Leverage and Derivatives: Overview of Huobi DM in 2020

2019 was an explosive year for the crypto derivatives market, and 2020 is no exception. The amount of new derivative products has grown markedly. The majority of exchanges have already launched the ability to trade different derivatives for major cryptocurrencies, which allows traders to increase their profits several times over. Very likely, we will see even more innovative products in the near future being developed to open more flexible trading opportunities.

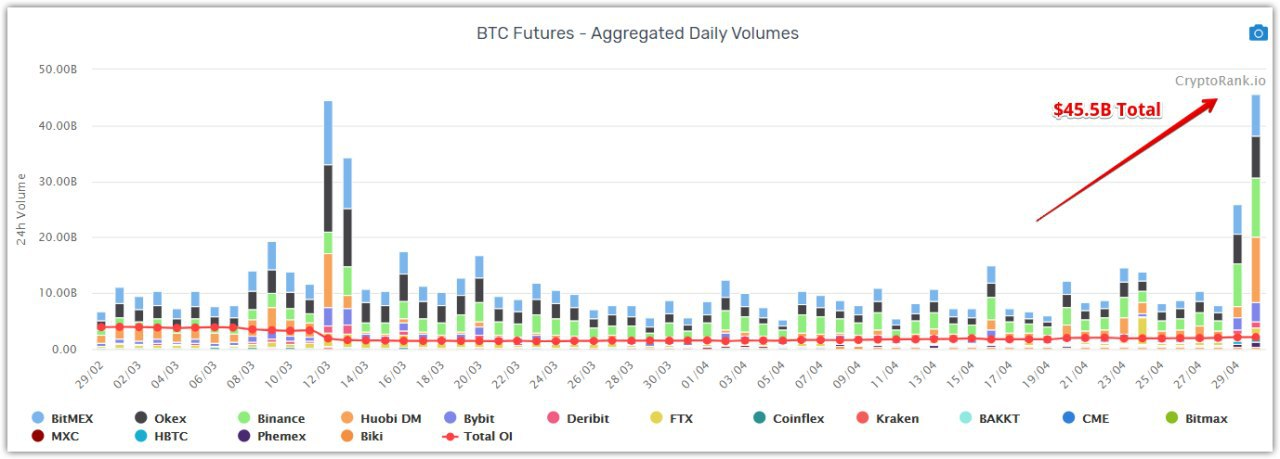

According to our latest data that is being aggregated from the major derivatives exchanges, the total daily volume of Bitcoin futures surpassed the $45.5 Billion mark on April 30. Moreover, aggregated open interest (OI) for Bitcoin futures contracts has exceeded $2B.

The Derivative Market includes a variety of financial products like futures, options, swaps, and contracts for differences. But on the Crypto Market, the most popular derivative product is Perpetual Swaps.

Futures or options are well known on the stock market, but perpetual swaps are innovative products that appeared on the crypto market in response to traders’ needs.

In comparison with futures, a perpetual contract will never expire nor be delivered. As opposed to the regular futures contracts that are settled weekly, monthly, or quarterly, the perpetual swaps use a daily pricing/settlement mechanism. Differing by exchange, swaps can be settled twice or three times per day. Additionally, a “Mark Price” is used to determine the profit and loss of the trader’s position and for the settlement price to maintain market stability.

