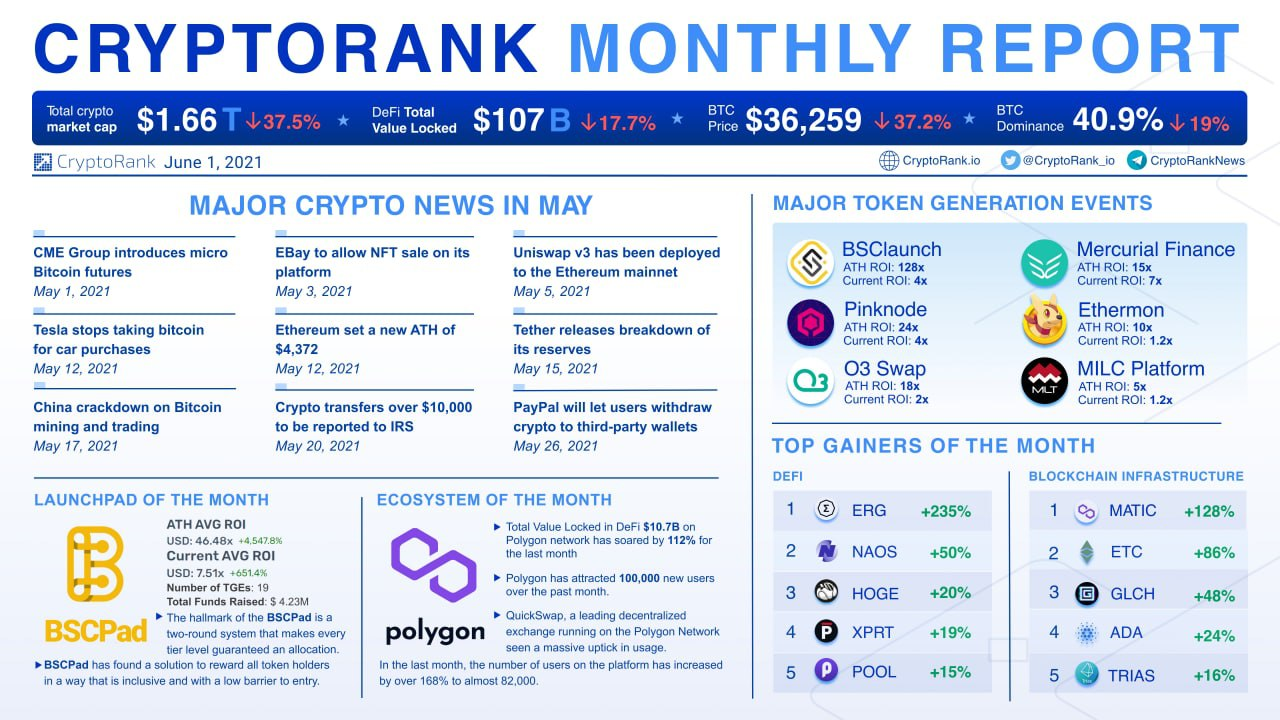

It was a bearish month for the cryptos. CryptoRank’s team collected the most significant market updates and trends that are worth noting for consideration. Look into the latest market intelligence and in-depth reports on popular blockchains and digital assets.

Highlights from the last month’s report

- Bitcoin plunges 30% to $30,000 at one point in wild session

- Ethereum sets an ATH of $4,372

- Crypto market loses $460B as Ether and altcoins follow Bitcoin’s deep dive on Black Wednesday

- Both centralized and decentralized exchanges demonstrate an impressive increase in volume hitting ATH

