Bithumb Global Jumps On the DeFi Train Integrating the Binance Smart Chain

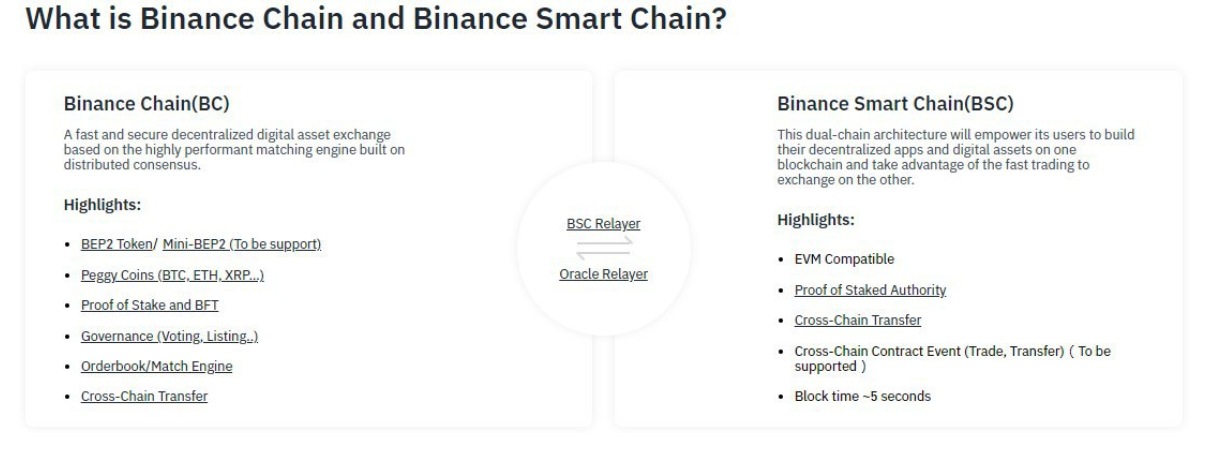

On November 9, 2020, Bithumb Global announced, that they will collaborate closely with the well-known cryptocurrency exchange Binance to integrate their Smart Chain ecosystem. Binance, founded in 2017, has had substantial growth in its 3 years of operation and is considered one of the most reliable and trusted platforms in the industry that proved its readiness to innovate by launching the Binance Chain in April 2019 followed by its complementary Binance Smart Chain (BSC) one year after as an “intuitive version of Smart Contracts functionality” (Binance.com, 17.04.2020). The Smart Chain is not only compatible with Ethereum’s Virtual Machine, it also supports “tooling along with faster and cheaper transactions”.

Binance Smart Chain competing with Ethereum in technology and developer acquisition

While transactions on Ethereum with its current Proof of Work consensus take a minute easily to be mined for a cost of up to several dollars, the Binance Smart Chain has an average block time of only 3 seconds for a fee of 1 cent. This is achieved by a Proof of Stake authority mechanism with 21 validators making it a centralized but more efficient approach than PoW. This allowed Binance to be the first centralized exchange (CEX) to release a decentralized exchange (DEX) to trade on when connecting a private wallet without requiring the user to pass a Know-Your-Customer procedure. BEP-20 tokens on the Binance Smart Chain get listed by voting. However, the hurdle is quite high, as it requires a project to deposit at least 1000 BNB that will not get refunded when the voting goes against the proposed new trading pair that is usually a project token to BNB only.

Bithumb Global decided to integrate not only the Binance Smart Chain but also list selected BEP-20 tokens, which are not subject to a voting procedure but due diligence by the Bithumb Global listing team. The Binance Smart Chain has evolved as a real competitor of Ethereum in terms of Smart Contract capabilities, making it easy for a project to launch a token. To encourage projects to consider the BSC, the company has established a 100 million USD fund “to drive collaboration between centralized finance (CeFi) and decentralized finance (DeFi)” (Binance.com, 11.11.2020) by funding the development of currently six DeFi projects.

