Huobi Futures Quarterly Round-up: 2020 Q2

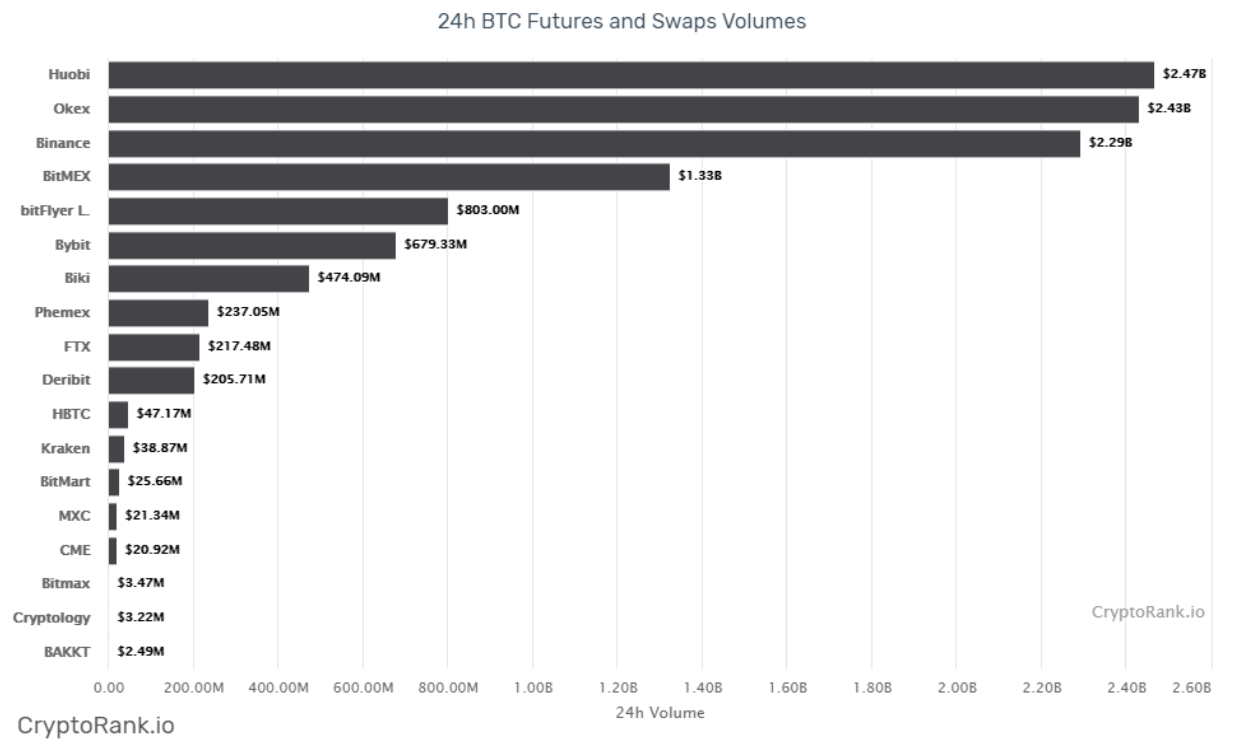

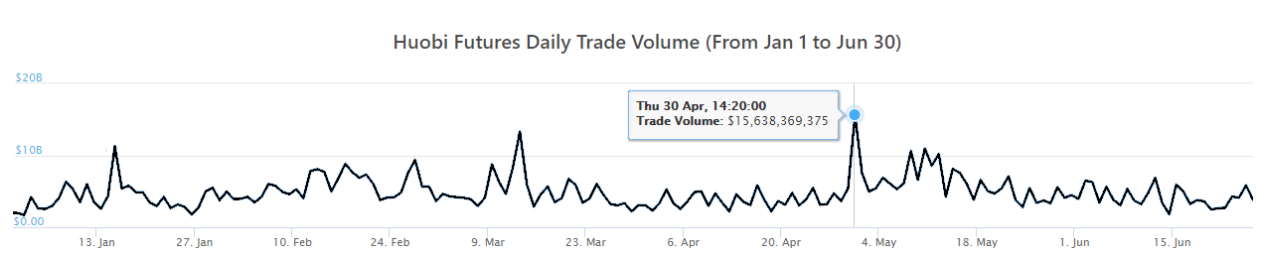

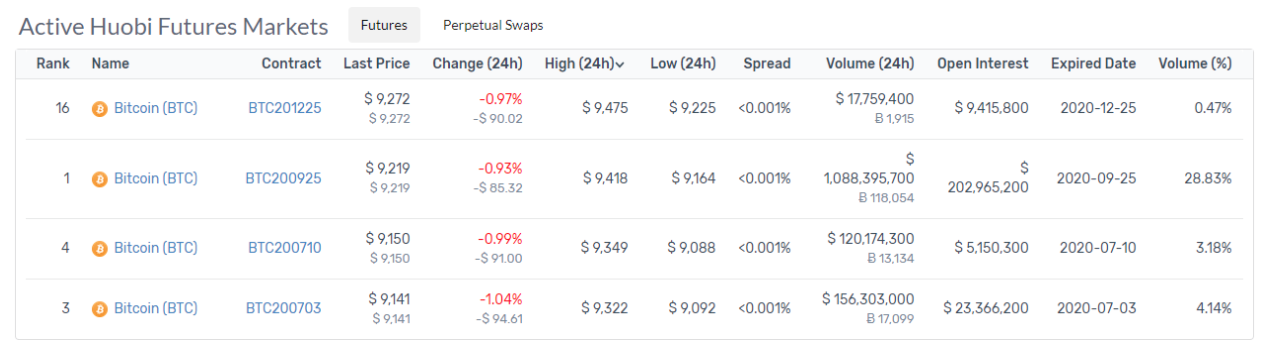

In June, Huobi Futures marked a new milestone as it took the lead in BTC Futures markets. Huobi Futures’ BTC contracts took the 1st spot based on 24h volume. In March, the Stock market fell over 30% and sent global markets into a tailspin with all asset classes, including major indices, treasuries, metals, and even crypto. During the next one and a half months, Bitcoin was recovering after the Black Thursday crash on March 12. All cryptocurrencies, including BTC, showed massive volatility. This raise of extreme volatility provided opportunities for investors, miners, and traders to take profit or hedge. On April 30, Huobi Futures hit a daily ATH volume of over USD 15.6 billion, in addition to weekly and monthly volume highs.

In March, the Stock market fell over 30% and sent global markets into a tailspin with all asset classes, including major indices, treasuries, metals, and even crypto. During the next one and a half months, Bitcoin was recovering after the Black Thursday crash on March 12. All cryptocurrencies, including BTC, showed massive volatility. This raise of extreme volatility provided opportunities for investors, miners, and traders to take profit or hedge. On April 30, Huobi Futures hit a daily ATH volume of over USD 15.6 billion, in addition to weekly and monthly volume highs. As of today, Huobi Futures offers 49 futures and perpetual swaps contracts on its platform, the most among the major exchanges. Huobi Futures currently houses half of the top 10 most liquid altcoin contracts, many of which are also the most traded pairs among all futures exchanges. In the last six months of operations, Huobi became the most popular derivatives platform for altcoins.

As of today, Huobi Futures offers 49 futures and perpetual swaps contracts on its platform, the most among the major exchanges. Huobi Futures currently houses half of the top 10 most liquid altcoin contracts, many of which are also the most traded pairs among all futures exchanges. In the last six months of operations, Huobi became the most popular derivatives platform for altcoins.

Product innovations

Innovation has always been a cornerstone of Huobi Futures. It has consistently rolled out new features that have improved accessibility to Huobi markets and further developed its ecosystem. Huobi Futures is the first exchange to launch locked margin optimization and partial liquidation mechanisms as well as tiered adjustment factors. These new features are system mechanisms designed to reduce possible losses and risks involved in liquidation. Huobi Futures released lower adjustment factors with more tiers in addition to partial liquidation to protect traders from triggering liquidation.