- The total value locked in DeFi hits an ATH of $157B

- The current supply of stablecoins crosses $100B

- Open interest on Ethereum futures hits an ATH

- Ethereum gas fees hit an ATH

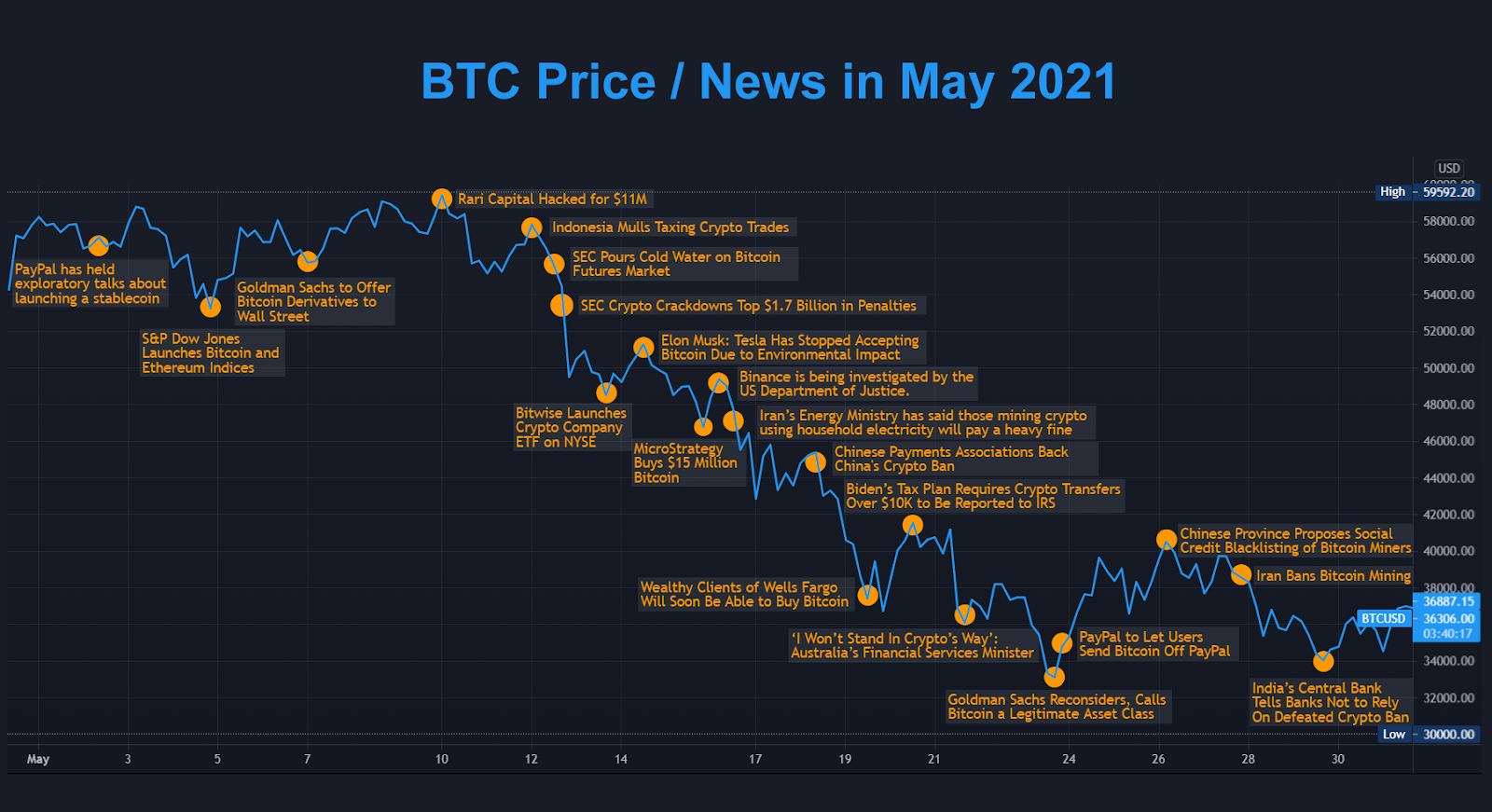

The main attention of market participants was focused on the following news:

Chinese Payments Associations Back China’s Crypto Ban

The financial committee in China has emerged with news that it will crackdown on Bitcoin mining within the country. The note released also includes a wide range of other financial risks.

On May 18 China banned financial institutions and payment firms from offering any services involving cryptocurrency — individuals are still permitted to hold it. This resolution caused a hashrate drop, which, together with Bitcoin depreciation led to a decline in BTC-mining profits to $1,48B in May. This also resulted in Chinese miners starting to move to other countries massively.

Iran Bans Bitcoin Mining

Iran’s President Hassan Rouhani has announced a four-month ban on cryptocurrency mining in the country. The restriction comes on the heels of massive blackouts that rolled across major Iranian cities last week.

Black Wednesday

On May 19 the crypto market suffered a dramatic Black Wednesday: the price of Bitcoin fell by 30%, Ethereum’s — by 38%. The most liquid stablecoin Tether plunged to $0.84. It led to total Bitcoin open interest declining by roughly 50% on May 21 — from $20.84B to $10.02B. Shares of tech companies with exposure to Bitcoin also decreased.

