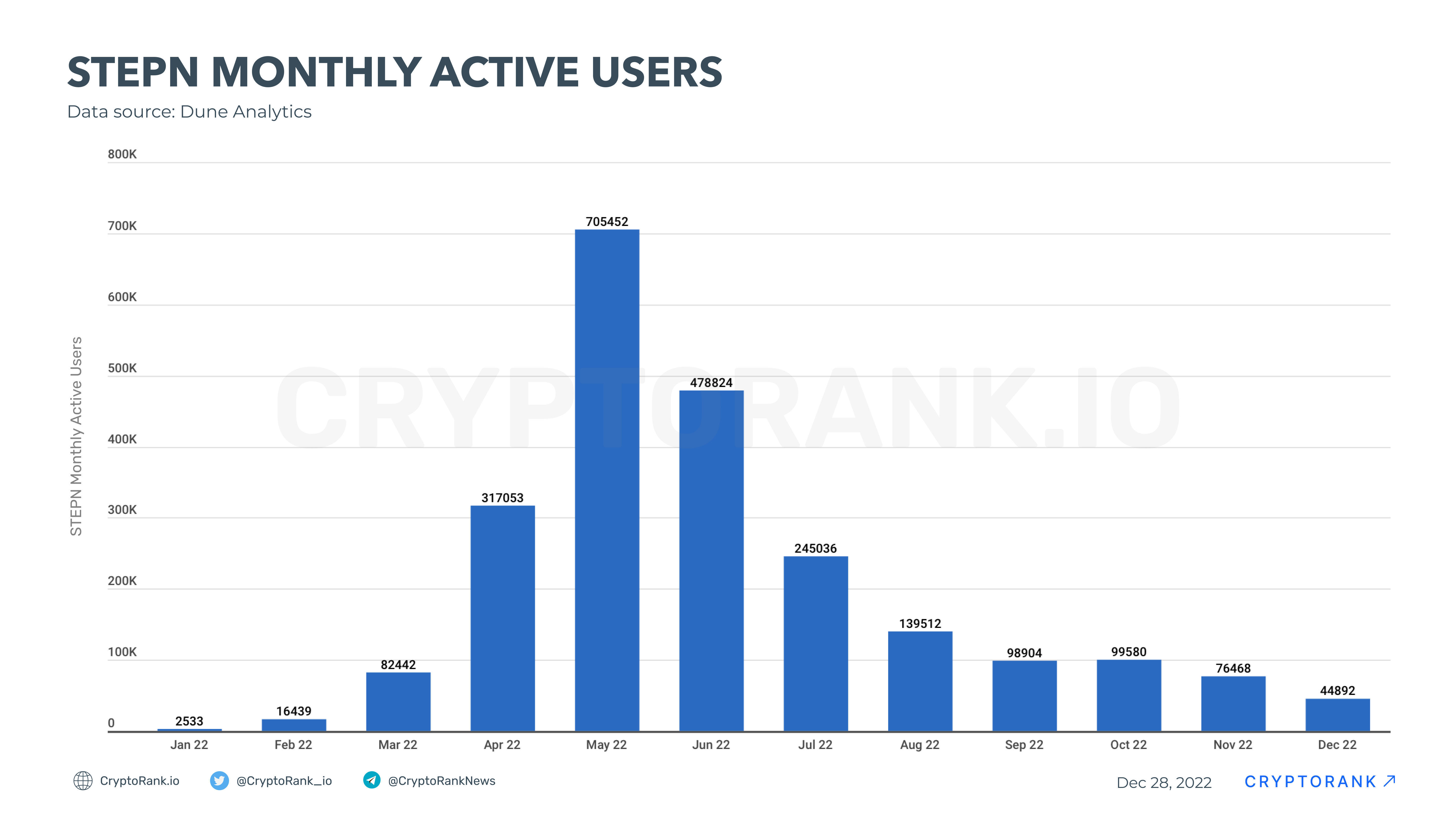

STEPN quickly gathered more than 700 thousand active users and almost 5 million registered users in the Web3 application, but its decline was just as rapid. The unheard-of success of STEPN came from the concept of Move To Earn, which allowed you to receive tokens for walking and running. As a result, STEPN’s user base multiplied, and soon, its users were about 20% of all users on the Solana network. Nevertheless, STEPN followed in the footsteps of Axie Infinity and began to lose positions very quickly due to the poor economics of the project (which is often compared to the Ponzi scheme), which led to a decrease in the income of players and loss of their interest.

The concept of “X to Earn” has shown its ability to attract and retain users. However, STEPN immediately had many competitors, copies, and analogs. What was previously successfully implemented in Play To Earn could be seen in any segment of human life: driving, watching, reading, sleeping, and so on. However, only a few applications manage to retain the user. We discussed this GameFi phenomenon and its problems in more detail in the article “The Rise and Fall of Play To Earn Games.”

The Bottom Line

The events of 2022 devastated the global economy, especially the cryptocurrency market. Nevertheless, the crypto market has resisted and has not stopped developing.

The destructive events of this year can be viewed from two sides. On the one hand, it caused significant damage to the markets. But on the other hand, the needs have cleared of malignant tumors and are preparing for further development.

Stay tuned for the second part of our annual recap. For more insights follow CryptoRank in Twitter and Telegram:

https://twitter.com/CryptoRank_io

https://t.me/CryptoRankNews

Download the CryptoRank app now on App Store or Google Play.