Decentralized Perpetual Exchanges

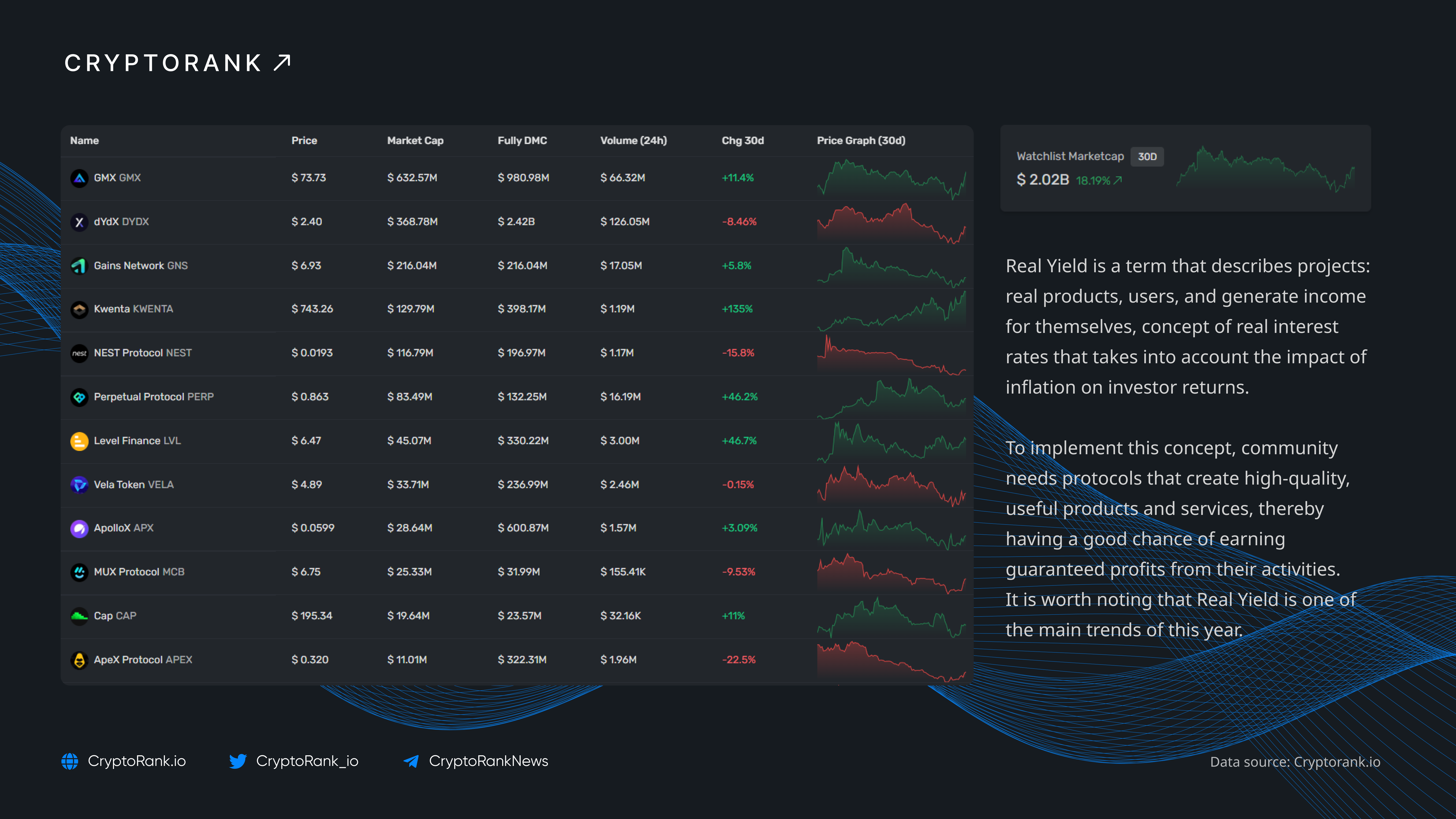

Real yield investments have gained popularity in the world of DeFi, offering investors a way to earn revenue from their investments similar to stock dividends.

However, what sets real yield apart in DeFi is that the yields are “real” and not generated through unsustainable token emissions or other manipulative methods.

By investing in multiple protocols at once, investors can diversify their portfolios and reduce their risk exposure. Smart contracts back these investments, offering greater security than traditional investments.

Real yield investments offer an attractive way to generate returns while maintaining control over funds and mitigating market volatility and other risks associated with traditional investments. In summary, real yield is one of the key investment trends in DeFi this year.