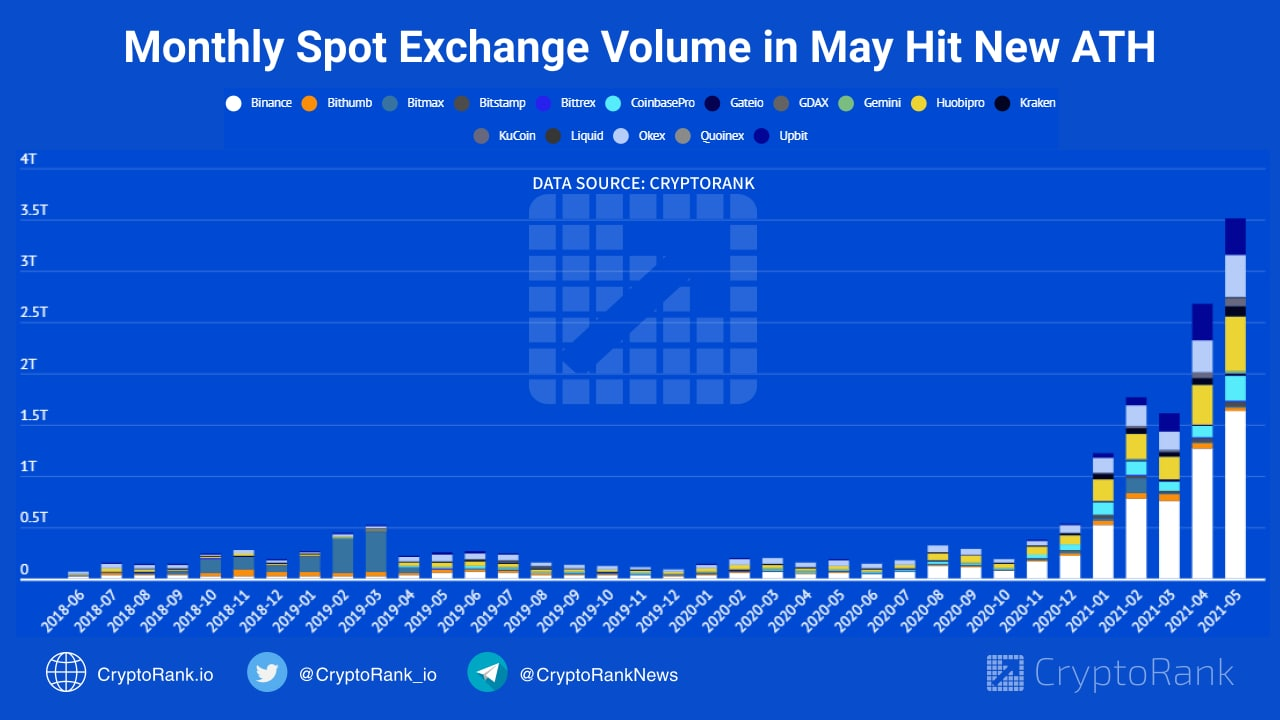

Spot trading volumes spiked at all kinds of exchanges

Spot trading volumes went up sharply: top-15 exchanges showed significant growth from April. In May 2021 monthly adjusted volume hit a new all-time high of $3.50T. Binance, Huobi Global, and OKEx turned out to be the leaders with volumes being the largest for real. HitBTC stood out too: its reported volume is almost four times the adjusted one.

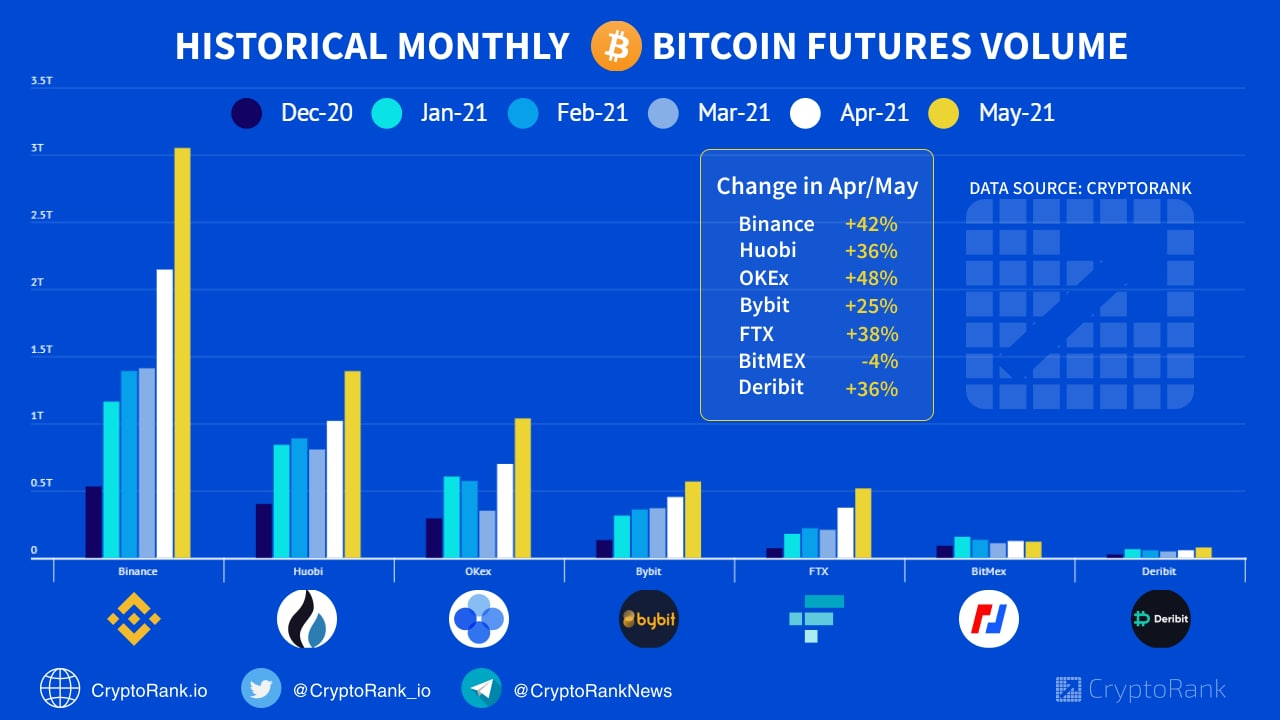

Derivatives Overview

May has proved to be a really good month for derivatives exchanges. BTC Futures Volume hit a new all-time high, increasing up to 48% on most of the major exchanges.

The most rapid growth of BTC Futures Volume was shown by the OKEx exchange, but Binance continues to be the holder of the largest one.

The top derivatives exchanges by monthly volume were:

- Binance: $3.05T +42%;

- Huobi Futures $1.38T +36%;

- OKEx $1.03T +48%;

- Bybit $568B +25%;

- FTX $517B +38%.

