Recap: The Current Shape of GameFi Fundraising

A trend that skyrocketed in 2021 that we cannot ignore is GameFi. Axie Infinity was its pioneer in the summer of 2021 when it completed the transition to the Ronin sidechain and perfected its Play-to-Earn model. This resulted in Axie Infinity becoming the second-highest revenue-producing app last year on Ethereum, generating more than $1.2B in revenue.

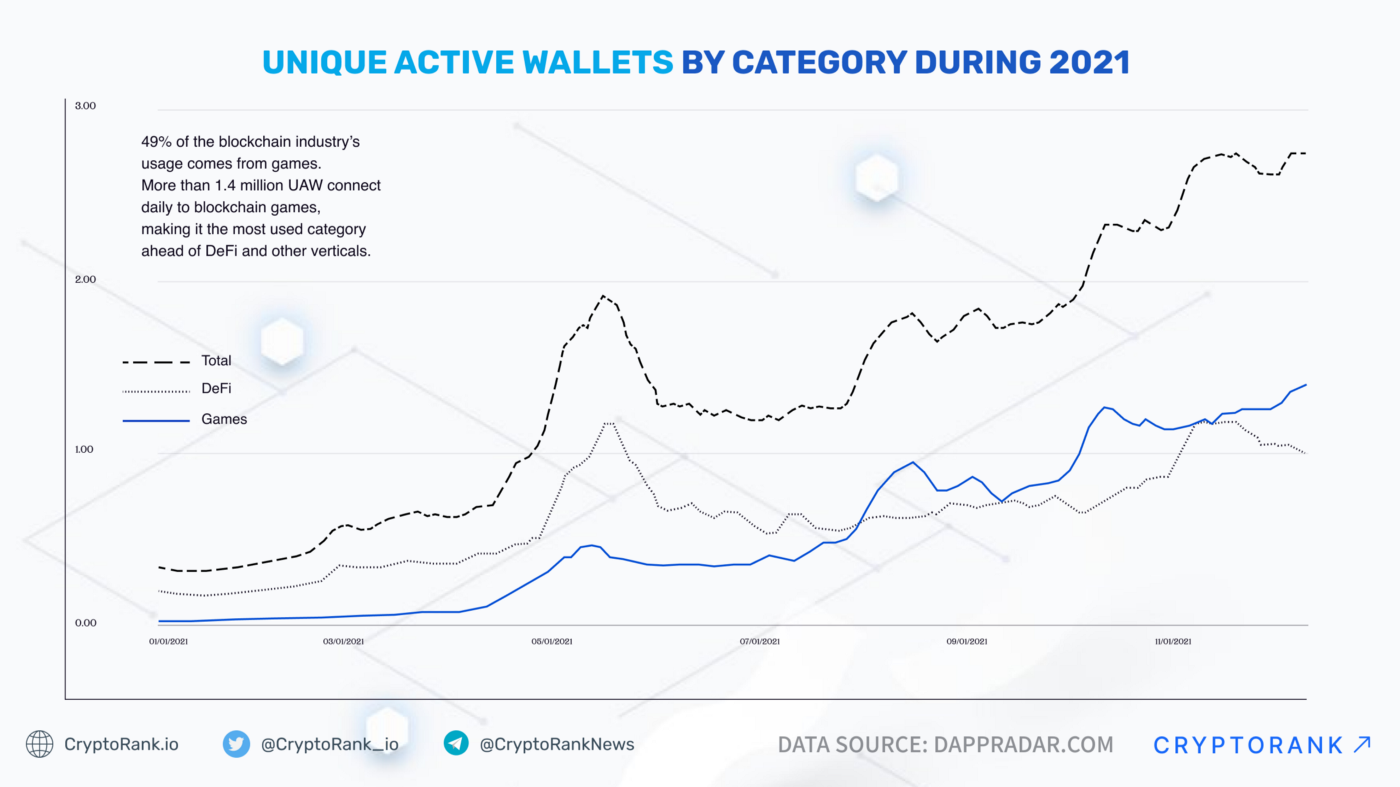

Ultimately, GameFi products have become the dominant category of the blockchain industry, accounting for 49% of the industry’s usage with over 1.4 million unique active wallets interacting daily with game dApps.

Unique Active Wallets by Category During 2021. Data Source: DappRadar

GameFi is disrupting the industry paradigm: the Play-to-Earn business model allows not only developers but also gamers and content creators to benefit financially. That’s why the overall interest in new projects is rising among players and investors.

The volume of investment in new GameFi solutions is staggering. Let’s focus on the very start of 2022. The volume of investments in GameFi projects exceeded $122M. These investments can be divided into three areas: Play-to-Earn games, infrastructure solutions, and gaming guilds.

Recent High Volume Fundraising Rounds Among GameFi Projects. Data Source: CryptoRank

Play-to-Earn games is the most attractive investment sector both in terms of volume and number of deals. P2E games like Chain of Alliance, Galaxy Blitz, Galaxy Fight Club, Heroes of Mavia, Summoners Arena, and Pixels have closed fundraising rounds this January.

The most sound investment can be seen with the mobile gaming startup nCore Games closing a $10M private fundraising round. Moreover, there are also three P2E game developing platforms on the list: Salad Ventures, RebelBots, and Ajuna.

The second important group is infrastructure solutions. Leading this group in January, a liquidity protocol for NFT collateralization MetaStreet raised $14M in a seed round. Another important project is Colizeum, an SDK for mobile game developers that will allow them to broaden their monetization options, combining traditional revenue-generating methods with the P2E model.