The meteoric growth of Huobi DM Swaps in 2020

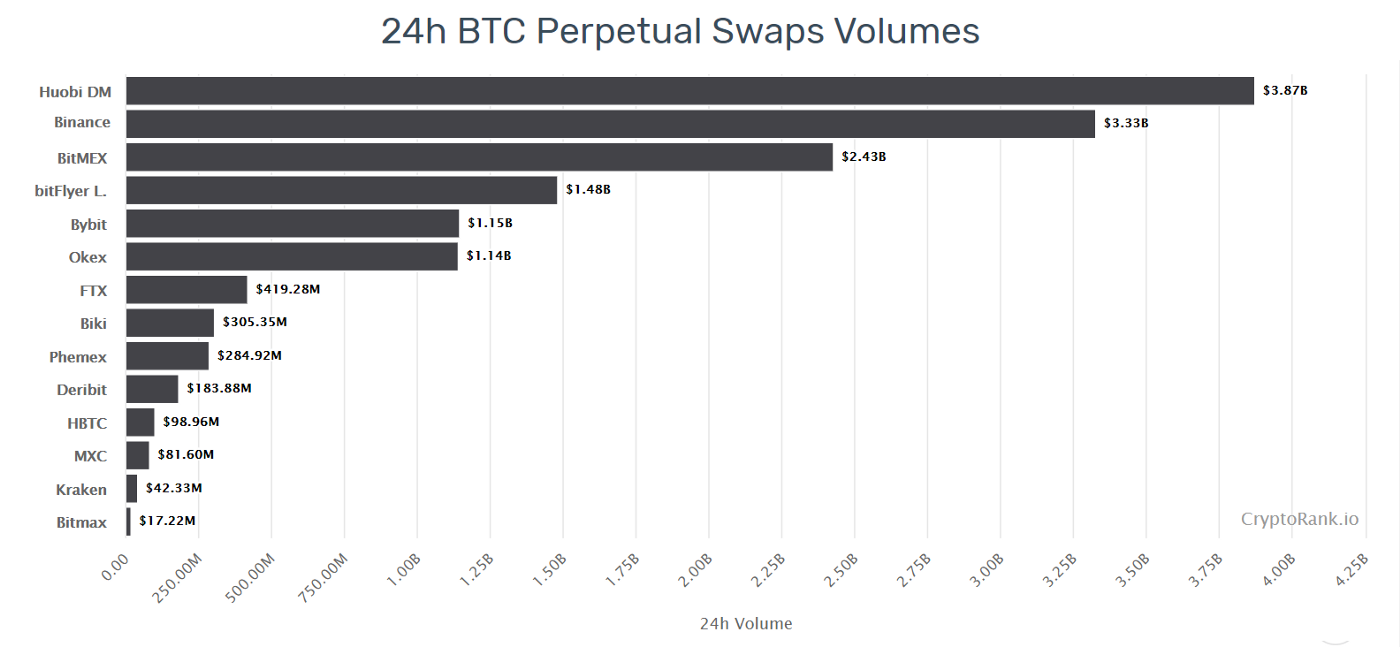

Cryptorank is tracking all major derivative exchanges which have significant market share. We provide a large data set to help you with analysis on a daily basis so you can make your own decisions. Here are the top crypto exchanges by perpetual swaps daily volume according to the information we gather. The snapshot was taken on April 30.