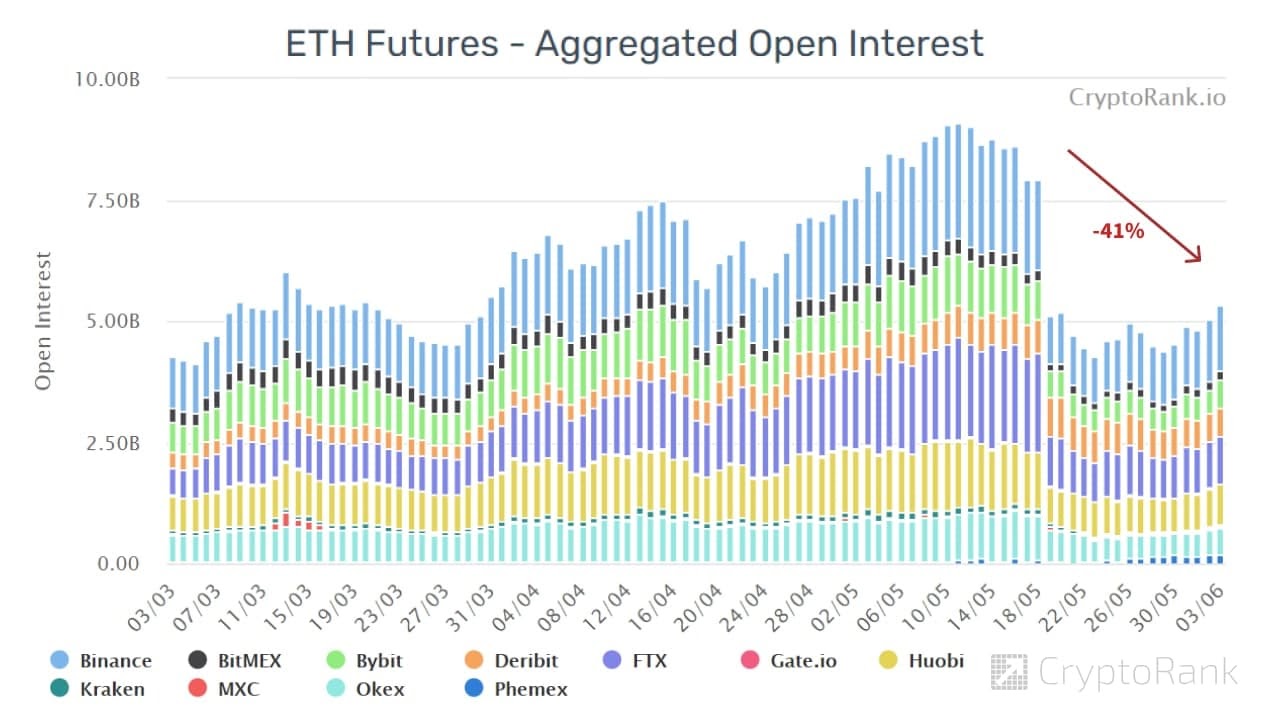

Ethereum Futures Aggregated Open Interest Declines in May

On May 21 the Aggregated Open Interest on Bitcoin Futures suffered a steep fall from $20.84B to $10.02B — a decline of over 50% in 30 days.