New solutions like BreederDAO, a digital asset factory that manufactures gaming assets within the metaverse, and DAO-to-DAO credit provider Kyoko, are also included in this group by our analysts

The most promising group is the third — gaming guilds. Play-to-Earn crypto gaming guilds are organizations that purchase in-game items and lend them to players in order to play and earn. Gaming guilds dramatically lower the barrier of entry to P2E games for all the players.

For example, Yield Guild Games’ Sub-DAO IndiGG has secured $6M in funding. Sequoia Capital India, Lightspeed, Variant Fund, Animoca Brands, Dune Ventures, and many other funds are among investors. IndiGG will utilize the funds to fuel platform growth, onboard Indian gamers, and drive local education of the Play-to-Earn movement.

Our analysis expects the same goals for other projects like Infinity Force, P2E Management platform, or Cosmic Guild. Cosmic Guild is a Play-to-Earn community of gamers and investors that can combine expertise and capital to achieve the optimal yield generation for stakeholders. Binance Labs led $1.5M the seed round, along with investments from Alameda Research, DeFiance capital, and Parachain Ventures.

Looking through the list of investors, we can see Animoca Brands investing nine times in GameFi projects. The company is the developer of NFT games F1 Delta Time, The Sandbox, and others. It actively invests in the market of non-fungible tokens, including the OpenSea, Dapper Labs, Star Atlas, and Axie Infinity projects.

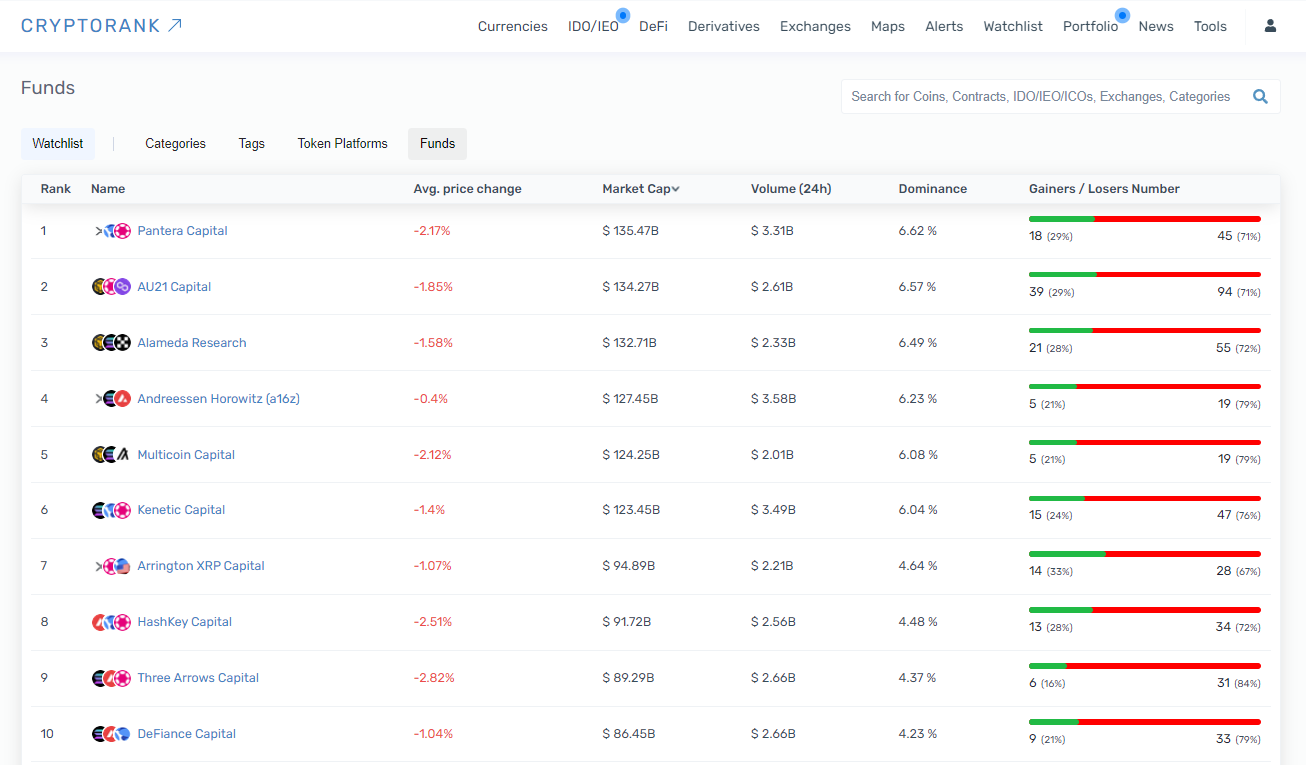

VC Crypto Funds Stats. Data Source: CryptoRank

Among other leading GameFi investors are Alameda Research, Binance Labs, Coinbase Ventures, Delphi Digital, Dragonfly Capital, Morningstar Ventures, and Sequoia Capital. This wide range of notable investors shows the whole venture market gravitation towards GameFi.

GameFi is a relatively young sector, with no really big AAA projects yet. However, the landscape is changing quickly. When a16z poured $150M into Mythical Games, Enjin soon announced a $100M gaming fund; similarly, French mobile game maker Voodoo invested $200M in blockchain games in Q3-Q4 2021. Thus triggering the beginning of these changes.

The entry threshold into GameFi is quite high, so guilds that sponsor members in exchange for a percentage of earnings are gaining popularity. The current investments in P2E guilds are creating a new intriguing situation, we can see that funds are not only going towards new projects and ideas but also to create future demand for P2E games.

Companies behind P2E are in search of sustainable economic models. As such, there is no leading genre among P2E games right now, so investments are being poured into every possible type of project.

However, this does not mean that the existing gaming giants will simply abandon this new niche. Ubisoft is preparing P2E solutions as well as other gaming studios. As a result, in the coming years we will see the formation of an entirely new market and model of computer games.