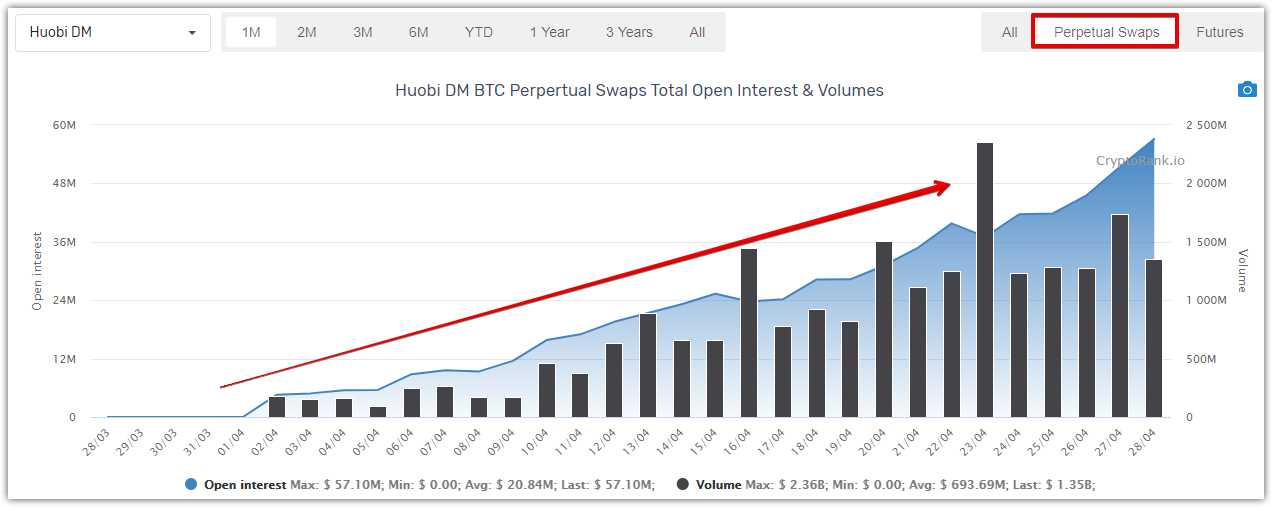

Huobi DM is the fastest-growing crypto-derivative exchange by trading volume. It launched the BTC Perpetual Swap Contract on March 27. Five days later, $183M worth of BTC Perpetual Swap contracts were traded on it. One month after the launch, Huobi DM marked a new record of $1.35B in 24-hour volume, indicating a 638% growth from its first day.

At the same time, the Open Interest of Huobi DM BTC Perpetual Swaps increased from $4.56m on April 2 to $56.4M on April 28, which shows a rapid growth of 1136.8%.

The landscape existed before the launch of Huobi DM

Bitcoin Futures rose in popularity over 2017, in the last crypto bull market. Traditionally, volumes have been dominant on BitMEX. Since then, many crypto exchanges have joined in to offer crypto futures, primarily BTC Futures, to capture a share of this fast-growing market.