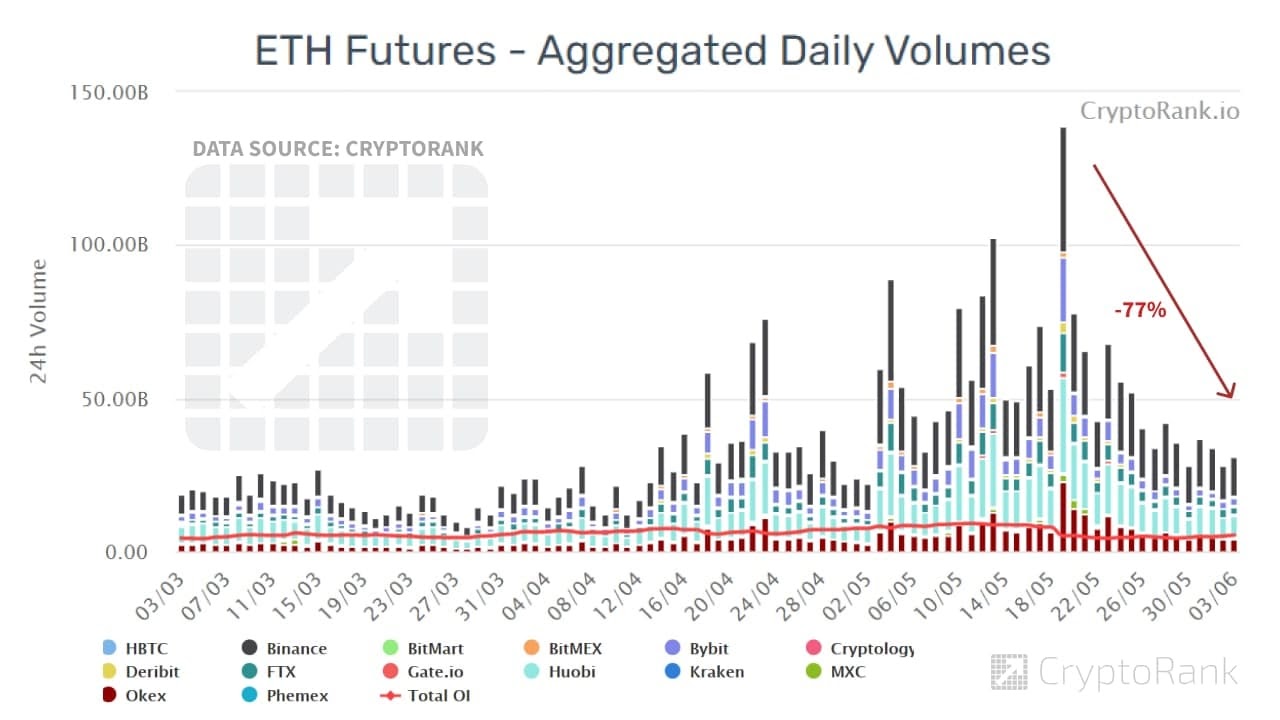

After Ethereum hit a new all-time high of $443 this May, an inevitable rollback took place. Ethereum futures aggregated open interest declined by 41%: from an ATH of 9.09B hit in the first half of May to 5.03B on June 3.

Ethereum futures aggregated daily volumes suffered an even sharper fall by roughly 77%: from $139B to $30.9B.

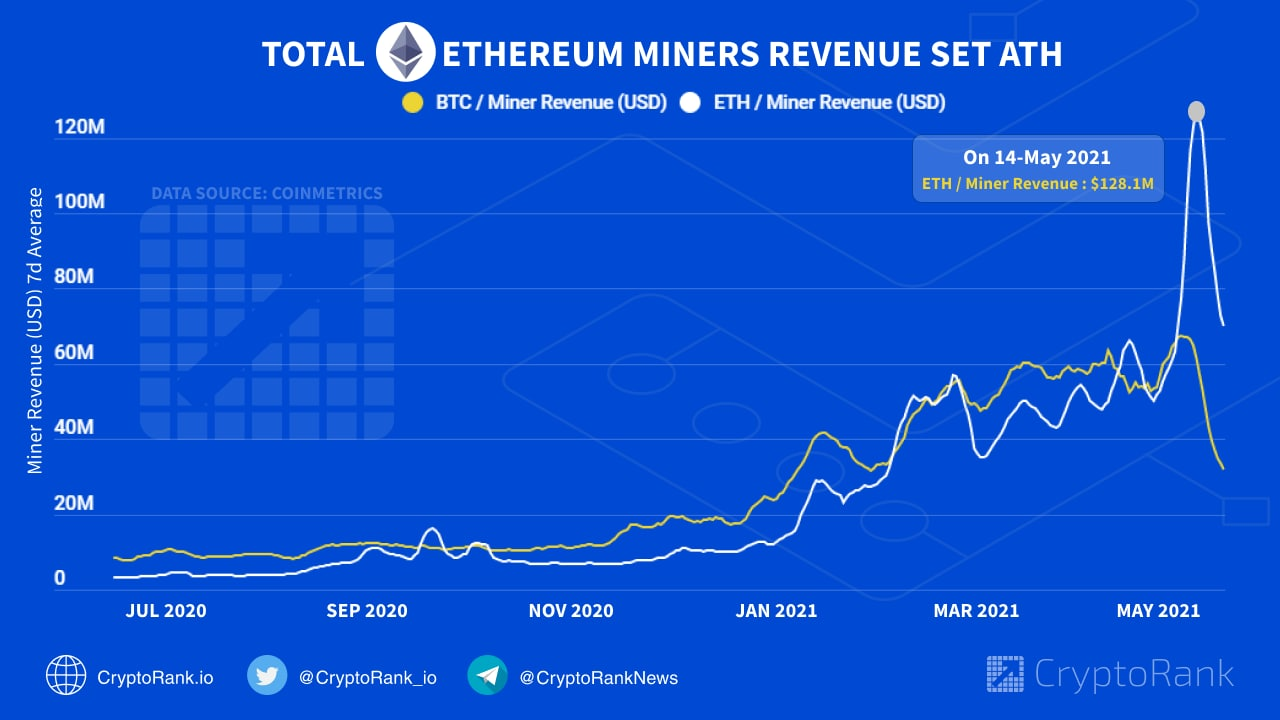

ETH miners now make more money than BTC miners

Ethereum overtook Bitcoin in terms of miner revenue and network value transacted. Meanwhile, a report from Goldman Sachs revealed that the global investment bank believes Ether has a “high chance of overtaking Bitcoin as a dominant store of value.”

Traders are focused on ETH because of its increasing dominance — its market capitalization is gradually gaining on half of Bitcoin’s, representing a crypto market dominance of over 20%.