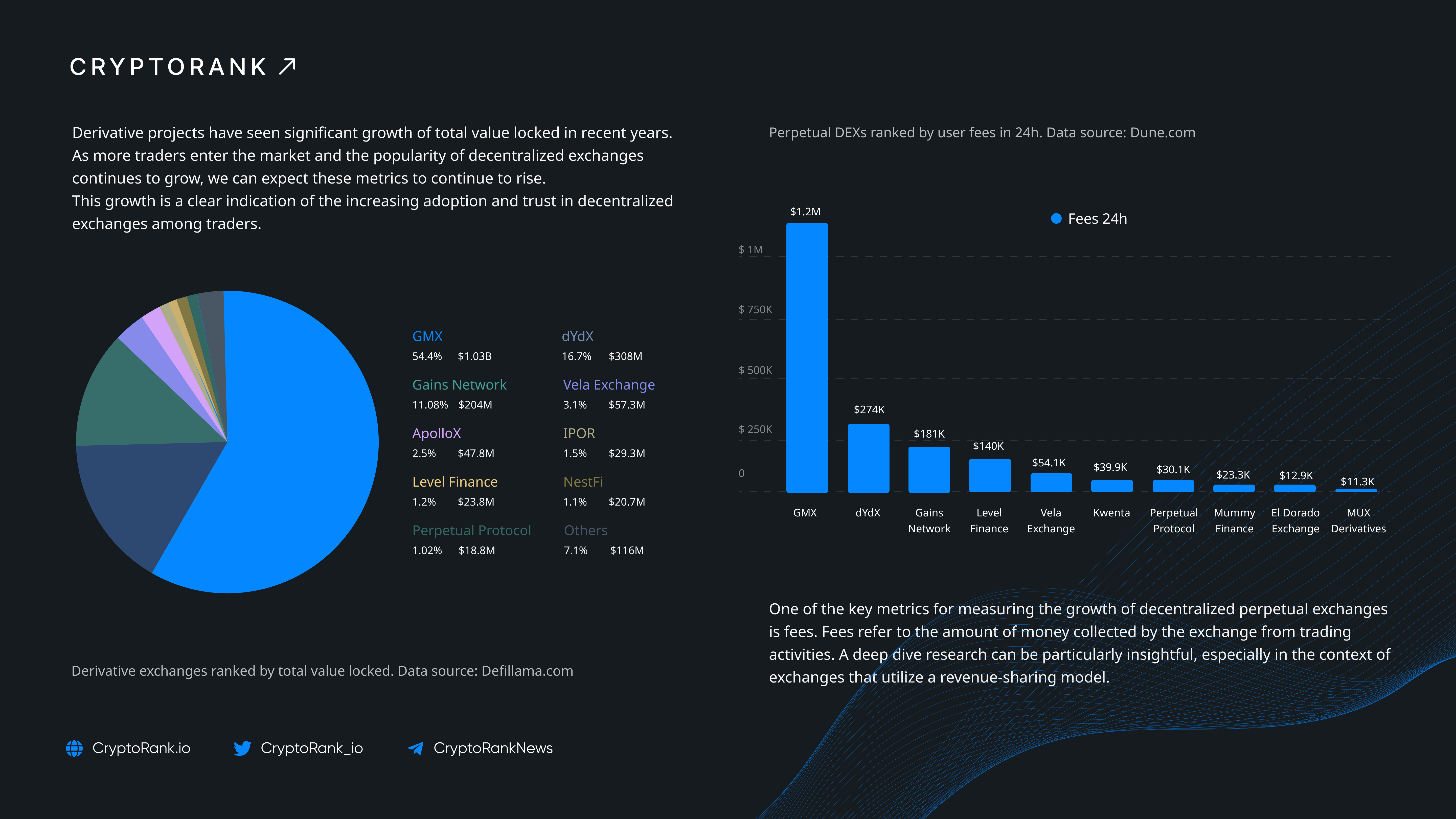

The decentralized exchange, which allows users to trade perpetuals or futures without an expiration date directly through smart contracts, is benefiting from a larger trend towards perpetual-focused decentralized platforms triggered by the recent fall of centralized giants like FTX. As a result, we have seen a significant increase in the number of holders and growing popularity among industry leaders.

Here are the most popular perpetual decentralized exchanges on CryptoRank.io over the last month.