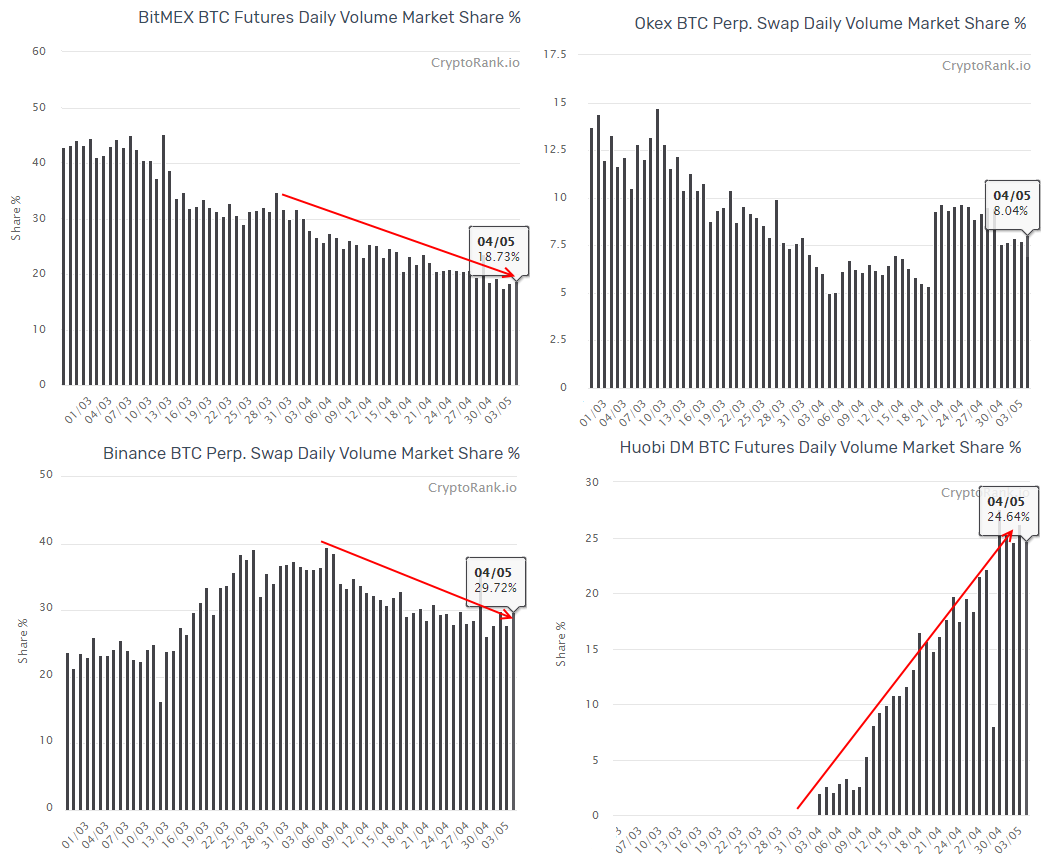

BitMEX dominated 57.3% of the crypto-futures trading industry as other exchanges like Huobi Futures and OKex Futures trailed behind. Okex Futures and Huobi Futures were the remaining exchanges that held a notable share of the market. BitMEX held onto its market leadership until the 2nd half of 2019, where the emergence of Huobi Futures, gradually increased its share of the market from BitMEX, while OKex Futures steadily maintained its market power.

Since the launch of Huobi DM Perpetual Swaps, BitMEX saw its market share drop from a high of 44.5% in early March 2020 to 18% on May 4. On the other hand, OKex and Binance Futures maintained their position with a Perpetual Swap market share of 8% and 29%, respectively.

As such, Huobi DM’s Perpetual Swaps Volume share jumped from about 1.8% at the end of March to nearly 24% by May 4 with $8.58B ATH Volume on April 30, while open interest share gained 4% over the period, according to CryptoRank’s data.

But what about liquidity?

Huobi DM’ BTC perpetual swap pending order volume within 0.2% bid-ask spread is around $1.3 million to $1.6million, which is higher than most competitors.

In addition to high volumes and good liquidity, Huobi DM offers innovative and convenient features, like the Tiered Adjustment Factor and partial liquidation mechanism, to prevent users from losing margin calls on the system. More details can be found in our previous article.

Huobi DM provides the opportunity to trade 13 perpetual swaps with leverage up to 125x. Nearby competitors offer notably more assets to trade on Swaps, for example, the FTX exchange has as many as 32 perpetual swaps, but its volume is relatively low. Furthermore, new products appear on Huobi fast enough to expect more Swaps in the near future.

Besides BTC & ETH, Huobi DM has the following altcoin Swaps: BCH, BSV, EOS, ETC, LTC, XRP, TRX, and LINK. On Friday, April 24, there were 3 new perpetual swaps listed for altcoins: ADA, DASH, ZEC.

All of the trading pairs are available for web, API, and app users; so if you like mobile trading, install Huobi App and trade anytime, anywhere. Trading at your desktop, however, is more secure. Additionally, it gives you more advantages, but with mobile trading, you can react to fastly changing conditions. Recently, the app was upgraded to a new version and now all the power of the Huobi Global is right at your fingertips.