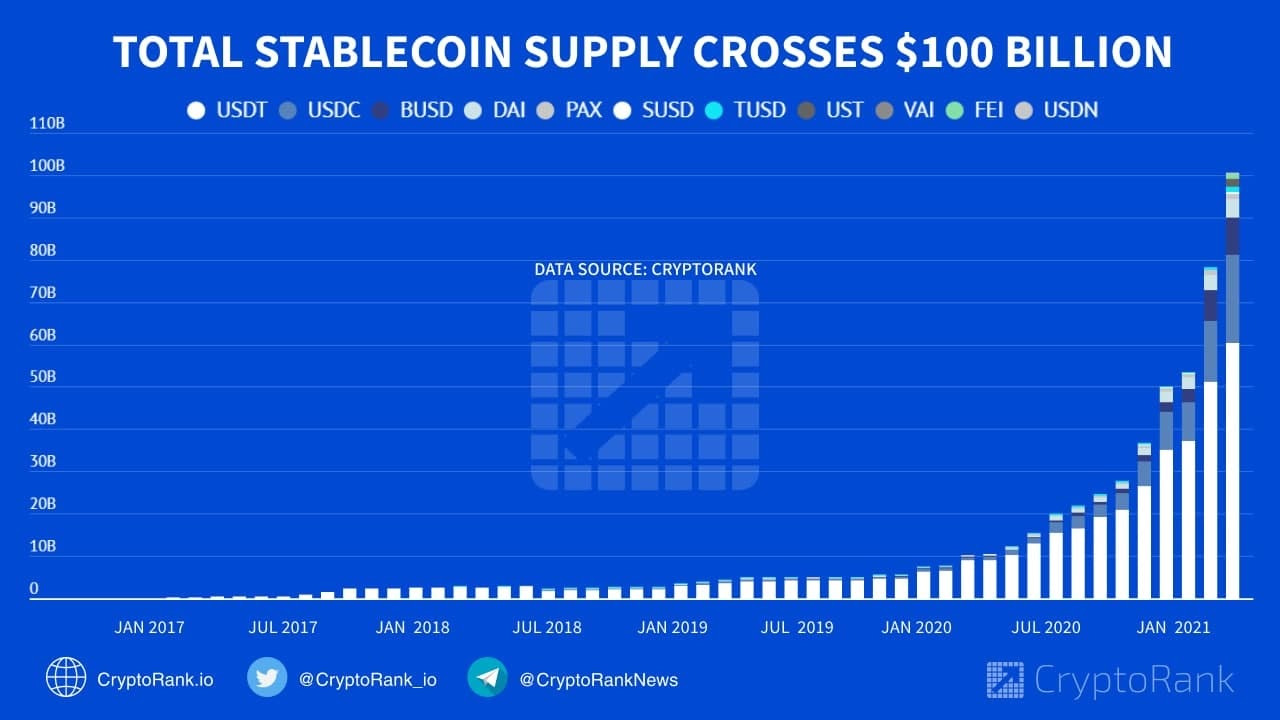

Total Stablecoin Supply Crosses $100Billion

The total outstanding supply of stablecoins surged past $100 billion in May. The sharp growth in stablecoins suggests that crypto market participants are increasingly deploying funds, including in areas such as derivatives and decentralized finance (DeFi).

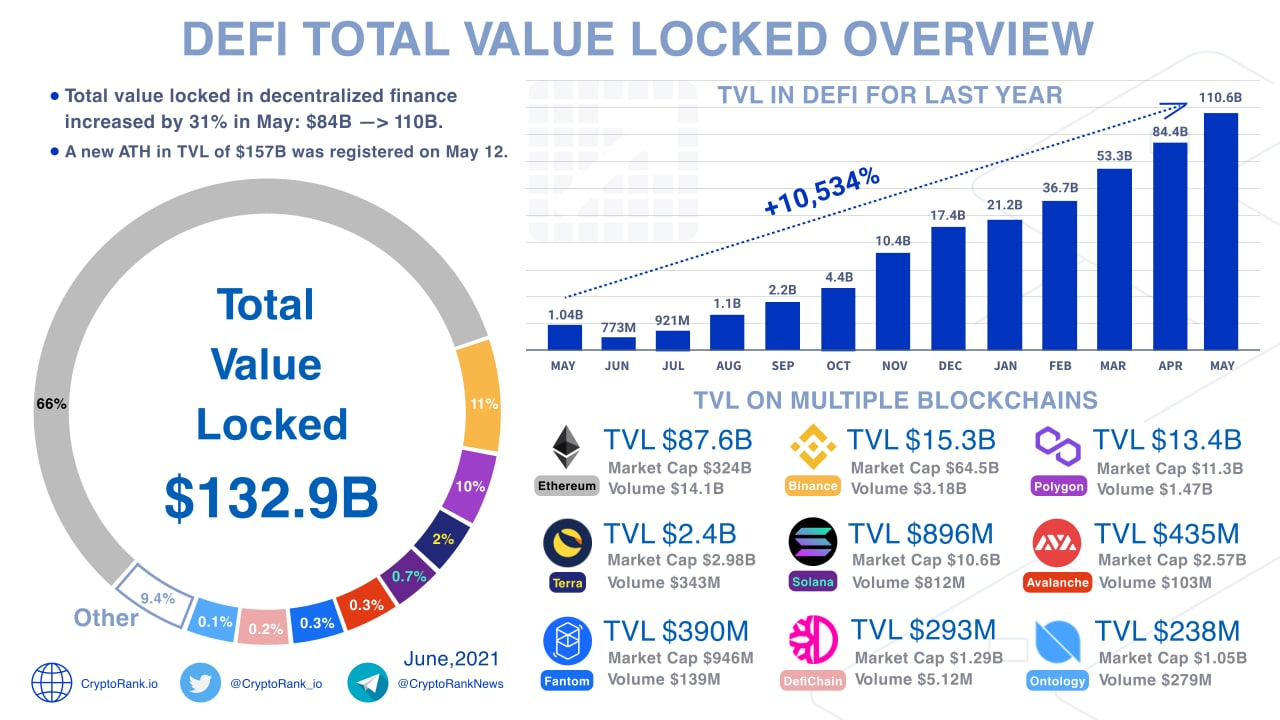

Decentralized Finance (DeFi)

The total value locked (TVL) in all DeFi protocols combined reached a new high of $157B on May 12. As the figures show, DeFi’s TVL has increased by more than 10,500% in just one year.