DeFi is subject to failure due to Smart Contract bugs and exploits by “Flash Loans”

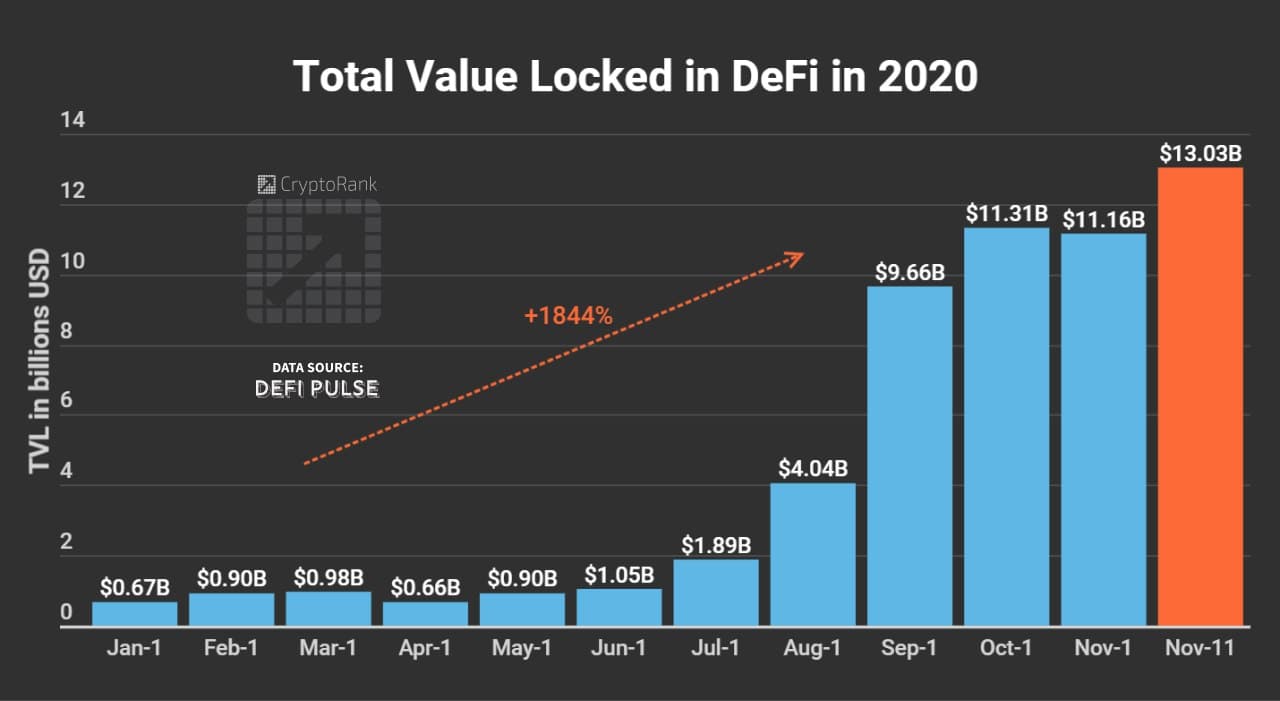

Since Binance has opened its ecosystem for third-party development, we’ve seen high token demand in conjunction with price appreciation even for existing projects making the transition of their token from another chain to Binance. Liquidity and utility demand are key factors an exchange relies on that also made Bithumb Global integrate Binance tokens in its aim to offer a low-margin trading experience not only of popular coins but also less known but promising projects. The DeFi space looks very promising in this regard after its exponential growth in 2020 – in usage, but also exploits.