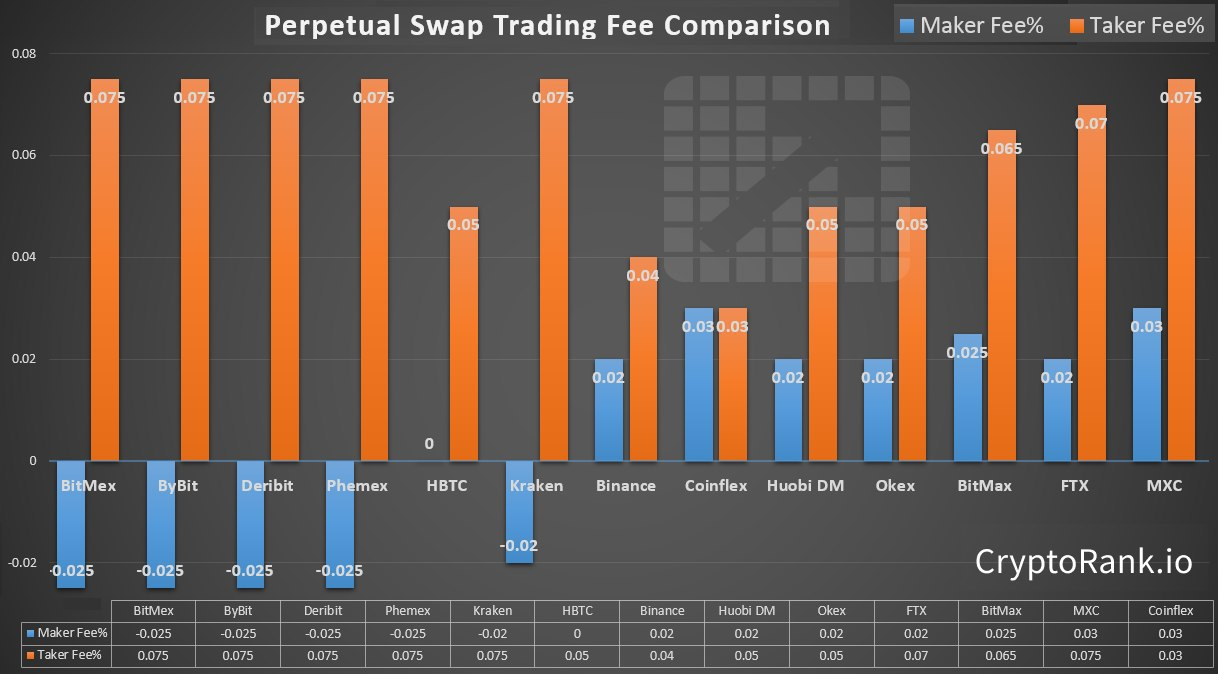

Perpetual Swap Trading Fees

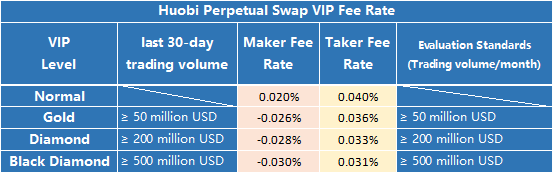

Successful high-frequency traders know that every dollar saved on fees improves your equity curve and this is another important factor to consider. Let’s compare Huobi with its major competitors by Trading Fees.

In this comparison table, we didn’t take into account any VIP programs and fee discounts for native exchange tokens holding. For example, the Huobi DM VIP client program offers the receiving of Maker a rebate up to 0.03%.

Conclusion and what to expect in 2020?

Since 2019, the crypto exchanges have struggled to be at the cutting edge offering the newest products and services to attract traders, hence the entire crypto derivatives industry has become more competitive than ever. As a result, the market share of the top 5 derivative exchanges has become less centralized and are now on a level playing field. The rapid growth of Huobi DM had a significant impact on the industry as the exchange continues to break records every month.

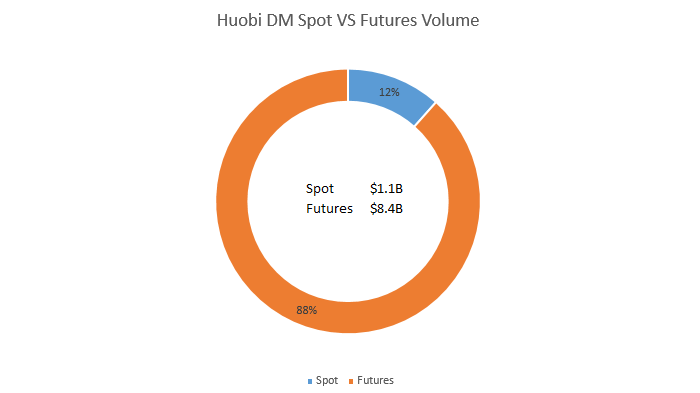

Although Bitcoin Futures is still in its infancy, already the futures market is challenging the spot market. On the Huobi DM trading platform since May 4, Futures and Swaps outperformed spot markets as investors look for more options to utilize their crypto assets.

With the addition of new Swap offerings such as DASH and ADA contracts, volumes are likely to continue growing in 2020. In the coming months, Huobi DM plans to expand its Perpetual Swap product offerings further.

Stay tuned in our Telegram channel and Twitter