GMX Fully DMC $980M

dYdX Fully DMC $2.42B

Gains Network Fully DMC $216M

Vela Exchange Fully DMC $236M

Level Finance Fully DMC $330M

MUX Protocol Fully DMC $31.9M

Mycelium Fully DMC $10.8M

Follow the links for even more insights

👉 CryptoRank.io/tags/perpetuals

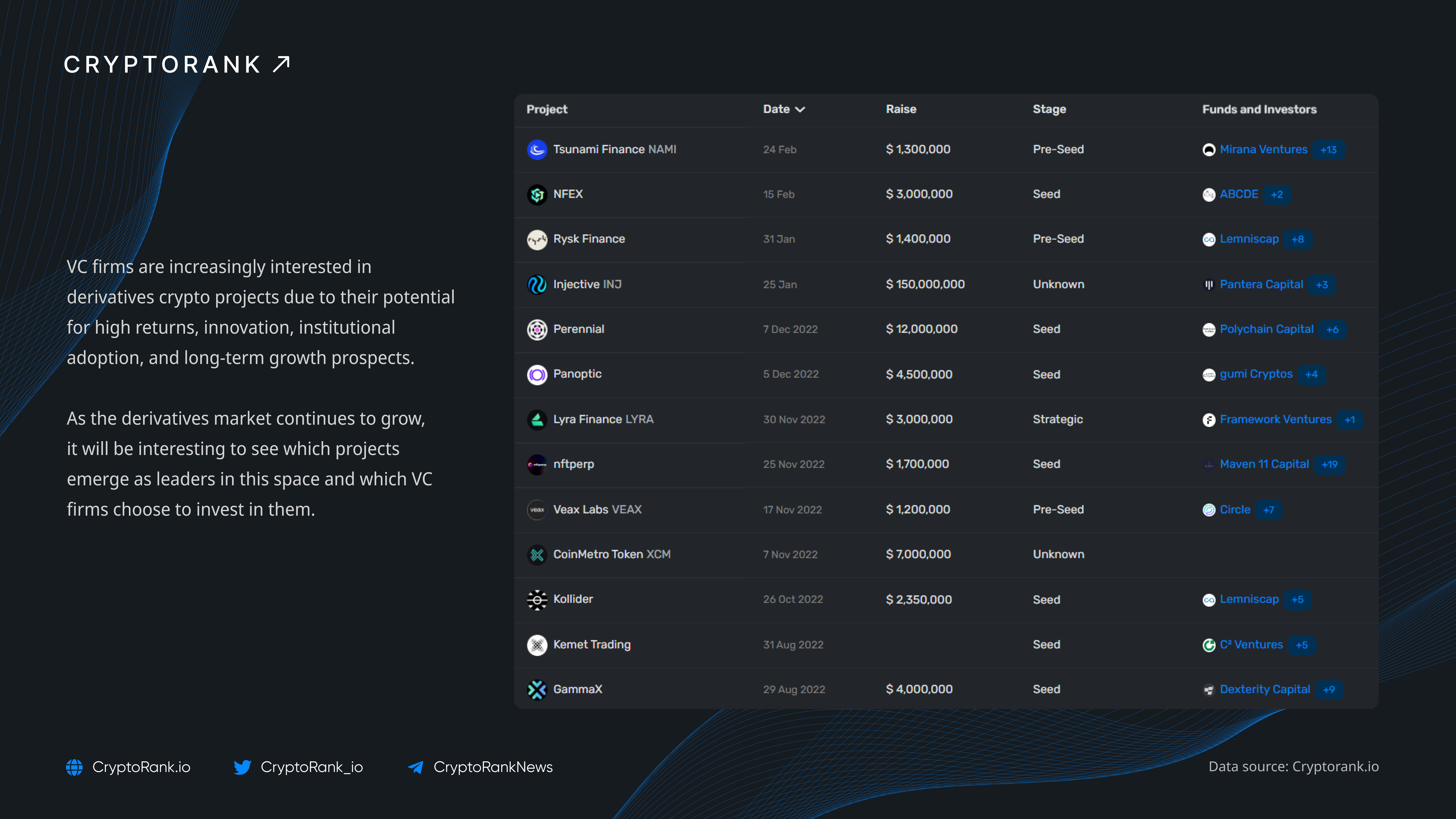

One of the key factors driving VC interest in derivatives crypto projects is the potential for high returns. Many of these projects have demonstrated significant growth in recent years, and as the market continues to expand, there is the potential for even greater returns on investment.

Another factor is innovation. Many derivatives crypto projects are at the forefront of new developments in blockchain technology and decentralized finance, and are pushing the boundaries of what is possible in the financial industry. This is an exciting prospect for VC firms that are looking to invest in cutting-edge technology.

Institutional adoption is also a driving force behind VC interest in derivatives crypto projects. As more institutional investors enter the crypto space, the demand for these types of investments is likely to increase. This represents a significant growth opportunity for VC firms that are able to identify and invest in the most promising projects.

Looking ahead, it will be interesting to see which projects emerge as leaders in this space, and which VC firms choose to invest in them. As the derivatives market continues to grow, it is likely that we will see even more innovation, increased institutional adoption, and higher returns on investment. For investors who are willing to take on the risks associated with this new and rapidly-evolving space, the potential rewards are significant.