Among other updates there are some useful features rolled out over the past 3 months:

- Released a new trigger order type based on the P/L ratio for easy taking profit or stopping loss;

- Implemented “Taker & Follow a Maker” function which allows traders to take orders or follow maker orders conveniently on the order book by clicking icons, either to open long/short positions or to close long/short positions;

- Added informative assets, daily earnings, and accumulated earnings charts;

- High leverages for futures trading increased up to 125x.

These features have gained tremendous popularity amongst its users.

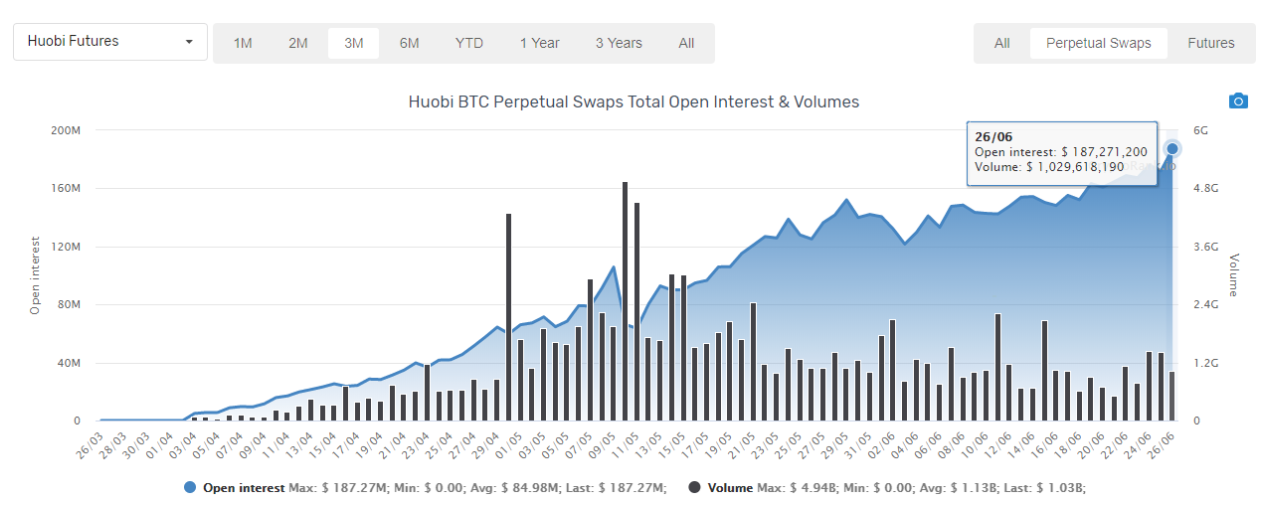

In late March, in response to market demand, Huobi Futures launched Perpetual Swaps. One month after the launch, on May 10, Huobi Futures Perpetual Swaps marked a new record of $4.94B in 24-hour volume, indicating a 6,327% growth from its first day.