Among the many blockchains, Ethereum tops the charts with a market share of 66% and a TVL of $87.6 billion.

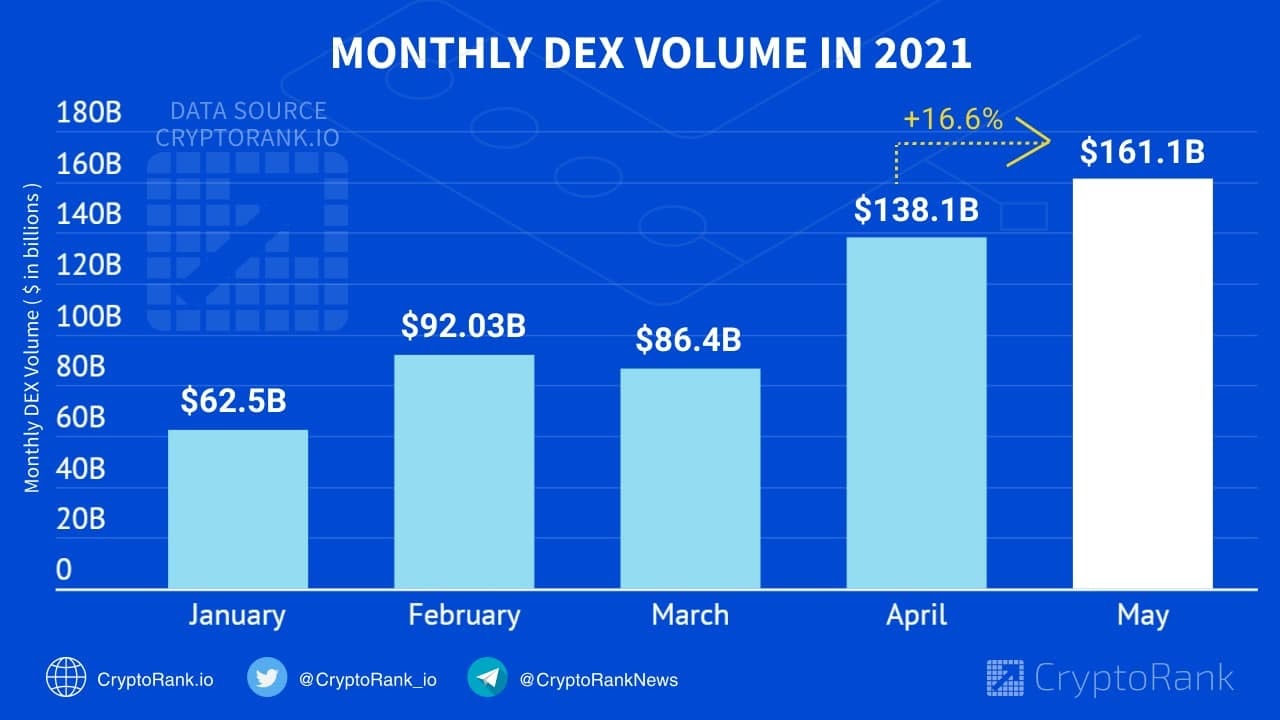

Monthly Volume on DEX Exchanges Registered a New ATH

May trading volume on decentralized exchanges reached $161B, surpassing the previous record of $138.1B set in April this year. Uniswap continues to be the dominant Ethereum-based decentralized exchange with a volume of approximately $59 billion. The long-awaited third iteration of the decentralized exchange protocol Uniswap was deployed to the Ethereum mainnet last month. At the heart of the upgrade lies the ability for liquidity providers (LPs) to make markets within customized price ranges, an approach dubbed concentrated liquidity.