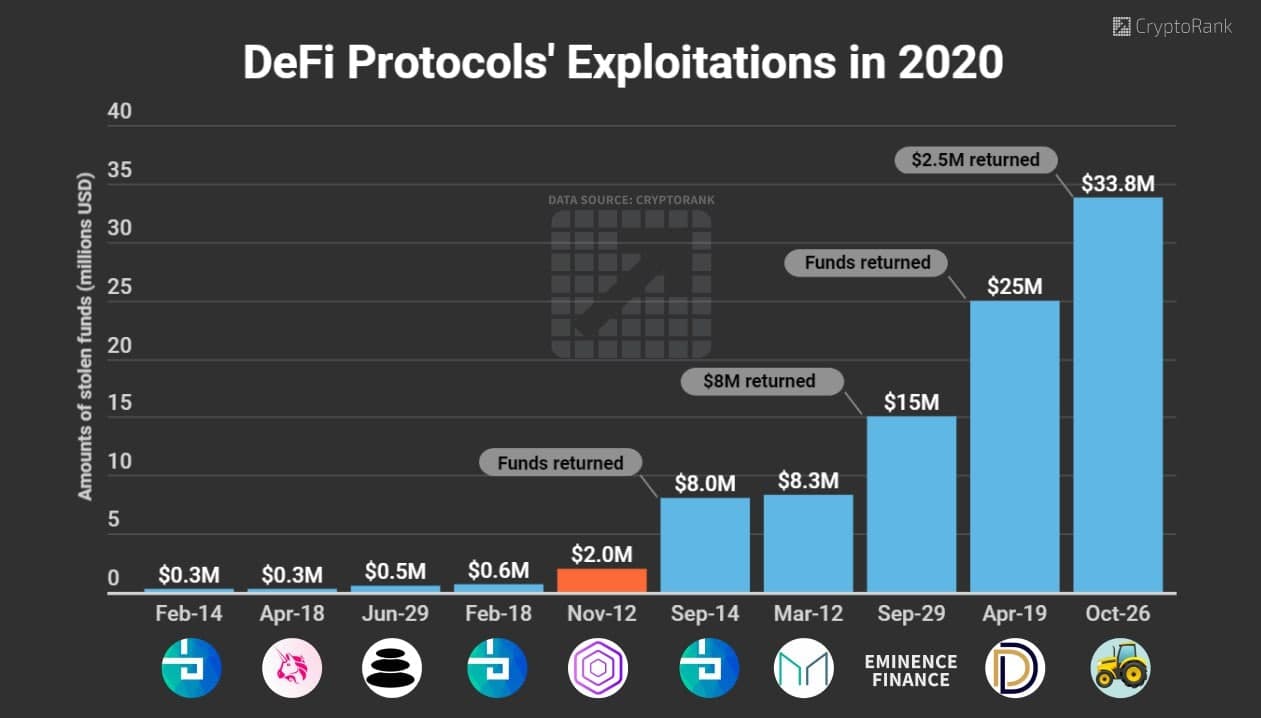

Smart Contract platforms bear a vast risk of errors and black swan events even when they have been thoroughly audited, as seen in the latest Akropolis hack that caused a loss of $2M due to a flash loan as reported on November 13. However, the value of cryptocurrency locked on Decentralized Finance platforms such as Compound Finance or MakerDAO has been growing steadily since Q3/2020:

Yield potential using Decentralized Finance services

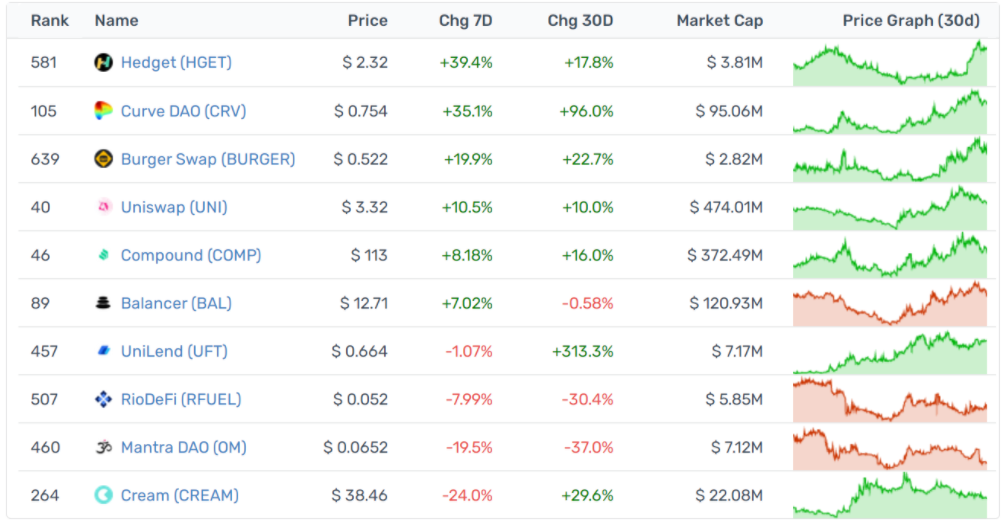

The advantage of using DeFi compared to traditional platforms is the accessibility bypassing the need for identity verification by users who just have to connect their wallet to a service, sign a digital contract and start lending assets to other parties on Curve Finance or adding liquidity to a pool that in turn generates interest to the creditor as on UniSwap or Sushi Swap. The governance tokens of these protocols are both available for trading on Bithumb Global. The first batch of DeFi projects supported by Bithumb Global are COMP, CREAM, UNI, BAL, CRV, Burger and the first projects Mantra DAO, Hedget, RioFuel, and UniLendFinance:

DeFi requires sophisticated users that can balance risk-to-return

Even though these decentralized platforms aim for ease-of-use, it still requires the user to have an understanding of the technical background and self-responsibility in holding the own wallet’s private key as well as theoretically check the contracts associated with a platform to determine if it is safe to use which even experts cannot guarantee. Due to such drawbacks, people still prefer less transparent centralized services that are safer, though not risk-free to use but generally cover losses caused by a hack themselves to continue operation as demonstrated by Bithumb Global in 2019: The exchange got hacked for $13 million in EOS but recovered successfully. DeFi is an interesting venture without a safety net. Investing and trading DeFi tokens on centralized, more secure platforms can be yielding speculation without exposure to high-risk platforms but instead long or short these assets whose functionality is primarily still governance with lots of promises for future features.

Bithumb Global empowers the DeFi space offering a liquid platform for rare tokens

While DeFi protocols are still in its infancy and only capable of supporting a few blockchains, tokens, and products, centralized platforms such as Bithumb Global can offer a much larger variety of assets for trading not only as a P2P model but in a liquid, high-frequency environment on a spot or derivative market that is suitable for professional traders. On top of that, retail investors enjoy coin staking combined with customer support that provides assistance where users in DeFi are usually lost when not educated enough to help themselves. Bithumb Global even made a step further to teach its users about the projects listed by launching BG Learning, allowing users to earn a slice of the cake when correctly answering a question about a project as we reported earlier.

Final Thoughts

To conclude, the possibilities in automizing personal finance with products yielding double-digit interest on crypto assets in times of negative interest rates at the bank are tremendous. Bithumb Global’s integration of the comprehensive Binance Smart Chain is a positive sign of collaboration that is much appreciated in this head-to-head race of blockchains and protocols seeking to offer the best interest rates and services on the market. Bithumb Global positions itself as an innovative platform and legit alternative to big market players providing competitive products with lots of upside potential.

Since its launch in May 2019, Bithumb Global has developed into a leading cryptocurrency exchange on the global market. For the past year, the company has established a competitive platform offering cryptocurrency trading and services in the blockchain sector. Today, Bithumb Global serves more than half a million cryptocurrency enthusiasts around the globe positioning itself as an innovative platform and legit alternative to other market players by providing competitive products with lots of upside potential.