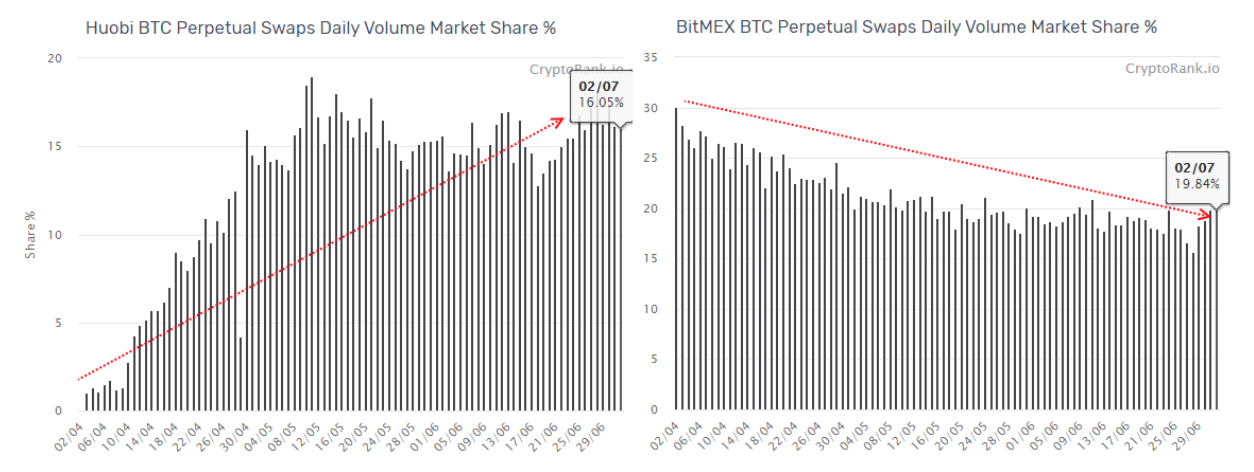

At the same time, the Open Interest of Huobi Futures BTC Perpetual Swaps increased from $4.56m on April 2 to $1.02B on June 26, which shows the rapid growth of 22,268%. Since the launch of Huobi Futures Perpetual Swaps, BitMEX saw its market share drop from a high of 31.7% in early March 2020 to 18.78% on June 30. Huobi Futures increased its position with a perpetual swap market share from scratch to 16.8%, becoming a leading player in the market of perpetual contracts.

Since the launch of Huobi Futures Perpetual Swaps, BitMEX saw its market share drop from a high of 31.7% in early March 2020 to 18.78% on June 30. Huobi Futures increased its position with a perpetual swap market share from scratch to 16.8%, becoming a leading player in the market of perpetual contracts.

In another major development, Huobi’s Bi-quarterly Contracts went live on June 15. These new BTC derivatives with Bi-quarterly settlement terms offer more diversification for the trader’s crypto portfolio, and this should greatly increase market participants who need to hedge with longer contracts. With this new Bi-quarterly futures, there are four types of Huobi Futures contracts with different expiry periods: Weekly, Bi-weekly, Quarterly, and Bi-quarterly.

In another major development, Huobi’s Bi-quarterly Contracts went live on June 15. These new BTC derivatives with Bi-quarterly settlement terms offer more diversification for the trader’s crypto portfolio, and this should greatly increase market participants who need to hedge with longer contracts. With this new Bi-quarterly futures, there are four types of Huobi Futures contracts with different expiry periods: Weekly, Bi-weekly, Quarterly, and Bi-quarterly.

Community events

During Q2, Huobi also hosted a great number of community events, which includes the following:

- Huobi All-Star VIP Fee Promotion

- Halving Countdown – Predict To Win

- Halving Countdown – HT Holder Exclusive

- Pizza Day Exclusive – Trade BTC To Share 25,000 USDT

- Halving Countdown Xtra – Share to Win 60,000 USDT

- 0% Trading Fees on HUSD Zone

- 0% Maker Fee on HUSD Trading Zone

- Huobi Pool 2nd Anniversary Celebration

- C2C Lending – HT Holder Exclusive 50% Fees Rebate

During the events, a prize pool worth $85,000 was unveiled, including 60,000 USDT distributed to HT holders who participated in the prediction rounds of Halving Countdown activity.

Noteworthy, that one of another significant event was the Huobi DM rebranding to Huobi Futures on May 14th, 2020.

Closing thoughts

The second quarter of 2020 was an enthralling time for traders since crypto markets displayed increased demand and volatility. Thus, the right choice of a trustworthy and reliable exchange for risk-hedging is far more critical than ever before. There is every chance that Huobi Futures arise as the market-standard choice for the crypto community due to the expansion of its ecosystem during 2020.