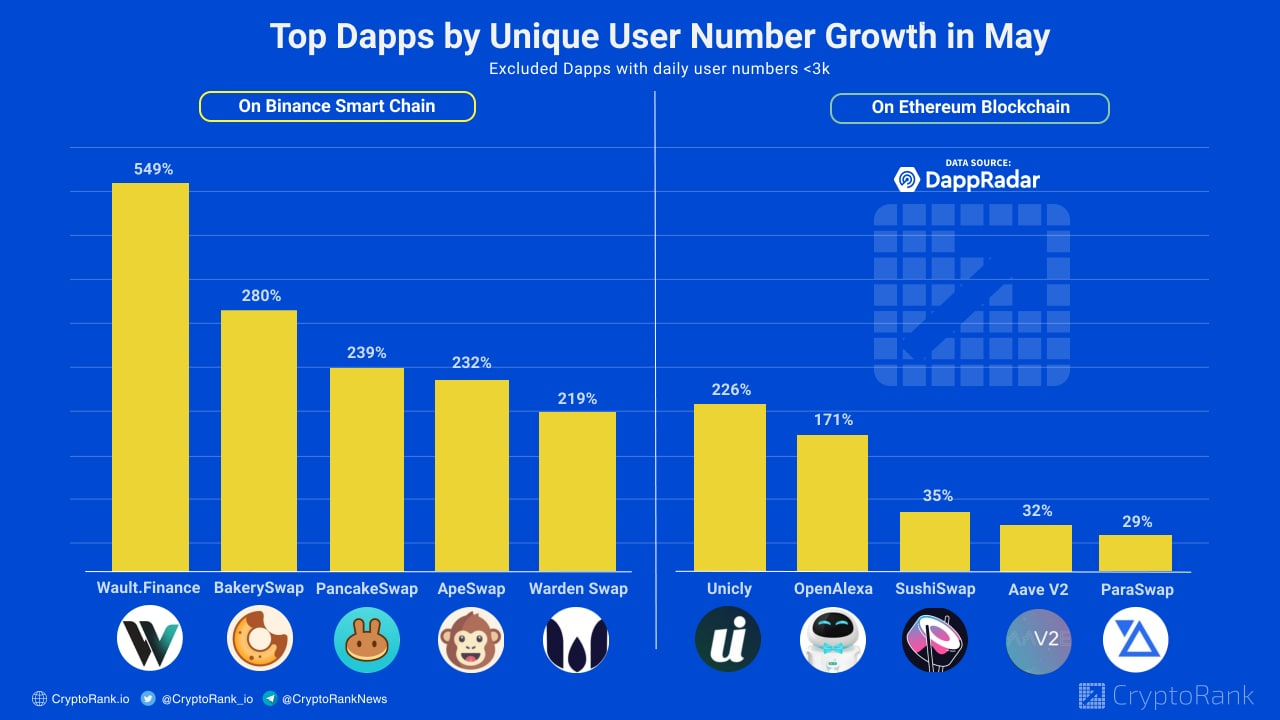

Top Dapps by Unique User Number Growth in May

Binance Smart Chain and Ethereum are dominating when it comes to attracting demand for decentralized apps, or dapps, at the moment.

Among dapps built on Binance Smart Chain, Wault.Finance has shown the highest surge in the number of monthly active users — 549%.

Among dApps built on Ethereum, the most significant growth in the number of monthly active users has been demonstrated by Unicly – 226%.

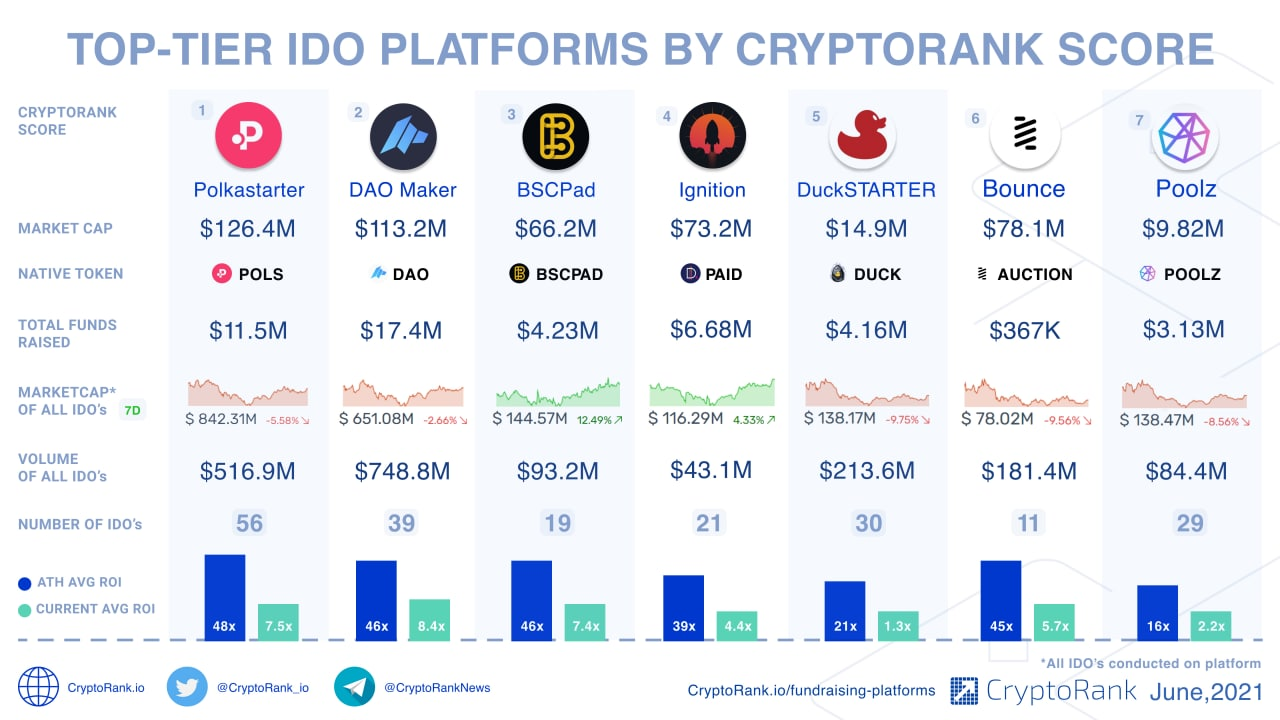

Launchpad Platforms May Overview

Even though it was a bearish month for crypto, the market cap of all IDOs conducted on BSPAD and Ignition by Paid shows robust growth. Moreover, most of the top-tier fundraising platforms still show positive average ROI of IDOs conducted on them.