The Bitwise Crypto Indexes were developed to provide investors with a clear, rules-based, and transparent way to track the value of crypto assets. The indexes are designed for benchmarking active strategies, serving as underlying indexes for index-tracking funds, or simply measuring the returns of the market over time.

The Bitwise 10 Large Cap Crypto Index (BITX) tracks the total return of the 10 largest crypto assets, as measured and weighted by free-float and 5-year inflation-adjusted market capitalization.

The Bitwise 70 Small Cap Crypto Index (BITW70) tracks the total return of the 70 largest crypto assets that fall outside of the Bitwise 10 Large Cap Crypto Index and Bitwise 20 Mid Cap Crypto Index, as weighted by free-float and 5-year inflation-adjusted market capitalization.

The Bitwise 100 Total Market Crypto Index (BITW100) tracks the total return of the 100 largest crypto assets, as measured and weighted by free-float and 5-year inflation-adjusted market capitalization.

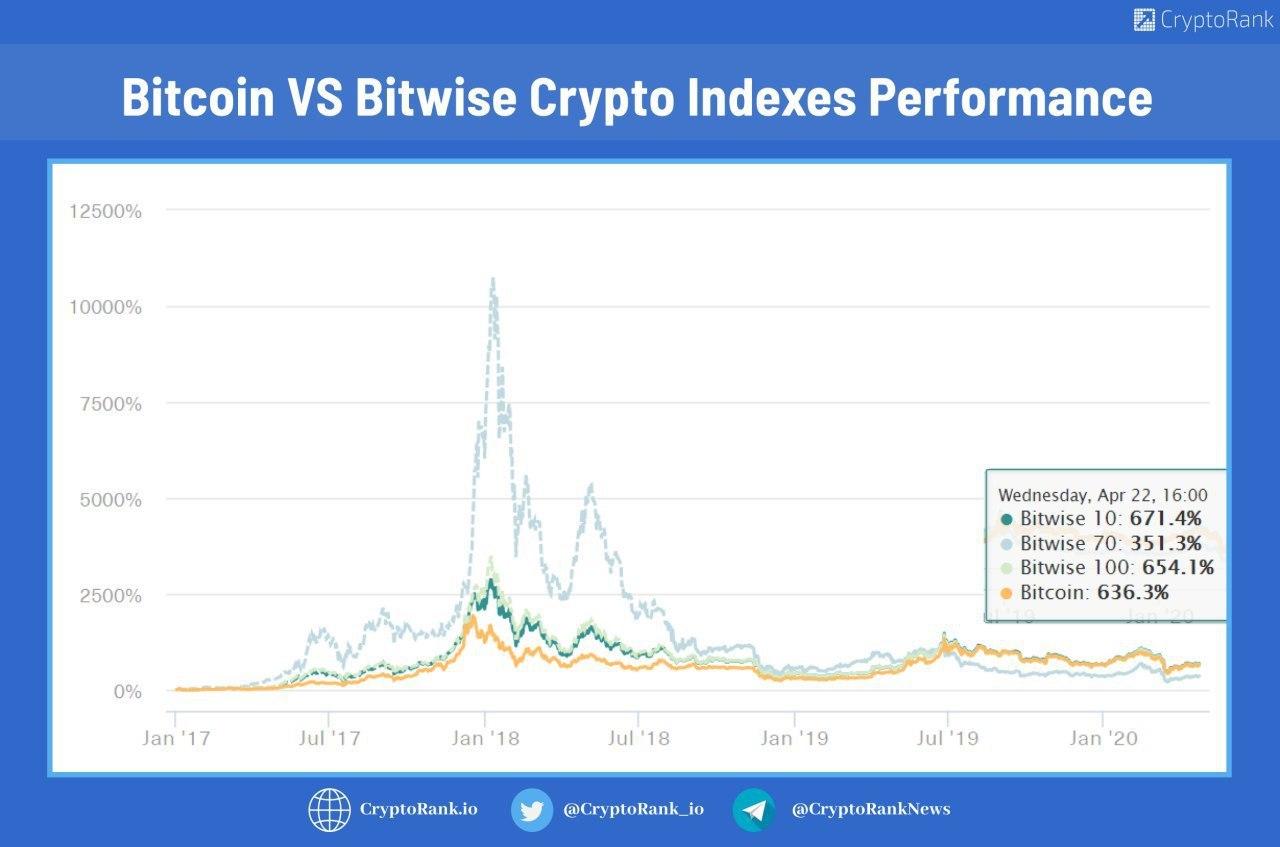

It worth mention that during the ICO hype, the performance of these indices significantly exceeded Bitcoin. YTD data shows that Bitwise 10 and Bitwise 100 outperformed BTC by 4% while Bitwise 70 Small Cap almost did the same.

But now, as you can see in the infographic, at 1/1/17 sine distance, there is no significant difference as to what to hold — bitcoins or indices, but Bitwise 70 Small Cap loses BTC. Thus, if there is no difference, then why do we need to create portfolios from some dubious shitcoins while we can simply hold BTC.